Drought forces tropical fruit sector in Spain to broaden its horizons

The tropical fruit sector is exploring new growing areas to ensure the category's growth in the coming years, in the face of the severe and prolonged drought in several Spanish provinces. Two major specialist companies have set their sights on the north-west of the Iberian Peninsula. A third is setting up in the Dominican Republic.

The most severe and prolonged drought on record has caused avocado and mango production in Axarquía district (Málaga province) to plummet. Faced with this difficult situation, which is unlikely to be resolved in the short term due to the lack of water infrastructure, operators are intensifying their search for new commercial alliances and production areas that will enable sustainable category growth in the coming years.

Major companies are looking to purchase new farms in areas where water supply is assured and to sign agreements with new partners committed to the future of tropical crops, even in provinces traditionally specialised in other crops. Supply efforts are extending beyond national borders, to make up for the shortfall in local production and to provide homogeneous fruit of the highest quality throughout the year.

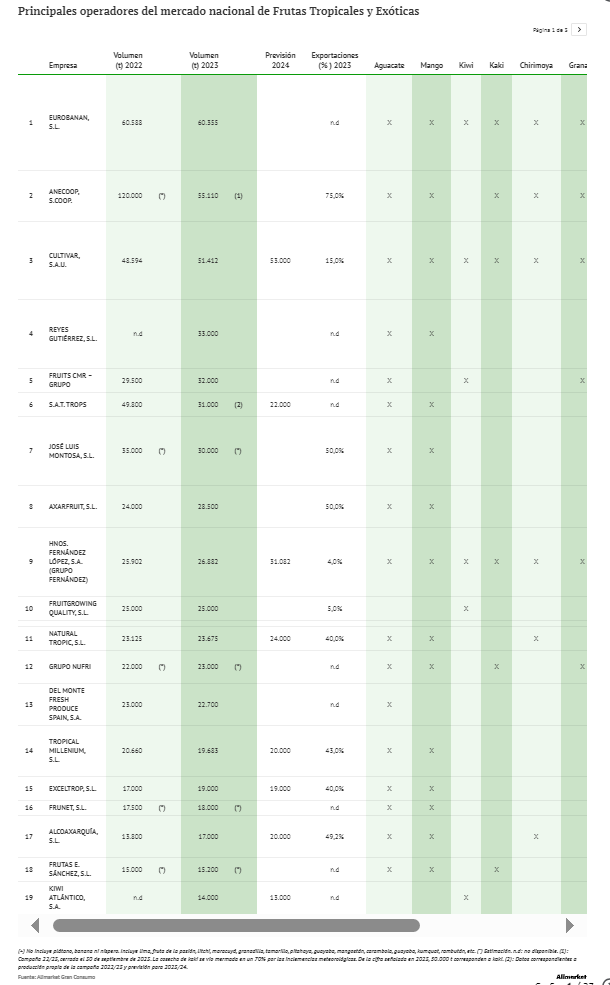

Two important companies, Trops and Grupo Reyes Gutiérrez (Fig. 1), have set their sights on Portugal and the Spanish province of Cádiz. Grupo Alcoaxarquía is once again crossing the Atlantic, this time to set up in the Dominican Republic.

Alcoaxarquía's expansion has attracted the investment firm Tresmares Capital as a shareholder. This is the first time that a private equity company has entered the Spanish tropical fruit sector which is owned by families and cooperatives. The results are already visible, at least in the case of avocados. Despite the sharp decline in Axarquía, total production will be at the same level as last year, thanks to the diversification efforts made years ago.

The need for new water infrastructure

Lack of rainfall, restrictions on irrigation and delays in the construction of new water infrastructure have seriously threatened the viability of farms. In addition, the cost of key agricultural inputs remains high. A sharp drop in production will lead to a significant reduction in value-added sales, according to the Spanish Tropical Fruit Association (AET).

The result for avocados is a 70-80% reduction in the current crop compared to the 2022/23 season, which already ended with a 60% reduction due to water shortages and high temperatures. The same is true for mangoes, which were 70% down on last season's production. Faced with this worrying situation, the AET believes that it is urgent to build a desalination plant or implement a project to bring regenerated water to the region. Otherwise, the plantations are in danger of disappearing. This is particularly true for avocados, as mangoes are more resistant to water shortages.

Imports on the rise to secure supply

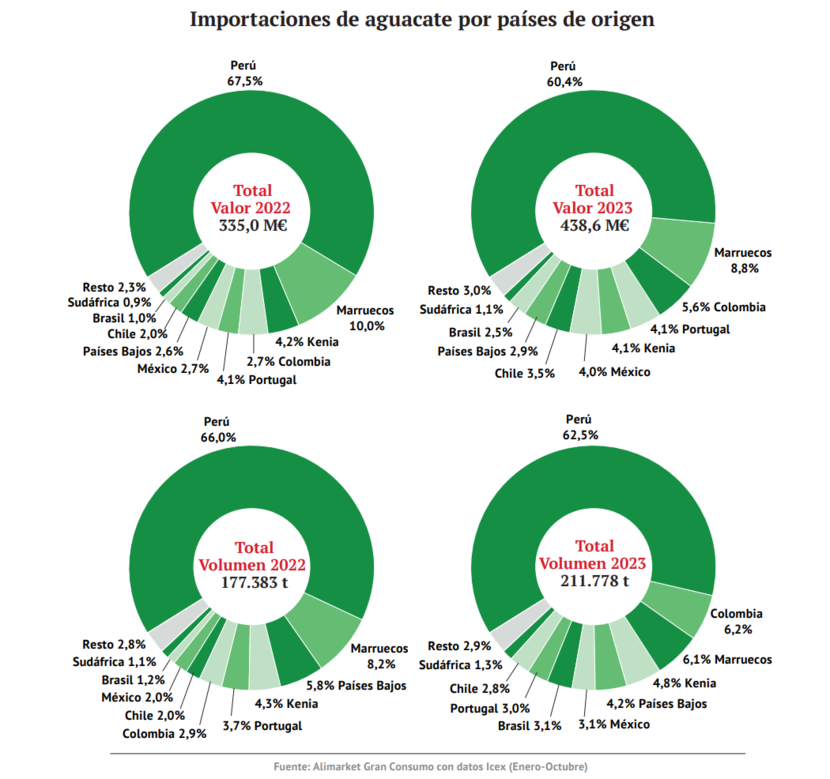

Data available up to October 2023, show this trend for both avocados and mangoes. Avocado imports were up 19.4% in volume terms (to 212,000 tonnes) in the first ten months of the year, this would be the highest level in the historical series at the end of the year. Peru remains the leading exporter of avocados to Spain, with a 62.5% share (Figure 2).

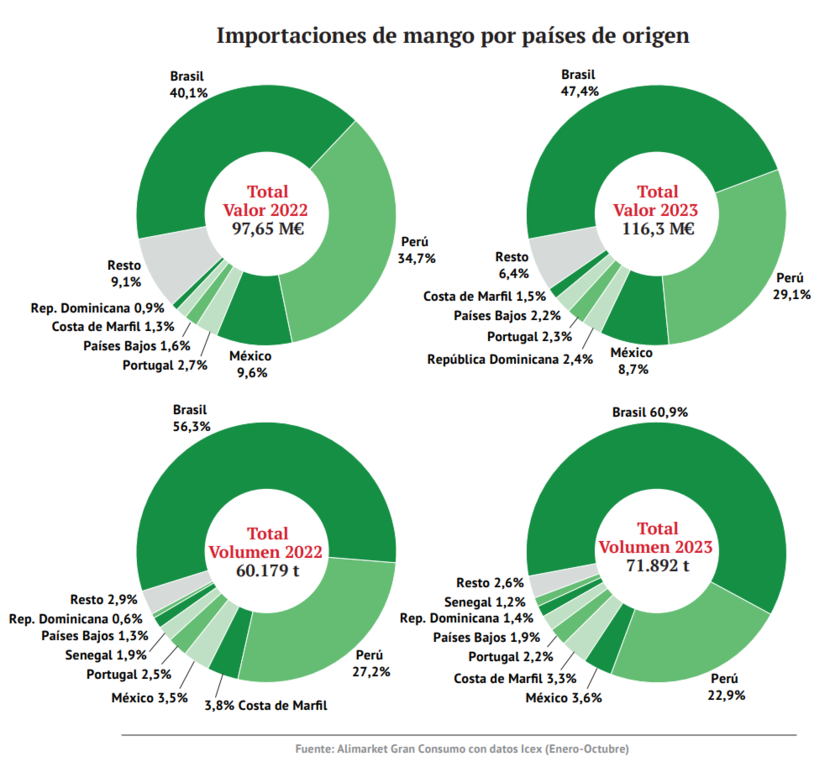

Mango imports increased by 19.5% to 72,000 tonnes between January and October 2023, with Brazil being the leading exporter with a 56.3% share (Fig. 3).

Decline in exports

Extreme weather events are becoming more frequent as a result of climate change, making campaign planning more difficult for the sector. This serious problem is exacerbated by the increasing presence on the European market of products from third countries at very competitive prices. Inflation, which is eroding the purchasing power of European consumers, is another no less important factor affecting foreign trade.

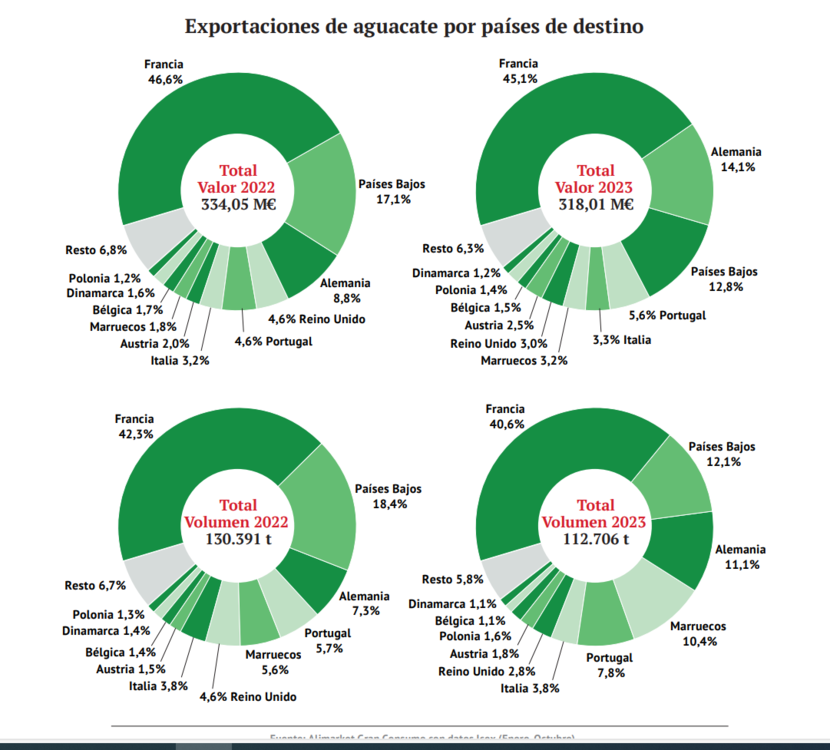

In this context, avocado export volumes fell by 13% between January and October 2023. By country, sales to Germany rose sharply (Figure 4).

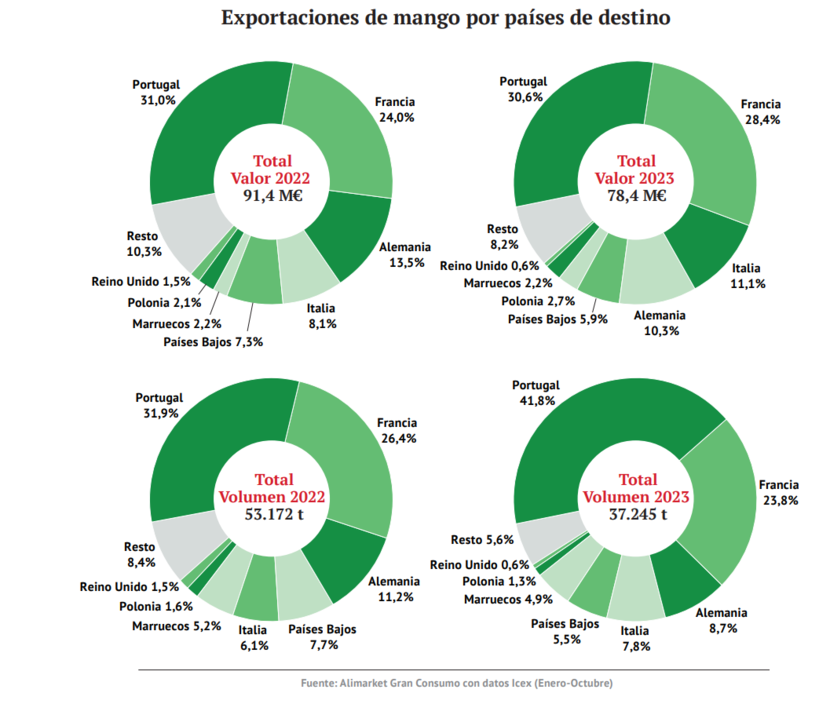

For mangoes, the decline was even more marked, with volumes exported falling by 30%. The destination with the worst performance was France (Figure 5).

Household consumption

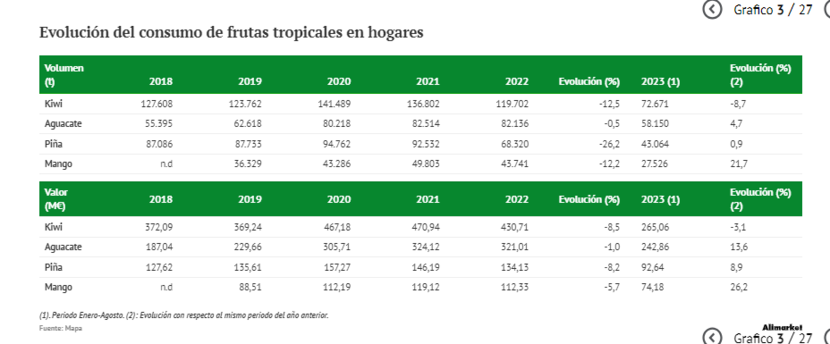

Tropical fruit consumption by Spanish households has generally performed well compared to 2022, when rising inflation and a sharp increase in out-of-home consumption weighed on demand (Figure 6).

Source: Alimarket