Overview of Dutch agri-food export to South Korea in 2023

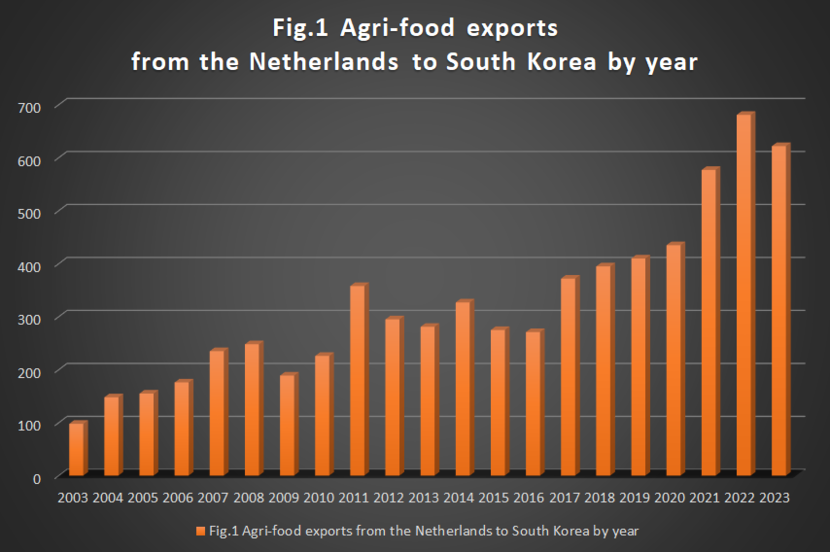

Dutch agri-food exports to South Korea showed a slight decline in 2023, with a total export value of EUR 622 million, a decrease of 8.9% compared to the previous year. It was the first time since 2016 that the exports decreased. Before 2023, it had grown by 20% annually on average. The economic recession impacted meat & dairy consumption and agri-food exports from the Netherlands to South Korea.

The agriculture team at the embassy of the Netherlands in Seoul monitors the trade between the Netherlands and South Korea and, when necessary, facilitates the businesses, removing trade barriers. Each year an overview of the exports is provided to assist the companies and highlight the rising opportunities in South Korea for Dutch companies. It is thereby important to emphasize that the importance of technology exchange and export of high-tech technology has increased, as the agriculture team at the embassy seeks to boost the resilience and sustainability of the local South Korean agri-food system.

The largest agri-food export commodity in 2023 was pork, followed by milk powder preparation, cheese, beer, butter preparation, and feed preparation. Pork, milk powder preparation, and cheese were ranked in the second, third, and 11th places respectively by export value among all the trade commodities, including non-agricultural products exported from the Netherlands to South Korea.

Table 1. Top 10 Dutch agri-food commodities exported to South Korea in 2021, 2022 and 2023

| No. | Commodities |

Year 2021 Exports (EUR.Mil) |

Commodities |

Year 2022 Exports (EUR.Mil) |

Commodities |

Year 2023 Exports (EUR.Mil) |

|---|---|---|---|---|---|---|

|

1 |

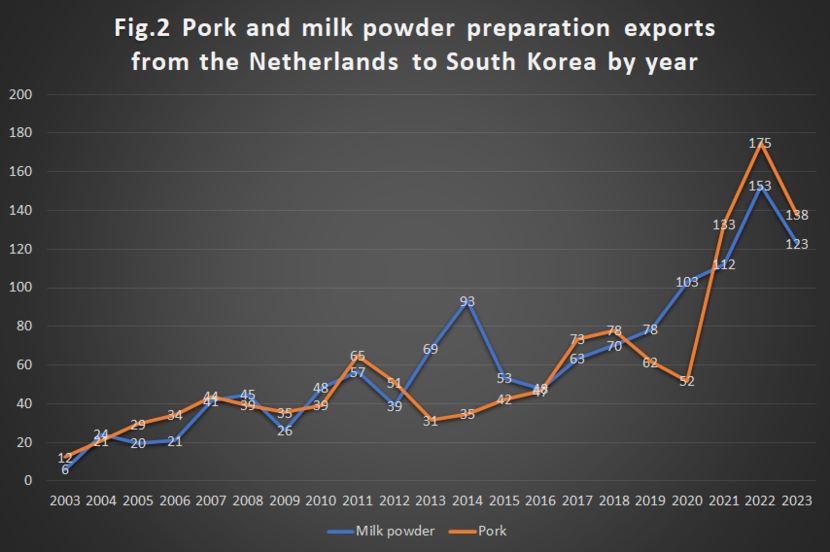

Pork | 133 | Pork | 175 | Pork | 138 |

| 2 | Milk powder preparation | 112 | Milk powder preparation | 153 | Milk powder preparation | 123 |

|

3 |

Cheese | 40 | Cheese | 43 | Cheese | 45 |

| 4 | Beer | 38 | Beer | 29 | Beer | 29 |

| 5 | Feed preparation | 25 | Feed preparation | 26 | Butter preparation | 24 |

| 6 | Butter preparation | 25 | Butter preparation | 24 | Feed preparation | 19 |

| 7 | Malt extract | 23 | Cocoa preparation | 15 | Preserved vegetables | 16 |

| 8 | Preserved vegetables | 17 | Food processing machinery | 14 | Cocoa preparation | 13 |

| 9 | Cocoa preparation | 16 | Preserved vegetables | 13 | Dextrin, Modified Starch | 13 |

| 10 | Farming machinery |

12 |

Casein | 13 | Chocolate | 13 |

Pork

Dutch pork exports hit a record high in 2022, but in 2023, exports decreased slightly due to a downturn in pork consumption from the economic recession and inflation. The Netherlands was the 4th largest exporter of pork after the US, Spain, and Canada. Around 80% of pork exported from the Netherlands to South Korea was frozen pork belly (called Samgyeopsal in Korean), mainly for Korean BBQ. Local pork is generally twice as expensive as imported pork, but Korean consumers prefer local products. Therefore, local pork typically goes to retailers, while imported pork goes to restaurants. It means the economic recession impacts imported pork more.

Milk powder preparation

Dutch milk powder preparation exports also decreased in 2023 after showing a record-high import value in 2022. Milk powder preparation is a blend of milk and whey powder created to lower customs duty when exported to South Korea. Due to the economic recession, dairy consumption went down. Local dairy processors suffered from the overproduction of raw milk in the 2nd half of the year. They had to dry leftover raw milk to make milk powder, which competed with milk powder preparation from abroad.

The Netherlands is the largest exporter of milk powder preparation, accounting for 70% of the market. As local raw milk in South Korea costs more than twice the world's average raw milk, the demand for high-quality dairy ingredients from abroad is high. The Netherlands has a good name in the Korean market for its high-quality dairy chain. Dutch milk powder preparation is mainly used in the Korean dairy and confectionary sectors.

Protein products were becoming popular among adult consumers for diet, sports, and immunity. South Korea increasingly imported Dutch milk powder products, such as whey protein, goat milk protein, and lactoferrin, as raw materials for the protein products.

Cheese

Dutch cheese exports grew and reached EUR 45 million in 2023, increasing 4.9 % compared to the previous year. The Netherlands has exported mainly Gouda cheese and some processed cheese to South Korea. In 2023, the Netherlands was the 5th largest exporter of cheese after the US, New Zealand, Germany, and Denmark. German and Danish exports showed an impressive growth of 62.5% and 115.4%, respectively.

Beer

The Dutch beer export value in 2023 was similar to the previous year, and the 2nd position in the Korean market remained unchanged. However, the largest exporter’s place was replaced by Japan instead of China. It was related to the recovery of the relationship with Japan.

Others

The growth in preserved vegetable exports is remarkable. Hi-tech agricultural machinery, live plants, chocolate & confectionary products continued growing.

Dairy exports have concentrated on raw materials for local dairy or confectionary professors. The recent trend is that finished dairy products for consumers, such as white and flavored milk, are growing. The Netherlands still needs to be allowed to export those products to South Korea and is working on market access.