Spain: The agrifood sector in the face of higher inflation

Ukraine’s invasion has overshadowed the positive outlook seen for the Spanish economy in 2022. While some factors had already appeared at the end of last year detracting from the dynamism of the recovery, the armed conflict in Ukraine has become the major conditioning factor for economic developments in the short term.

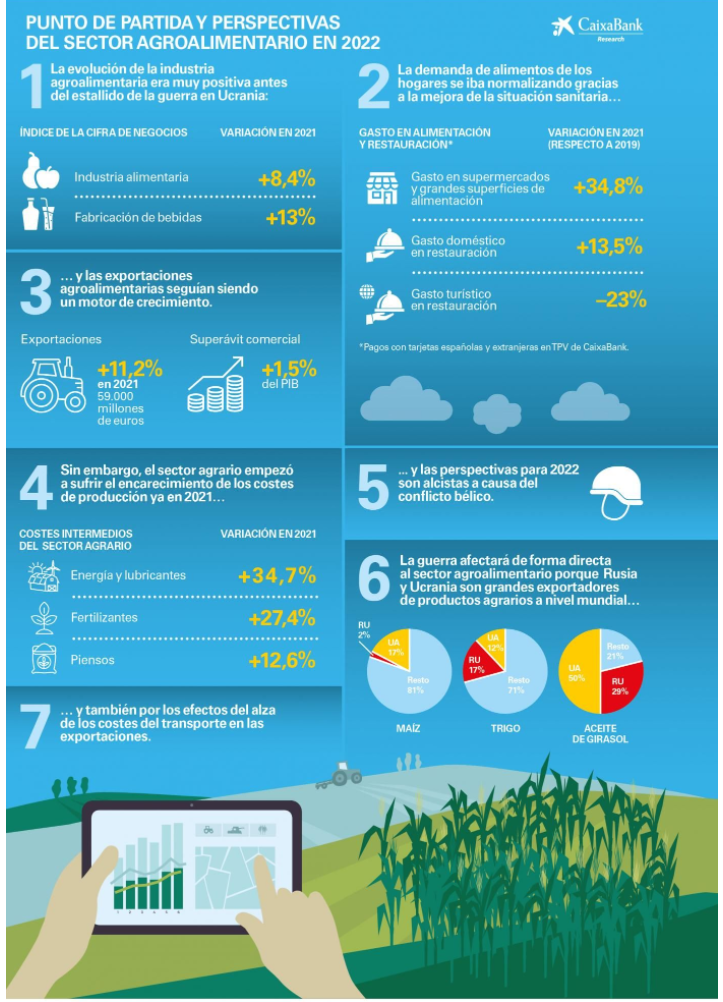

According to CaixBank Research’s report (Fig. 1), at the end of 2021, some factors had already appeared hindering the economic recovery in Spain, such as the spread of the Omicron variant, disruptions in global supply chains and inflationary pressures, especially from energy prices. Ukraine’s invasion has become the main focus of attention and the major conditioning factor for the shot-tem economic developments in 2022.

Price evolution, key for the sector in 2022

It is still too early to know the definitive scope and repercussions of the war on the Spanish economy and its agrifood sector in particular, but the main channel of impact is undoubtedly the increase in energy costs. In this sense, it can be said that it never rains but it pours. In 2021, the production capacity of the Spanish agrifood sector was heavily pressured by rising production costs (energy, fertilizers, feed), an aspect linked to bottlenecks and inflationary pressures of a more global scope. The invasion of Ukraine represents a new energy shock and will delay the normalization of the functioning of global value chains.

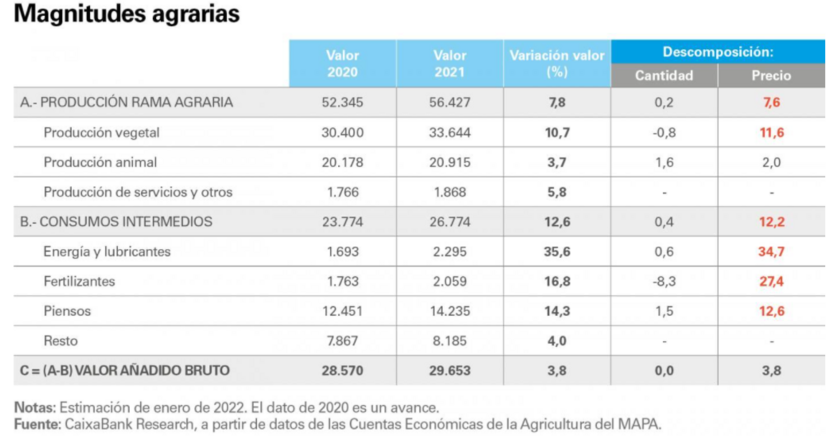

As for the primary sector, the rise in production costs undermined its performance. According to statistics published by the Ministry of Agriculture, Fisheries and Food (Fig. 2), in 2021, agricultural production increased by 7.8% in value, an increase that is due exclusively to higher prices, since the quantity produced hardly changed (0.2%).

The value of vegetable production increased by 10.7% (Fig. 2), mainly due to the increase in the price of certain products such as olive oil, cereals and industrial crops. The value of animal production increased by 3.7% (Fig. 2), as a result of both an increase in the quantity produced and a modest rise in prices.

To calculate the value added of the primary sector, production costs must be subtracted, which in 2021 rose sharply (12.6%), due to the increase in energy costs (34.7%), fertilizers (27.4%) and feed (12.6%). As a result of all this, value added increased by 3.8% in nominal terms, but the advance was zero in real terms (Fig. 2).

Food manufacturing industry evolves favorably

The food and beverage industries have followed an upward trend throughout 2021, with an increase of 8.4% in turnover (nominal value). Beverage manufacturing, which was more affected by the pandemic due to its greater dependence on the HORECA channel, has experienced a particularly strong recovery in 2021 (increase of 13.0% in turnover) and already exceeds the pre-crisis level.

There are two issues that currently generate a lot of concern in manufacturing industries in general: (1) supply shortages due to the disruptions that global value chains are going through, tensions that are being aggravated by the invasion of Ukraine and (2) increased of energy costs.

With regard to the rise in energy costs and in the specific case of the food industry, the impact is being relatively limited thanks to its lower energy intensity compared to other Spanish industrial branches. In the food industry, energy represents 2.2% of intermediate costs, compared to 4.3% for the Spanish manufacturing industry as a whole.

Evolution of agrifood demand

On the demand side, a full normalization of food consumption patterns, inside and outside the home, is expected as the health situation normalizes. Spanish spending in supermarkets remains high and restaurant/bar spending is already above pre-crisis levels. In this area, there is concern that a persistent increase in food prices will eventually erode consumer purchasing power and real consumption.

According to the CaixaBank Research’s report, data up to February showed a very positive evolution of food expenditure. However, rising food prices paid by the end consumer reduce the purchasing power of shoppers and may eventually erode real consumption. Since December 2021, inflationary pressures have only increased and the outlook is bleak in the face of a new energy shock and rising agricultural commodity prices on international markets.

On the other hand, the recovery of international tourism is expected to support foreigners' spending on tourism, a segment that still shows a significant gap with respect to pre-crisis figures.

Spanish agrifood exports continue to break records

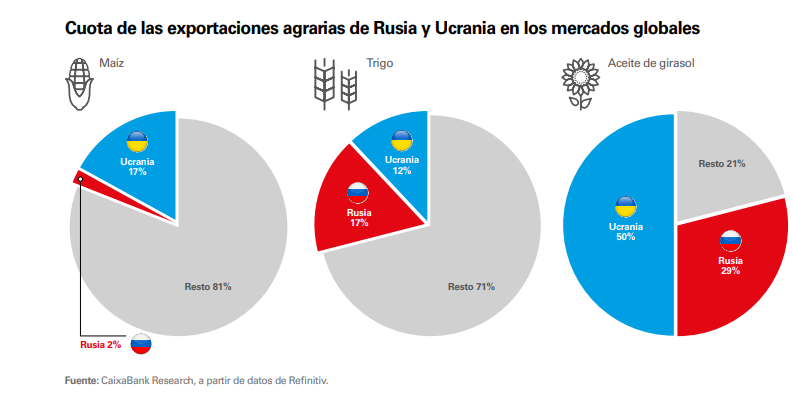

The invasion impact on exports will be limited, as the weight of the Russian market had already been drastically reduced since 2014 by the "Russian veto" on imports of European agricultural products. Spanish agrifood exports to Russia and Ukraine accounted for barely 0.4% and 0.3%, respectively, of the total in 2021. However, the sector will be directly impacted by the sharp rise in the price of certain inputs from the "breadbasket of Europe" (Fig. 3). In particular, 27% and 62% of corn and sunflower oil imports, respectively, come from Ukraine, and Russia is a major supplier of mineral fertilizers (8. 6% exported to Spain).

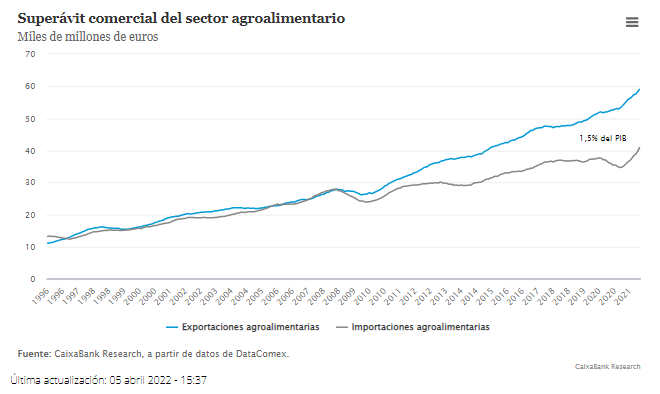

Focusing on the medium term, expectations are placed on the Next Generation EU (NGEU) funds, which can be a very important stimulus for investment in innovation and digital transformation. This will contribute to consolidate the high international competitiveness enjoyed by the Spanish agrifood sector. Proof of this is the excellent figure for agrifood exports in 2021, which, with an increase of 11.2%, broke a new record and reached €59 billion.

In 2021, Spain had a world share of 3.9% in terms of agrifood exports. It ranks fourth in the EU (behind the Netherlands, Germany and France) and seventh worldwide. Moreover, the external surplus of agrifood goods stood at 1.5% of national GDP in 2021, compared to 1.1% in the previous year (Fig. 4).

Irrigation and climate change

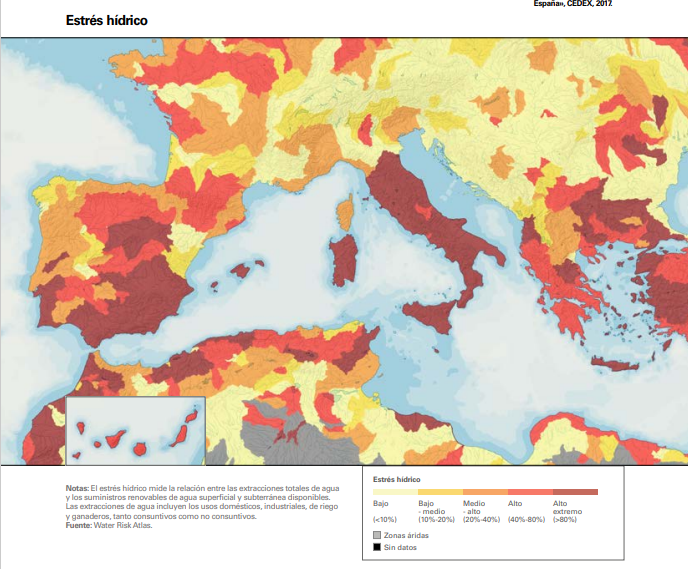

This winter's drought has highlighted one of the most important challenges facing the sector: improving the use of water resources in a scenario of increased water scarcity. In many regions of the world, including some Spanish regions (Fig. 5), water is subject to high levels of water stress. Water stress levels are likely to increase in currently more stressed areas as the effects of climate change intensify.

In Spain, the agricultural sector accounts for 82.1% (70% worldwide) of water use. Indeed, irrigation is a basic element of the Spanish agrifood system: the irrigated area represented 22.9% of the total cultivated area, but its production contributes slightly more than 50% of the final plant production. Without any doubt, irrigation is the fundamental pillar on which the production and export potential of the fruit and vegetable sector rests: Spain is the leading exporter of fruit and vegetables in the EU and one of the three leading exporters in the world, together with China and the USA.

Climate change requires a huge effort to adapt Spanish irrigation to the new circumstances and, in this sense, the NGEU funds will be a great support to continue modernizing irrigation, with the aim of promoting water saving and energy efficiency.