Summary of pangasius’s farmer needs assessment in Mekong River Delta, Vietnam

The Mekong River Delta (MRD) in Vietnam is widely recognized as the most productive region for brackish and freshwater aquaculture and fisheries due to its favorable environmental conditions, vast water surface area, and abundant fishery resources. By 2022, The area of pangasius farming in the Mekong Delta was about 6,000 hectares processing 1.6 million tons and bringing about US$2.4 million in income. Pangasius production is concentrated in the provinces of An Giang, Dong Thap, Ben Tre, Can Tho. In provinces with large pangasius farming areas such as An Giang and Dong Thap, the number of small-scale pangasius farming households has decreased significantly, and the pangasius farming area is concentrated in large-scale farming households and companies.

During August and October 2023, the Netherlands Embassy in Vietnam commissioned Agriterra Vietnam in collaborated with the International Collaborating Centre for Aquaculture and Fisheries Sustainability (ICAFIS) to conduct an in-depth assessment of the needs of smallholder pangasius farmers in 2 selected provinces (Can Tho and Vinh Long), which are reported as the top leading pangasius production areas in Vietnam. This mission aimed at gaining a comprehensive understanding of the aquaculture farmers’ challenges in the improvements in water quality and efficiency, reducing disease-related expenses in fish farming, minimizing the use of antibiotics, fostering technological innovation, and implementing a stratification process for agriculture and more importantly is to identify their specific needs towards ultimately arriving at uncovering potential opportunities for enhanced involvement of farmers in sustainable aquaculture production supply chains. As a result, key findings over pangasius – were identified afterwards, laying a concrete foundation for several substantial conclusions as the following.

1. Smallholder farms profitability rate low – A need to improve scale and production efficiency

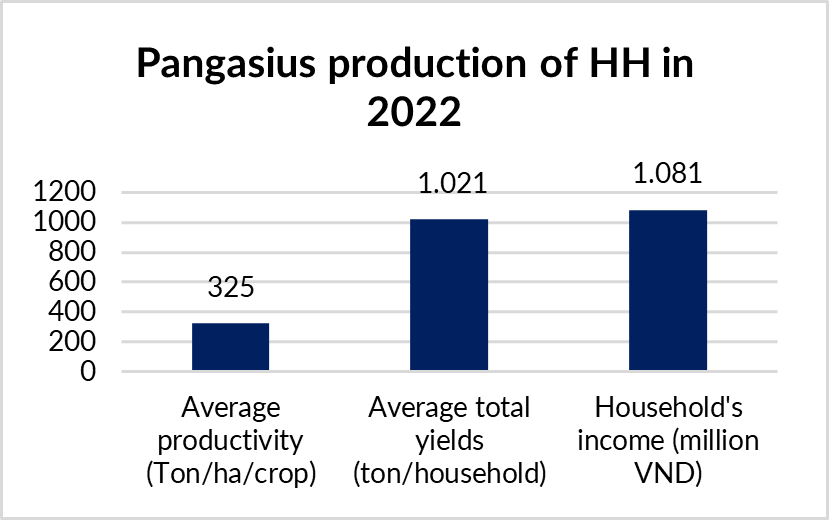

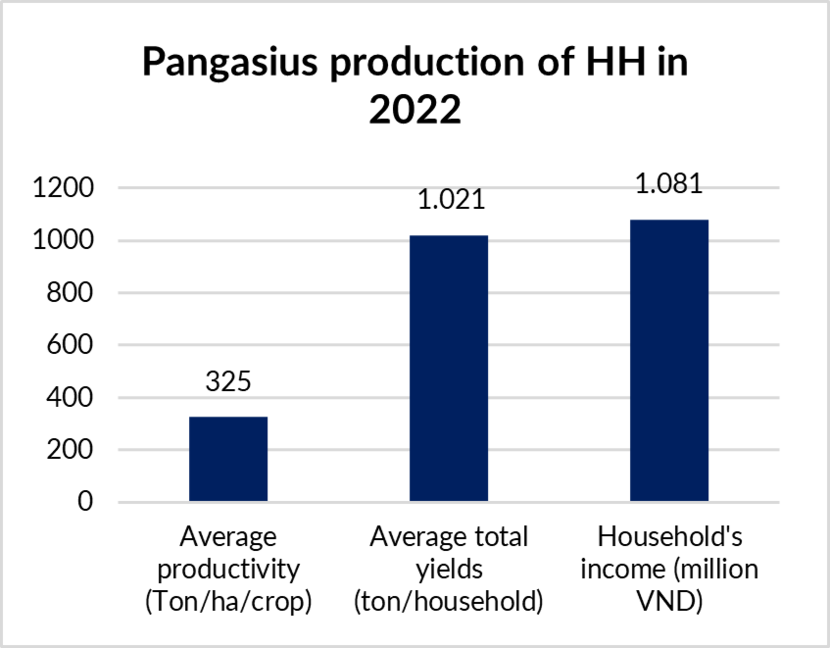

- Production area: The average production area per household (HH) in 2022 was 3.14 ha, 325 tons/ha/harvest. The area of small-scale HHs only accounted for 20-30% of the total area, mainly concentrated in provinces such as Vinh Long, Can Tho, Tien Giang, and Hau Giang.

- Labor size: The average size of a pangasius farming HH was 4.2 people/HH. The number of workers per household participating in pangasius was 1.7 people.

- HH income: The 2022 average profit per HH of surveyed was VND 1,042 million. Nonetheless, there was a need for a huge investment capital averaging 26.96 billion/year, and the profitability rate is only 4%/10 months or about 5%/year.

2. High investment costs – An urgent need to optimize the costs

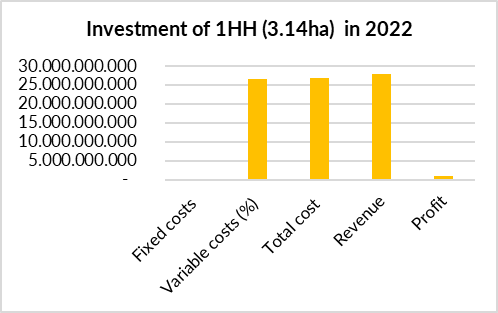

The average investment cost household was 8.56 billion VND/ha/harvest, so each HH needs 26.96 billion VND/harvest for their average area of 3.14ha.

Investment structure: Fixed costs (1%); Variable costs (99 %) (including (i) Feed (84%) (ii) Seed (8%); (iii) Drug and chemicals (3%) and (iv) Bank loan interest was 2%).

Feed cost was the dominant factor of HH. Currently, most of the ingredients for pangasius feed are imported, and prices have increased due to fluctuations in the world markets, causing the selling price of pangasius feed to continuously increase

3. Feed and seed costs are dominant costs – A need to switch towards a more efficient farm

- Access to seed: 100% HH bought fingerings from local seed production households without quality certification. The survival rate of surveyed farming was only about 52%, a big drop compared to in the previous years (about 62% in 2019) and even 90% in some years. Pangasius fingerling quality was problematic because of seed degeneration, decreased growing rate, increased mortality, and deformity rates over time due to lack of quality control, reuse of seeds and increasingly polluted water environment.

- Access to feed: 100% of HHs used industrial feed purchased from local agents. 82% of HHs bought feed on deferred payment. Currently, the FCR in pangasius farming tends to increase to 1.7-1.8 compared to in the past (1.2-1.4). There are currently an estimated number of 30 factories supplying feed to pangasius farming HHs.

- Access to drugs and chemicals: 91% of farmers bought drugs and chemicals at local agents; 53% bought on deferred payment. Approximately 50-60% of farmers used drugs and chemicals empirically. By 2022, over 500 supplier companies were providing drugs and chemicals to farmers. Farmers have difficulties choosing appropriate drugs and chemicals to improve farming efficiency, The quality and origin of drugs and chemicals for farming are also very complex and unclear.

4. Bounded investment in technology – More incentives and education for technology adoption

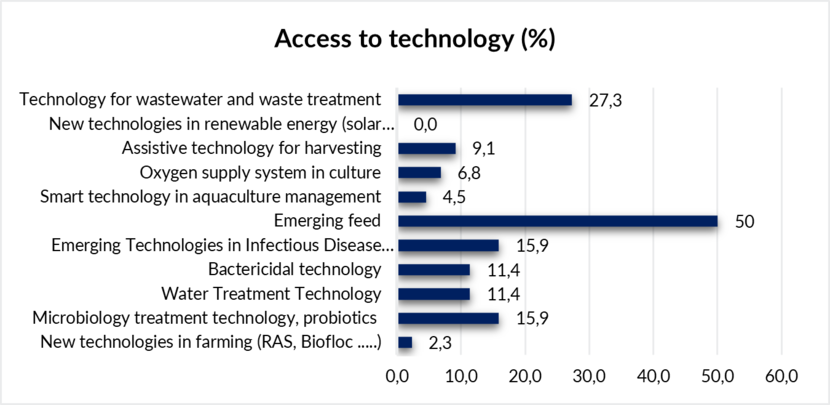

Technology in the pangasius farming industry is less diverse and innovative than that in shrimp farming. Among all aspects, the proportion of new feed-related technologies is 50%, wastewater sludge management is 27%, followed by disease prevention and treatment technology (16%), and biological products to improve the environment, farming environment and fish health (16%), disinfection technology (11%), and water treatment technology (11%).

Farming HHs’ access to new technology through the direct introduction by sales staff from companies (43% of pangasius farming households). In addition, surveyed results showed most farming HHs access new technology through informal channels and from other farmers; official channels from schools, research institutes, cooperative alliances, and NGOs have been playing a very limited role.

Keys incentive for farmers 1) Know-how on technology (45%, 2) Investment capacity (35%) and 3) Technical capacity (25%)

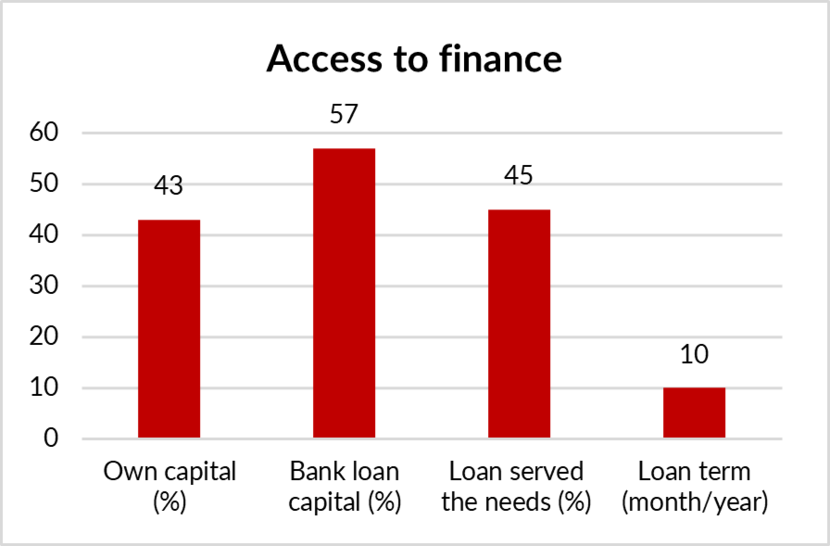

5. Limited access to bank loans – A need for preferred loans and credit from the company

The average investment cost /household was 8.56 billion VND/ha/harvest, so each HH needs 26.96 billion VND/harvest for their average area of 3.14ha.

Investment structure: fixed costs (1%) and variable costs (99 %) (including 1) Feed (84%) 2) Seed (8%) 3) Drug and chemicals (3%) and 4) Bank loan interest was 2%).

Current bank loans only met 45% of the HH’s total investment needs and were mainly provided by state-owned banks (Agribank and ViettinBank). Pangasius HHs often access bank loans with higher interest rates than normal mortgages. In addition, local agents also pre-financed farmers, about 81.8% of feed costs that are paid by households in the form of deferred payments to agents.

6. A big gap in business management training – A need for more skills in business management

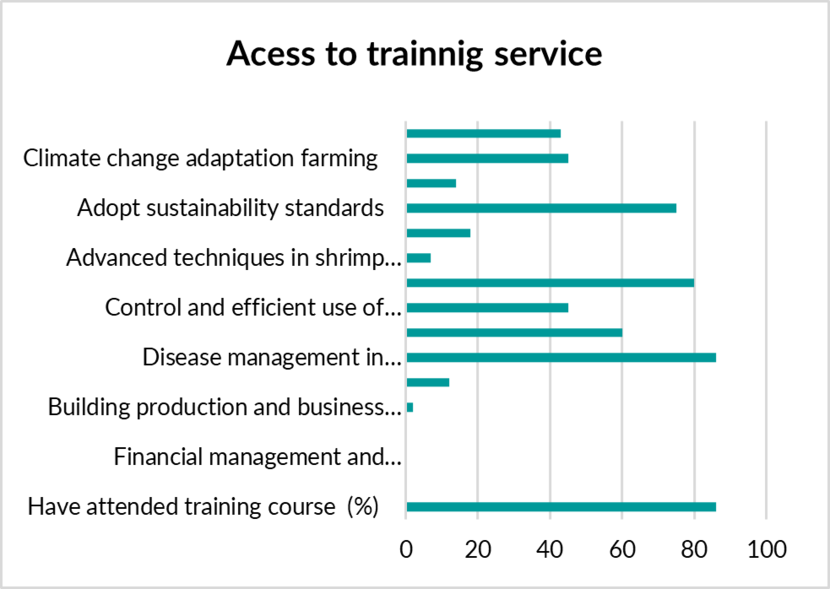

Strong access to technical training: 86% of farmers participated in at least one training course with main training topics including: 1) Disease management (86%) 2) Effective feeding management (80%) 3) Applying sustainability standards (75%) 4) Control quality of input (60%) 5) Adapt to climate change (45%) 6) Market information (43%). Nevertheless, no farmer had ever access to training on business plans and financial management.

Pangasius farms in the Mekong Delta employed very high production intensity, a high stocking density (60 fingerling/m2), and stocking fish in deep and concrete ponds, with a high level of water exchange daily.

90% of farmers accessed information through local TV and seminars; and 80% via training courses. 84% of farmers applied farming quality standards, mainly VietGAP standards (84%) and ASC standards (6.8%).

7. Smallholder farmers were positioned lowest in negotiation power of the value chain – A need to strengthen the collaboration

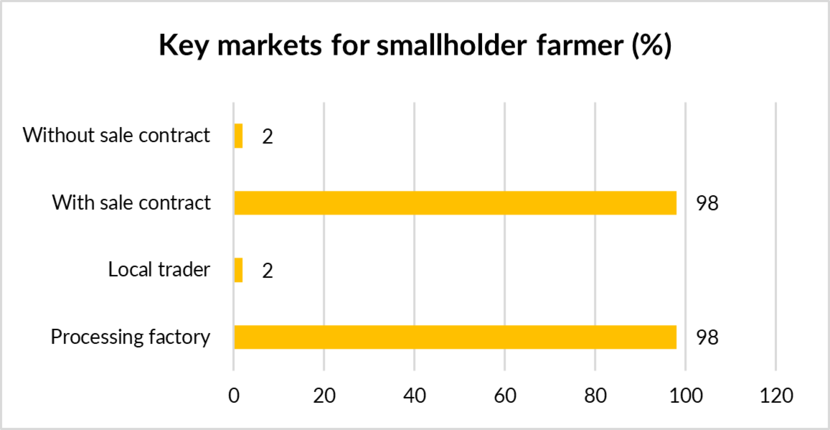

The assessment indicates that pangasius farming sector remains problematic due to its lack of cooperations among farmers, cooperatives, and processing facilities; 82% of small-scale pangasius farming households said they did not participate in any local collaborative groups or cooperatives. Fish purchasing companies often paid a max of 10% when sourcing fish, the remaining 90% was paid in instalments within 1-2 months.

98% of households signed purchase contracts with businesses, sold fish to processing enterprises and mostly complied with the quality conditions required by the business set forth in the contract. Processing companies have built raw material areas accounting for 65-70% of the company's output needs. Processing companies only sourced 30 - 35% input material from farming households in the form of signing direct purchase contracts when the fish reached the required size.

By July 2022, the MRD had 100 enterprises and pangasius processing facilities, with the capacity to process pangasius for export and about 124 by-product material processing facilities with a capacity of 1.5 - 2 million tons of raw pangasius/year.

Conclusion of the pangasius’s farmer needs assessment in Mekong River Delta, Vietnam

-

- Big investment and low-margin profit in pangasius farming

- The number of small-scale farming HHs has been decreasing over the last 5 years and is being substituted by large-scale farming households and companies.

- Variable costs made up almost the entire investment cost (99%) compared to the fixed costs (land, technology, and infrastructure - 1%).

- Fingerling survival rate is low while feed expenditures are high which is so much of a risk for the MDR farmers.

- The benefits of technologies remain unclear to farmers, this requires certain conditions such as 1) Know-how on technology (45%; 2) Investment capacity (35%: and 3) Technical capacity (25%)

- Farmers faced challenges with weak access to finance (a shortage of about 55% of the total investment) and with high-interest rates due to risks determined in Pangasius production.

- Lack of cooperation among farmers, cooperatives, and processing facilities

- A large number of small-scale farming HHs has been decreasing over the last 5 years due to large enterprises’ requirements of farming areas.

Recommendations

-

- Remain smallholder farmers need to be re-organized toward a collective model to mitigate the production and investment risks, improve farm efficiency, and strengthen their position in the value chain.

- Promotion and incentivization of the adoption of technologies for production

- Domestic ingredients need to be utilized to avoid dependence on imported materials that help reduce costs. The integrated supply chain from mills to farmers needs to be shortened to reduce the transaction costs.

- There needs to be state long-term projects/programs to invest in addressing potential risks (high survival rate of fish fingerlings, disease, etc)

- Research needs to be in place to find solutions for functional feeds, and improved farming systems thus reducing the amount of feed use and environmental pollution.

- There were about 6,000 ha of pangasius ponds with each having an estimated seed quality-driven loss of VND 5,4 million/year this is equivalent to USD 220 million/year. Hence, there needs to be improvements for pangasius seed, appropriate technical measures, and technologies to increase survival rates.

- More incentives – i.e., training in technology applications – to farmers to enable them to adapt well to new environmental challenges, climate change.

- Improve farmers’ access to finance (banks, financial institutions/provider), promote sustainable supply chain and shorten it to reduce costs of input from suppliers to farmers.

- Build a closer linkage among cooperatives and processing enterprises to provide farmers with better access to inputs (quality feed, seed, drugs, etc) which drives a better-quality control for exported pangasius.

- Dutch experience and expertise might be a valuable asset in terms of creating a smart cooperative model of all pangasius farmers’ interests. This also helps improve fish traceability and pangasius value chain structure.

- Sludge is a big problem in the pangasius farming industry (6-10 tons/ha/crop). This is a huge resource that needs to be researched to take advantage of and exploit the value of mud, such as producing organic fertilizer and growing medium for plants. This intervention will help reduce negative impacts on the environment.

This summary is part of the report of the “Aquaculture farmer’s needs assessment in the Mekong Delta, Vietnam” commissioned by the Netherlands embassy in Vietnam and conducted by Agriterra Vietnam in collaborated with the International Collaborating Centre for Aquaculture and Fisheries Sustainability (ICAFIS). The complete report can be downloaded here: Report: Aquaculture Farmer's Needs in Mekong Delta Vietnam | Rapport | Agroberichten Buitenland

Do you have any questions for the agriculture department of the Netherlands embassy in Vietnam please send an email to HAN-LNV@minbuza.nl. For the latest updates, news, funding opportunities and more follow us on Twitter @AgroVietnam, and Vietnam | Landeninformatie | Agroberichten Buitenland.