Washington's tree fruit industry gathers at NW Hort Show in Kennewick

Between December 3rd and 7th, 2023, the 119th Annual Meeting of the Washington State Tree Fruit Association (WSTFA) and the NW Hort Show convened in Kennewick, WA. This event serves as a crucial platform for the Northwest tree fruit sector, providing opportunities to reconnect and stay updated on the latest developments in state and federal policies, economic forecasting, as well as research and innovation.

The Netherlands Agricultural Office's attendance at the event was part of the Orchard of the Future collaboration between the Netherlands and Washington, signifying the ongoing exchange and cooperation between the two regions in advancing sustainable agricultural practices and fostering innovation within the tree fruit industry.

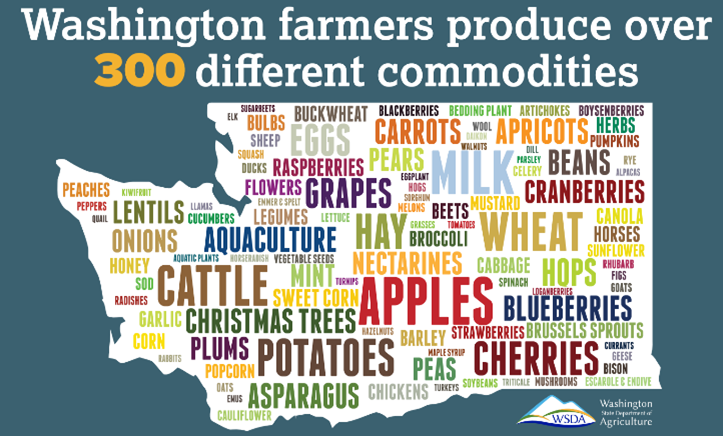

Washington: number 1 producer of apples, hops and cherries

The state of Washington has a large and diverse agricultural sector with a market value of almost US$ 13 billion. It produces over 300 crops and is, with a value of US$ 2.1 billion, the largest apple producer in the United States. Other important commodities are wheat (US$ 1.7 billion), milk (US$ 1.7 billion), cattle (US$ 1 billion), potatoes (US$ 943 million), hops (US$ 435 million), and cherries (US$ 408 million). The state is also the largest producer of aquaculture in the United States. Notably, the Netherlands is the strongest trade partner for the state of Washington in the EU.

2023 NW Hort Show

The NW Hort Show, which focuses specifically on the tree fruit sector, is organized annually in December by the WSTFA and rotates between the three main apple, pear and cherry production areas in Washington: Wenatchee, Yakima and Kennewick. The 200+ exhibitors consist of suppliers to the orchard sector including nurseries, robotics, fertilizers, agricultural financial service providers, biocontrol, picking platforms, tractors, data solution and technology for in the orchard and the packhouse, crop management, labor, sprayers and spaying technologies, as well as packaging, sorting and storage technologies. The show attracts about 2500 visitors. Most are growers from Washington and Oregon, but the show also attracts visitors from Canada and Mexico.

WSTFA Annual Meeting: Deep Roots – New Strategies: innovative thinking for today’s challenges

The NW Hort Show coincides with the annual meeting of the WSTFA. This two and half day, very well attended event, provides an important opportunity to update members and stakeholders on state and national policy developments, sector economics, challenges and opportunities, as well as new research and technology development. The theme of this year’s event was “Deep Roots – New Strategies: innovative thinking for today’s challenges”.

Several industry organizations, including WSTFA itself and USApple provided an overview of the latest updates. Attendees also heard from the WA Department of Agriculture, state politicians, the Washington Tree Fruit Research Commission (WTFRC), and the Rabobank. The Orchard of the Future partnership was featured multiple times during the various sessions and Peter-Frans de Jong, orchard researcher at Wageningen University presented updates on research to improve spraying technologies and the latest on a test with a prototype for a pear harvesting robot.

State of Washington policy developments impacting the tree fruit sector

WSTFA represents growers, packers, and marketers of apples, pears, cherries, and other tree fruits in Washington, contributing to approximately 28% of the state’s total agricultural production value. Jon DeVaney, the association's president, highlighted key focal points for the sector which will be important topics during the 2024 Legislative Session in Washington:

- The new overtime wage law in Washington for seasonal agriculture has adversely affected both workers (resulting in reduced hours and subsequently lower pay) and growers (leading to increased costs). The sector is actively lobbying for seasonal flexibility to address these challenges.

- Sales and Used Tax on reusable packaging, which carries higher tax rates compared to disposable packaging, acts as a deterrent. There's a push for reconsideration or adjustment of these tax rates.

- The potential for state funding for the Agricultural Leadership Program, initiated by the tree fruit sector, is under discussion in the Governor’s Budget. This program focuses on nurturing emerging leaders in the industry and has support from the WA Department of Agriculture.

- Media outlets have sought expertise from WSTFA, prompting the association to strengthen its communication channels. Efforts include enhancing their website and utilizing platforms like Facebook to convey messages effectively.

- The Washington State government is increasingly leveraging data analyses to identify issues and formulate responses, including evaluating injury rates within the sector. Prioritizing safety and training remains a core focus for WSTFA.

National policy developments impacting the tree fruit sector

USApple, headquartered in Virginia, represents the US apple industry on national issues and serves as its primary voice. They work with federal regulators, legislators, and the Administration to advance the industry's goals. Additionally, they act as a media contact and manage crisis communications for the sector. The US stands as the world's second-largest apple producer, yielding an annual production of 5 billion kilograms managed by over 26,000 apple growers. The sector's estimated downstream value reaches about US$ 23 billion. Approximately two-thirds of the apple is grown for fresh consumption, while the remainder is allocated to processing for juice and other apple-related food products. One out of every four apples intended for fresh consumption gets exported.

Key focus areas for USApple include:

- The new Farm Bill, specifically targeting programs such as the Specialty Crop Research Initiative, Specialty Crop Block Grants, Market Access Program, and Federal Crop Insurance, all pivotal in providing federal financial support for the industry.

- Expanding and opening new international markets while striving for the elimination of tariffs in foreign markets.

- Preventing events, decisions, laws, or regulations that might adversely affect the US apple industry.

- Agricultural labor remains a critical focus, encompassing both offensive and defensive strategies. This involves advocating for legislative reforms related to H-2A Reform (temporary ag workforce visas) and the Farm Workforce Modernization Act.

- Lobbying for additional financial resources, such as the industry's receipt of over US$ 311 million in direct Corona Food Assistance Program payments. USApple has advocated, with success, for USDA to purchase an additional US$ 60 million worth of fresh apples and US$ 40 million of processed apples, a response to the abundant 2023 harvest in the US resulting in notably low apple prices. The efforts also encompass the enforcement of Buy America Provisions, ensuring robust and reliable apple crop insurance, and support for the Market Access Program.

Economic forecast for Washington's free fruit industry

Rabo AgriFinance provided an economic forecast for Washington's free fruit industry, noting the collision between global and national developments and rising incomes, health focus, and taste preferences, fueling challenges and opportunities for the sector. Inflation impacted consumer spending despite rising incomes, driven by increased housing, food, and transportation costs. Predictions for 2024 suggest stable global GDP growth around 3%, with advanced economies resembling 2023 figures and emerging economies maintaining 4%, hinting at a potential gentle landing for the global economy.

Freight costs showed a positive trend, decreasing and stabilizing since early 2023. El Nino's persistence into 2024 could affect US weather, offering a relatively warmer Northwest winter and a cooler, wetter southern US first quarter.

Consumer behavior adapted to rising prices, focusing on convenience, shifting to cheaper retailers, altering protein choices, and exploring different products. US consumer fruit preferences revealed bananas as the top choice, followed by apples, strawberries, grapes, oranges, watermelon, and blueberries, while cherries and pears ranked lower. Berries dominated retail sales in value, followed by apples.

Stable trends marked the US fresh apple and pear markets, with notable export shares and primary markets. Cherries faced seasonal availability. Blueberries showed promising potential.

Rabo AgriFinance highlighted growth prospects for the fresh fruit industry, contingent upon various factors, including fruit genetics, grower and consumer needs, and the evolving Gen Z demographic's diversity.

Lastly, Rabo AgriFinance addressed labor challenges, signaling a tightening farm labor market due to shifting trends in Mexico. Increased education, income, reduced migration, and changing demographics affect the US farm labor scenario. The complexity of the current equation calls for innovative solutions beyond historical norms.

WTFRC Technology Roadmap to prioritize and support innovation in free fruit production

The second day of the annual meeting was dedicated to updating the tree fruit industry on the latest research and technological advancements. Ines Hanrahan, Executive Director of the Washington Tree Fruit Research Commission (WTFRC), presented the WTFRC Technology Roadmap, outlining the Research, Development & Engineering activities for the next two years. She stressed the importance of vibrant local, national and global public-private partnerships, including the Orchard of the Future Collaboration. The scope of the technology roadmap is apples, and the focus is on industry challenges. The roadmap defines outcomes, not specific solutions. She provided a detailed overview of the trends and challenges for the apple sector in Washington as well as barriers to technology adoption under growers and packers. The Technology Roadmap provides a pathway towards identifying priorities and next steps.

Trends in WA apple production

Broad trends

- The industry is currently going through a down cycle

- Labor costs continue to rise

- Increased competition within Washington State

- Consolidation

- Increasingly challenging regulatory environment

- Increased climate volatility

Apple production trends

- Input inflation cuts into margins

- Newer orchard designs opt for uniformity and 2 dimension

- Aging population

- Production technology trends

- Steady tech progress has been made in many areas of production

- More data without the ability to act on it

- Increasing monitoring/mapping for intensive orchard management

Barriers to Current/Future Tech Adoption

- Declining profitability of production

- Lack of uniformity across the apple sector and overtime

- Upfront cost efficiency

- Technology proliferation and low success rates

- The need to redesign orchard infrastructure in preparation for automation solving for total cost of ownership

- Perception of the difficulty of certain tasks

- Limited opportunities in new varieties

- Lack of awareness of the potential of non-obvious technologies.

- Growing concern about the availability of a tech-literate workforce.

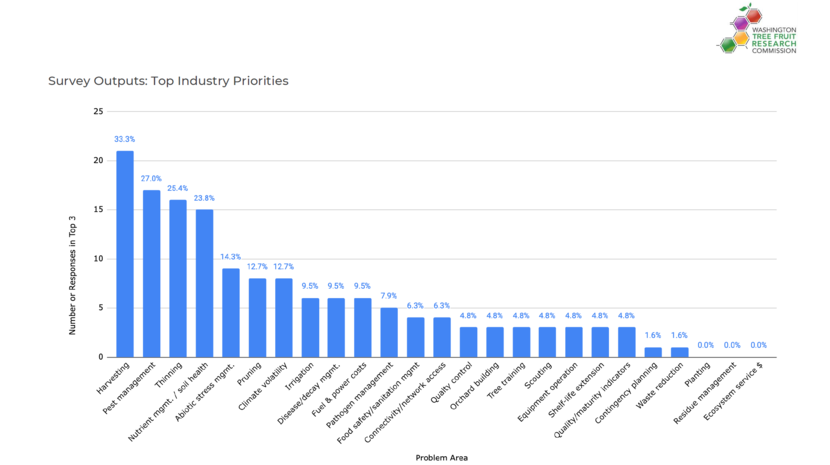

To develop the roadmap the steering committee which consisted of WTFRC staff and apple growers engaged with over 100 stakeholders and held multiple focus group sessions. Additionally, a prioritization survey was conducted which received 63 responses. These efforts together provided insights into the top industry priorities which are outlined below:

From this list of top industry priorities the sector selected three high priority areas with three different timelines to impact:

- Irrigation (near term)

- Irrigation sensors and infrastructure

- Irrigation optimization software

- Advanced irrigation control systems

- Crop Load Management (mid-term)

- Pruning tools

- Chemical thinning tools

- Hand-thinning (blossom, fruitlet, green fruit) tools

- Crop Load Modeling tools

- Harvest Labor (long term)

- Assistive Technologies

- Labor Management Systems

- Harvesting Robots

Within each priority area the existing technology landscape is described, strategies and example activities are identified for focus and action, and prioritized across the roadmap.

In addition, together with Western Growers Center for Innovation & Technology and Farmhand Ventures, WTFRC has also developed a start-up Agtech Toolkit which is designed to help startups better understand grower’s problem statements, use cases and economics for key crops including apples. Other crops are romaine lettuce and citrus and more crop pages are being worked on. It provides an opportunity of entrepreneurs, startups, growers and workers to more efficiently collaborate.

WUR tree fruit research and Orchard of the Future

Peter-Frans de Jong presented, in front of a packed ballroom, research on precision spraying and blossom thinning in the orchard and participated in a panel on harvest automation where he presented the results of the trail that has taken place with the first automated pear picking robot. Ines Hanrahan, Executive director at WTFRC presented the activities of the Orchard of the Future Collaboration, including the research work with Wageningen University related to Fruit 4.0., the 3 Bilateral Innovation Collaboration (BIS) projects between the Netherlands and Washington on automated spraying, full automatic homogeneous blossom thinning and yield regulation and the validation of a microwave based handheld sensor for inspection of fruit. Also the activities for 2024 were announced, including delegation visits to and from the Netherlands.

Additional meetings and visits: WTFRC pear commission, WSU Prosser and Douglas Fruit

During a meeting with two Washington pear growers, discussions revolved around the challenges faced by the pear industry in Washington. WTFRC has been actively working with this sector on a list of research priorities.

The pear sector in Washington is relatively small compared to the apple and stone fruit industries, accounting for only about 5% of the state's tree fruit production. Unlike the apple sector, the pear industry is notably conservative, displaying a more reserved approach towards innovation. This sector is divided regarding their interest in adopting innovative practices.

The Netherlands has a more advanced and innovative pear sector. Forward-thinking Washington pear growers expressed a desire to innovate and are interested in exploring developments in the Netherlands, seeking opportunities to exchange knowledge and experiences. As part of the Orchard of the Future collaboration a visit to the Netherlands specifically focused on the pear sector will be planned for late 2024 or early 2025.

We had the chance to visit the Irrigated Agriculture Research and Extension Center (IAREC) of Washington State University (WSU) in Prosser, where Dr. Naidu Rayapati, the IAREC Director, introduced us to their operations. Among WSU's four research centers, Prosser stands as the largest, housing 19 faculty members and hosting 35 Ph.D. students. It's a diverse institution, funded by WSU, the Washington Department of Agriculture, USDA, and various commodity groups.

Within WSU Prosser IAREC, three specialized centers operate: AgWeatherNet (AWN), the Center for Precision and Automated Agricultural Systems (CPAAS), and the Clean Plant Center Northwest (CPCNW). Notably, CPCNW serves as the USDA's Plant Import Quarantine facility in the US Northwest.

Prosser’s main focus spans tree fruit research and orchard technology, particularly automation. During our visit, we engaged with several Ph.D. students who presented their prototype orchard automation technologies, showcasing ongoing applied research work at the facility.

We had a great opportunity to tour Douglas Fruit's orchards and packing facility in Pasco, WA. Douglas Fruit is known for producing apples, cherries, and peaches across 3000 acres and 13 ranches. Their exclusive partnership with Stemilt, initiated six years ago, involves growing and packing products for Stemilt's distribution.

Their apple orchards are equipped with traditional V trellises and boast varieties like Cosmic Crisp and Tango. The market prices stand at approximately US$30 per box for conventional apples and US$38 for organic ones. To track picking rates, they utilize Picktrace, achieving an average of 45 minutes per acre (0.4 hectares).

Recognized for their dedication to quality, diverse and innovative farming methods, and their collaborative approach within the industry, Douglas Fruit was honored with the Good Fruit Grower's Grower of the Year Award at the 2023 NW Hort Show.

More information

For more information about the Orchard of the Future collaboration between the Netherlands and Washington and our activities in 2024, please visit our website: Orchard of the Future – Together we are creating a future proof orchard industry or reach out to our office in Washington, DC.