Summary of shrimp's farmer needs assessment in the Mekong River Delta, Vietnam

The Mekong River Delta (MRD) in Vietnam is widely recognized as the most productive region for brackish and freshwater aquaculture and fisheries due to its favorable environmental conditions, vast water surface area, and abundant fishery resources. As of 2022, the total shrimp farming in the MRD area reached 747,000 hectares, of which the farming area for black tiger shrimp (Penaeus monodon) and white-legged shrimp (P. vannamei) is 610 thousand hectares and 117 thousand hectares, respectively. With an estimated 220,000 shrimp farms distributed along 8 coastal provinces with a diversity of shrimp farming models, which includes ecological shrimp model (improved extensive farming, shrimp-rice, shrimp-mangrove forest), semi-intensive, intensive farming and super-intensive farming models. The shrimp farming industry creates jobs for about two million workers at about and bring about 4.2 billion USD export value in 2022. However, Vietnam’s aquaculture sector is seen as going through significant challenges leading to immediate negative effects on smallholder farmers that need to and can, be addressed with Dutch expertise.

During August and October 2023, the Netherlands Embassy in Vietnam commissioned Agriterra Vietnam in collaborated with the International Collaborating Centre for Aquaculture and Fisheries Sustainability (ICAFIS) to conduct an in-depth assessment on the needs of smallholder shrimp farmers in 4 selected provinces (Ca Mau and Bac Lieu). This assessement aimed at gaining a comprehensive understanding of the aquaculture farmers’ challenges and identifying their specific needs towards ultimately arriving at uncovering potential opportunities for enhanced involvement of farmers in sustainable aquaculture production supply chains. Below information is a summary to show key findings and conclusions regarding the shrimp sector that were collected and analyzed.

1. Fragmented production – An urgent need for re-organizing farm-level production

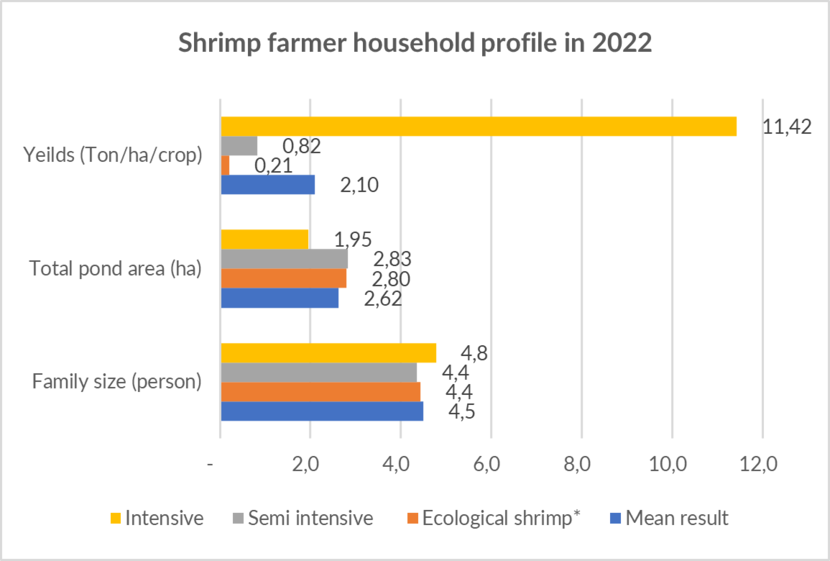

Assessment results showed that the average farm size per household (HH) for the 2022 shrimp farming was 2.62 ha. For the farming scale, most HHs are seen as small-scale. Most of the farms below 3ha account for up to 85% while the rest, whose size is over 3ha, make up less than 15% and belong to companies and a few HHs.

Another important issue pointed out was of the labor force as data collected represented a weak abundance in labor market in the region – the average per HH was recorded as only 4.5 of which 2.1 take their part in shrimp farming. This demonstrated the likelihood of a high potential shortage of this force for the sector.

HH’s shrimp farming-sourced income is also a crucial perspective that was studied which averages VND 195 million per year. This income varies greatly on farming methods, i.e., intensive farming HHs have the highest income of VND 452 million, the ecological shrimp is VND 102 million, and the semi-intensive is VND217 million.

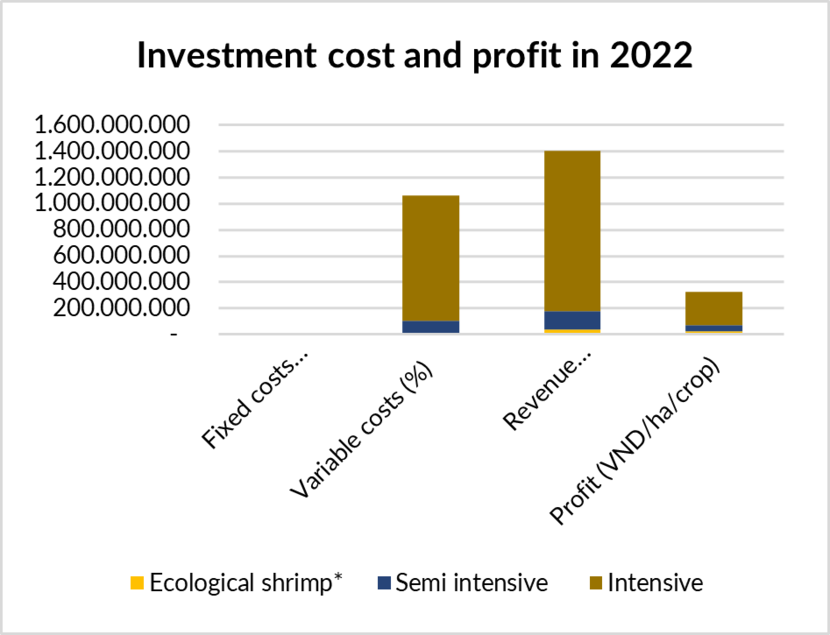

2. A steady increase in investment costs – An urgent need for cost reduction

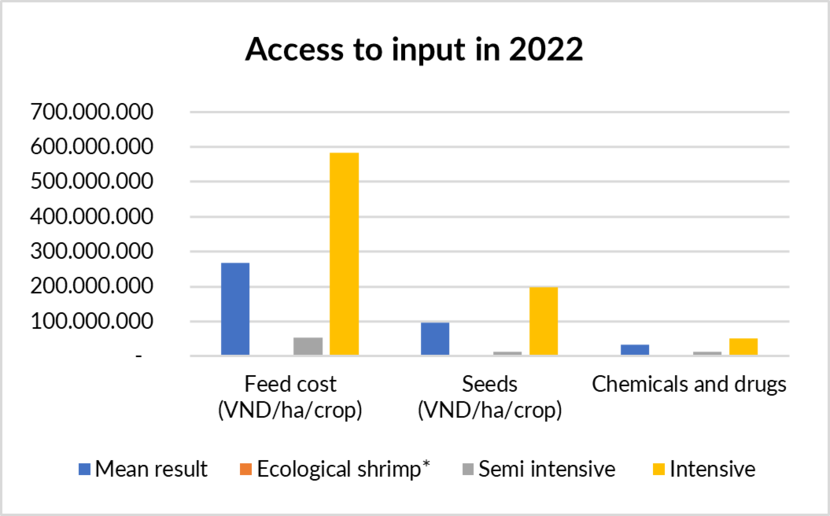

The assessment results also showed the financial capital and investment structure that shrimp farmers need for their farming. In 2022, the average investment cost/ha/household was VND 179 million, this would mean the total investment/HH is VND 470 million/harvest (2.62 ha/HH on average). Assessment analysis proved that of the total investment, Variable costs accounted for 99%, including Feed (57%), Seeds (20%), drugs and chemicals (7%), electricity (5%), Sludge collection (4%), Labor (3%) and bank interest rates (2%). Feed and seed costs have been increasing over the last 5 years due to upward prices of input materials for feed production.

There is a substantial difference in investment costs between the intensive and ecological farming models (intensive shrimp farming: 396 million VND/ha/year, the ecological shrimp: 12 million VND/ha/harvest). For the ecological shrimp farming model, there is no need for industrial feed investment, the main costs are for seeds and drugs (34% each) and pond dredging and sludge removal (23%).

The average profit margin is 27%, of which the highest profit ratio is from the ecological shrimp (66%), intensive shrimp reaches the lowest profit (21%), then comes the semi-intensive (34%). Rise in product price due to increase in production cost. In the US market Vietnam shrimp per kilo was US$11, whereas the price of Ecuador’s was US$7.43 in 2022.

3. Feed and seed costs are dominant – A need for a switch toward more efficient farm

The survey found that farmers’ access to seed remained problematic as the survival rate was reported as low which is about 15% for the ecological shrimp, and about 50-55% for semi-intensive and intensive shrimp models. In particular, 100% of HHs bought shrimp quality-certified seeds from local dealers and companies in the production area.

Besides, the intensive farming model has proved to be more efficient, both economically and environmentally as it requires better water management techniques by which shrimp is more survived and FRC is also improved. All HHs, both intensive and semi-intensive farming, used industrial feed purchased from local feed agents, and an average of FRC was calculated as 1.49, in which FCR from intensive shrimp farms is 1.48 which is slightly lower than that from semi-intensive shrimp farming - 1,51.

For access to drugs and chemicals, 95% of the farmers bought from local agents while 50-60% of farmers used drugs and chemicals empirically. Farmers were observed to struggle with choosing appropriate drugs and chemicals to improve farming efficiency. The quality and origin of drugs and chemicals for shrimp farming remained complex and unclear.

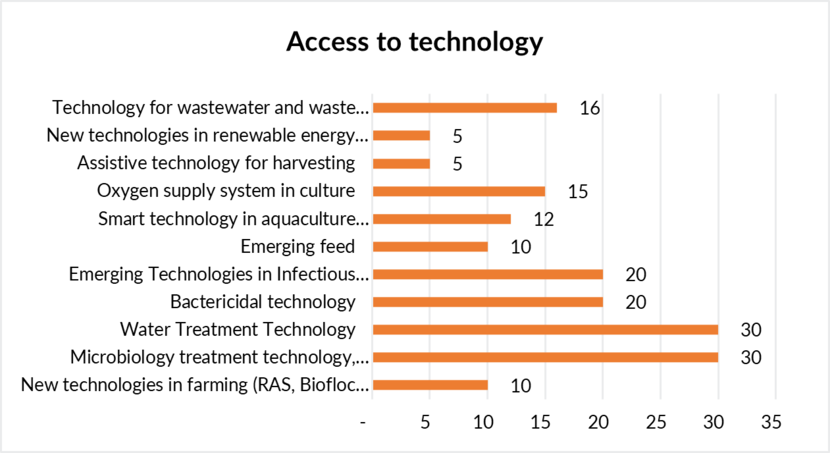

4. A modest investment in technology – Removing barriers to knowledge and technical capacity

There is a high demand for new technological applications among shrimp farms in the Mekong Delta. For the ecological shrimps, technologies have not been adopted as widely as the intensive and semi-intensive shrimp farms have.

There is a need for both intensive and semi-intensive shrimp farming households to embed technologies into multiple aspects, including water treatment (30%), biological products to improve shrimp health (30%), sterilization (20%), and antibacterial (20%), disease prevention and treatment technology (20%), gas and oxygen supplementation (15%), pond smart management (12%), food (10%), closed farming (10%), among others such as waste management, sludge settlement, feeding, harvesting. The main technology introducers involve the Fisheries Department in collaboration with the agricultural extension centre, provincial cooperative alliance, and designated technical staff of supporting companies.

5. Limited access to bank loans – A need for access to preferred loans and credit from the company

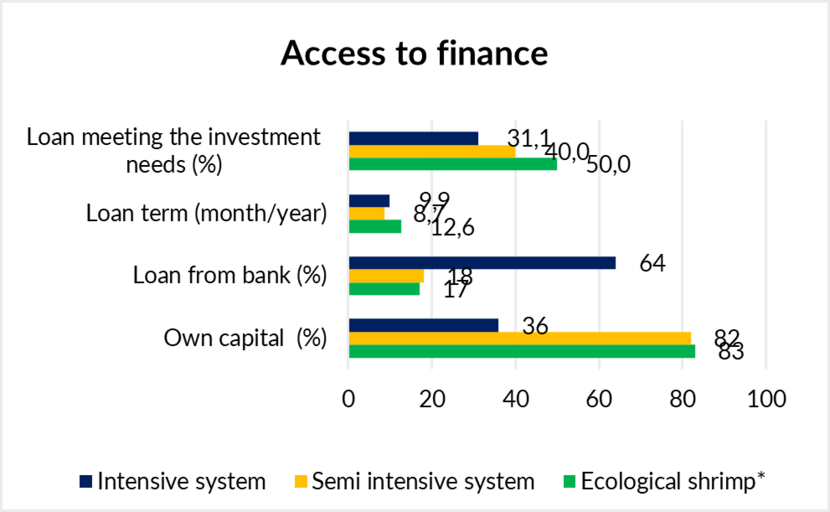

The household's average investment capital needs for shrimp farming was 470 million VND/harvest. At the assessment in 2022, the investment capital comes from 2 sources: households' capital, accounting for 43% and bank loans, accounting for 57%.

Current bank loans only meet 40% of the investment needs of households, especially for intensive farming households. The banks that provide credit mainly to farmers are state-owned banks including Agribank and ViettinBank. Most of shrimp farming households borrow using land title as collateral to secure a loan from state banks, so the interest rates are normally lower compared to households borrowing for pangasius farming. An average portion of feed costs (48%) is paid by households in the form of deferred payments to local agents. The proportion of semi-intensive shrimp farms buying feed on deferred payment is quite high, 88%; Whilst of the intensive shrimp farming is 55%. Shrimp farms that buy feed on credit pay 15-20% on a 3-6 month period in the event of feed prices rising.

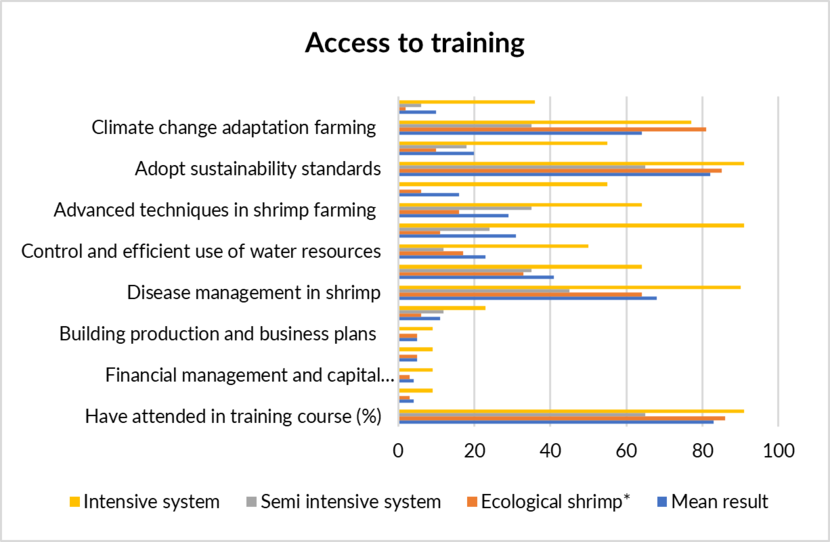

Farmers gained strong access to technical training, 83% of farmers have attended at least one training course on shrimp farming techniques. Of all models, intensive farming was in a dominant position in farmers’ access to technical training (95%). Farming households had a great need for access to information and techniques, popular topics include i) Apply sustainability standards (82%); (ii) Disease management (68%); (iii) Climate change adaptation (64%); (iv) Quality control of input products (41%); (v) Effective feeding management (31%); (vi) Advanced techniques (29%); (vii) New technologies (20%). Nonetheless, most farmers have never participated in any training courses on developing business plans and financial management in shrimp production.

The most preferred topics for intensive shrimp farmers are: 1) Disease management 2) Effective feeding management 3) Applying sustainability standards (over 90%) and 4) Adapting to climate change. Most farmers have ever applied shrimp farming quality standards, mainly ASC standards (42 %), GlobalGAP (12%), BAP (10%) and VietGAP (8%) The standard application rate is high in intensive shrimp farming models (95%) and ecological shrimp (79%), while in semi-intensive farming models, this rate is only 18%. 98% of farmers accessed information through local television/seminars, 95% accessed through training courses and 75% reached out through seminars.

6. A big gap in business management training – A need for more skills in business management

7. Unstable sourcing model – A need for shortening the value chain with more collaboration

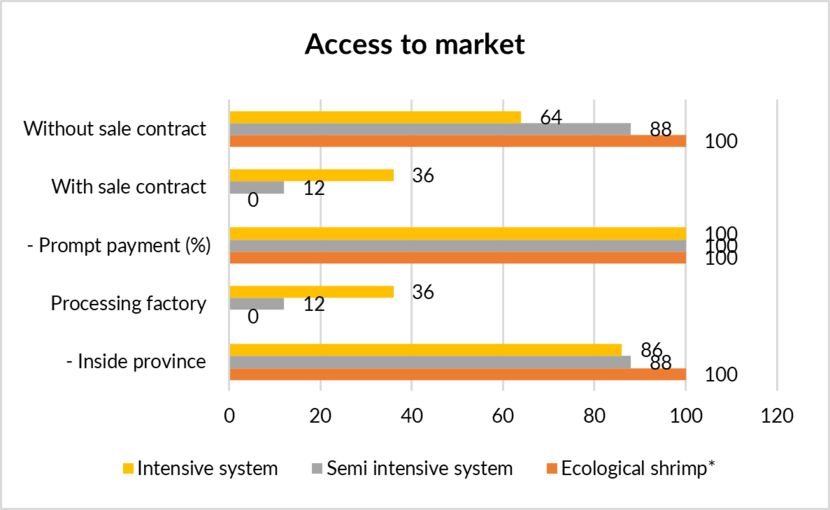

The proportion of smallholder farmers who reached processing companies was minor. Assessment indicated an average of only 7% of households have direct contracts with processors while the rest 93% of farmers sold shrimp to traders and wholesalers in the province.

The number of raw materials from the company’s production areas satisfied about 14.6% of the total raw material demand. In the region, there are large shrimp processing enterprises, such as STAPIMEX, MINH PHU SEAFOOD CORP, FIMEX VN, Tai Kim Anh Seafood Joint Stock Company, SEA MINH HAI, KIEN CUONG SEAFOOD.

Conclusion of the shrimp’s farmer needs assessment in the Mekong River Delta, Vietnam

- In simplest terms, the average production scale/HH in the MRD appears to be modest (2,62ha) in comparison to other countries (Ecuador: 100; Thailand: 6.96; India: 5.15 and Indonesia: 2.8. Source: Juárez et al. (2021).

- Overall, variable costs were calculated to dominantly make up almost the entire investment cost which were structured by key costs, including feed, seeds, drugs and chemicals. While investment in the fixed costs (land, technology, and infrastructure) was seen to be minor (1%).

- Local agents (dealers and traders) played a dominant role in providing access to seed, feed, and drugs to farmers for feed and drug suppliers and pre-financing production for farmers among other services.

- The assessment found that the costs for the adoption of technologies remained very low, only 1%. The main incentives driving farmers to apply technologies are: 1) Understanding of technology (30%) 2) Technical capacity (12%) and 3) investment capacity (10%).

- Shrimp farms were said to have been struggling with access to financial resources since their capital satisfied only 30 - 50% of the total investment needed in shrimp farms. For the shrimp farms, their financial capacity allows only a small percentage of investment for fixed and technological applications, less than 1% of the total shrimp farms’ investments was allocated to long-term capital, such as machines and technologies to improve their shrimp farming sustainability. Shrimp farming households have high needs for loans (from 30-50%/total investment capital/harvest).

- Farmers and cooperatives should be better provided with access to financial resources (banks/financial providers). In addition, promoting a sustainable supply chain from input suppliers to farmers, which is to cut off input material costs, is much needed. The assessment results represented several households receiving training on cooperative management and financial management.

- There was a relatively high ratio of households selling products directly to local traders, and only 10% selling directly to processing companies. Thus, it has been very difficult for processing factories to control the quality when sourcing products locally.

Recommendations

- There is a need for shrimp farmers to manage their farms better and further improve production efficiency to become more competitive with other countries.

- Since the variable investment was escalating while the profit margin appeared to be low and there is a significant need to access affordable feed, seeds, and drug materials with lower prices and, at the same time, encourage farmers to apply more technology into production.

- There should be a semi-integrated or fully integrated sustainable supply chain between input suppliers and farmers.

- More incentives, e.g., training, should be given to farmers by the technological suppliers so they can put more investment into digital applications which enable them to better adapt to new environmental challenges, and climate change to improve their efficiency.

- Farmers need to be equipped with more skills in business management to join with one another in the form of cooperative to improve their existential scale of production.

- It is crucial to develop and promote a closer linkage model between cooperatives and processing enterprises to support farmers with better access to quality seeds, feed and drugs to improve productivity and reduce investment costs. At the same time, it helps enhance better management of shrimp quality as well as the quality management system for exported shrimp.

This summary is part of the report of the “Aquaculture farmer’s needs assessment in the Mekong Delta, Vietnam” commissioned by the Netherlands embassy in Vietnam and conducted by Agriterra Vietnam in collaborated with the International Collaborating Centre for Aquaculture and Fisheries Sustainability (ICAFIS). The complete report can be downloaded here: Report: Aquaculture Farmer's Needs in Mekong Delta Vietnam | Rapport | Agroberichten Buitenland

Do you have any questions for the agriculture department of the Netherlands embassy in Vietnam please send an email to HAN-LNV@minbuza.nl. For the latest updates, news, funding opportunities and more follow us on Twitter @AgroVietnam, and Vietnam | Landeninformatie | Agroberichten Buitenland.