Saudi Arabia's 2019 Budget

Saudi Arabia’s 2019 Budget highlights the government’s keenness to accelerate economic growth while utilizing the private sector as a catalyst for its economic transformation.

The largest ever, Saudi Arabia's 2019 Budget: Call on Oil and Support Private Sector to Raise non-oil revenue

SAR 131.4 billion ($US 35 billion, 24% increase from 2018 Budget) is allocated for economic resources, i.e. for mega projects and initiatives related to Vision 2030 Realization Programs, and that include funding initiatives to optimize the agricultural sector with the aim of contributing to the country’s strategic objectives for food security.

However, in addition to the government’s plans to boost spending in bid to stimulate the private sector, the Public Investment Fund (PIF), which is Saudi Arabia’s sovereign wealth that manages over US$ 250 billion in assets, is expected to contribute, off-budget, directly to capital spending in the private sector. PIF will play a pivotal role in supporting economic growth. PIF’s contribution also includes other initiatives such as Neom and the Red Sea Project aimed at achieving Vision 2030 objectives.

The private sector will continue to play a major role in the Kingdom’s agricultural development. This mostly due to government programs that offer long-term, interest-free loans; technical and support services; and incentives (e.g., free seeds and fertilizers, low-cost water, fuel and electricity, and duty-free imports of raw materials and machinery).

According to MoF, the government is working on several economic reforms aimed at stimulating investment in the economy and enhancing investor confidence through increased private sector participation and accelerated growth. It will introduce privatization programs and capital expenditure projects that achieve economic growth and deliver vital projects through private sector stimulus packages and the development of new sectors.

Anyways at the end of the day Saudi Government spending is a key driver for economic activities and growth in Saudi and the region.

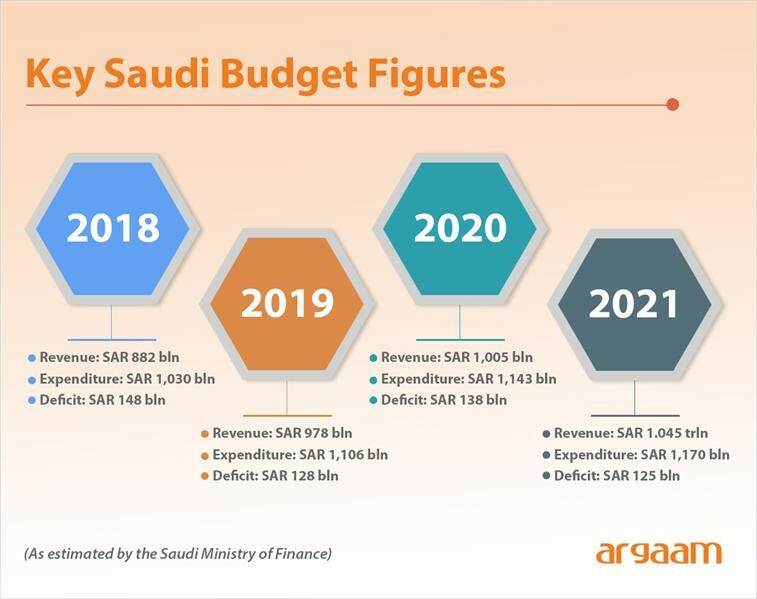

Spending & Revenue Key Figures (source: Saudi Ministry of Finance – MoF)

- Budgeted expenditure of SAR 1106 billion (US$ 294 billion - at the fixed Exchange rate 3.75), an increase of 7.3% over 2018 (Actual spending in FY 2018 was $US 275 billion)

- the priorities are consistent with recent years: Military and security services 27% of total allocations ($US 78.5 b, down 5.5% from 2018), education 17.5% ($US 51.5 b, flat), healthcare and social development 15% ($US 45.9 b, rose 17% from 2018)

- GDP growth is expected to reach 2.6% in 2019 compared to 2.3% in 2018

- Estimates revenues of SAR 975 billion (US$ 260 billion), 9.0% increase from FY 2018

- 68% of the revenue will come from oil revenue (it is estimated that the Saudi Government’s projections may be based on as high as $80 pb in 2019, and crude oil production of 10.1 mbpd)

- Non-oil revenue to reach SAR 313 billion (US$ 84 b) in 2019, up 9% from 2018, and will come from a number of areas, including rises in expat fees, VAT, and improvement in the collection process of taxes

- The Saudi government is expecting a slightly lower deficit at SAR 131 billion (US$ 35 b, 4.2% of GDP)

- 20% increase in government investment (capital expenditure) to SAR 246 billion (US$ 65.6 b)

- Operating spending (OPEX) is expected to increase by 4% to a budgeted total of SAR 860 billion (77.8% of the total expenses). Wage bill is at SAR 456 billion (41% of the total expenses).

Agriculture Office of the Embassy of the Kingdom of the Netherlands to the GCC countries - By Anas Monzer.