Spain, fourth largest plant-based food market in Europe

Sales in the plant-based food retail market reached near 500 million euros between 2020 and 2022 (+9%). The positive figures are mainly driven by alternatives to refrigerated dairy and meat product substitutes. There are also significant developments in vegetable beverages and new emerging categories. However, this vitality faces the difficult obstacle of the inflationary context.

According to the report published by Alimarket magazine, for the rolling year ended January 29, the vegetable beverages category grew at a rate of 2.7% in volume and 3.5% in market value. Meanwhile, meat alternatives grew by 8.3% in volume and 13.2% in value, rising to 17.6% and 21.9%, respectively, for new-generation products that go beyond the traditional offer of tofu, soy and seitan.

The evolution of yogurts and vegetable desserts accelerated during the past year by over 30% in volume and over 45% in value, taking over from meat alternatives as the segment that grew the most during the past year.

A market value of 500 M€

These three main families of veggie products would already be generating around 270 M kiloliters and a market value very close to 500 M€. Vegetable beverages account for 8.4% of overall demand on the shelf where they coexist with drinking milk, while vegetable yogurts and desserts account for close to 3% of total shelf space, and meat alternatives continue to generate an insignificant share of consumption with respect to the meat products with which they compete.

With respect to the data presented in April of this year by Good Food Institute Europe, based on the measurement for the full year 2022 and included in Alimarket's report, the Spanish plant-based market is estimated at 447.4 M€, with an overall growth of 4%, although this institution omits the measurement of vegetable alternatives to yogurts and desserts, which, according to Alimarket, are already contributing a market value of between 80 and 90 M€.

The market value of vegetable beverages amounted to 352.8% M€, up 5%, with a 4% increase in volume. Meat alternatives are in the red in terms of sales, falling by 3% in 2022 to €84.7 million, with an 8% drop in volume. Other categories represented are vegetable cheeses, which grew by 22% in value and 26% in volume, totaling 6.2 M€, and seafood alternatives, with 1.7 M€ and 442% growth.

Spain, second largest European market for plant-based beverages

The above figures place Spain as the fourth largest European market for plant-based products in terms of market value, behind only Germany (1,911 M€), the United Kingdom (982 M€) and Italy (681 M€). However, the Spanish market is consolidated as the second largest in value for plant-based beverages, behind Germany (€552 million) and ahead of Italy (€310 million) and the United Kingdom (€309 million). In terms of vegetable substitutes for meat, Spain would be in seventh place in the European context, still far from markets such as Germany (643 M€), the United Kingdom (530 M€) and the Netherlands (221 M€), which hold the first three places.

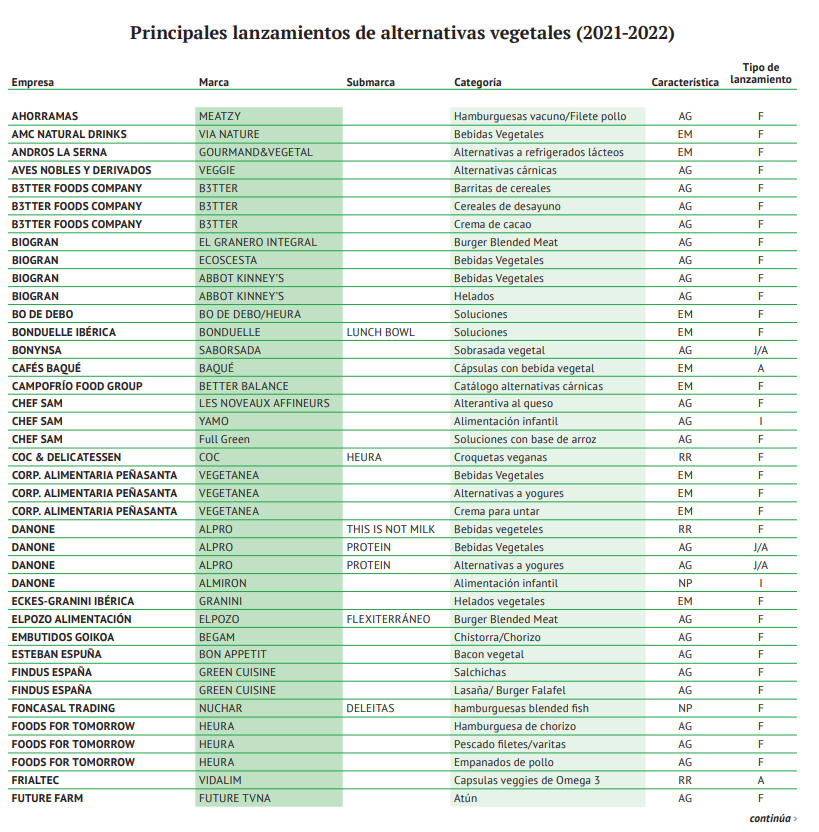

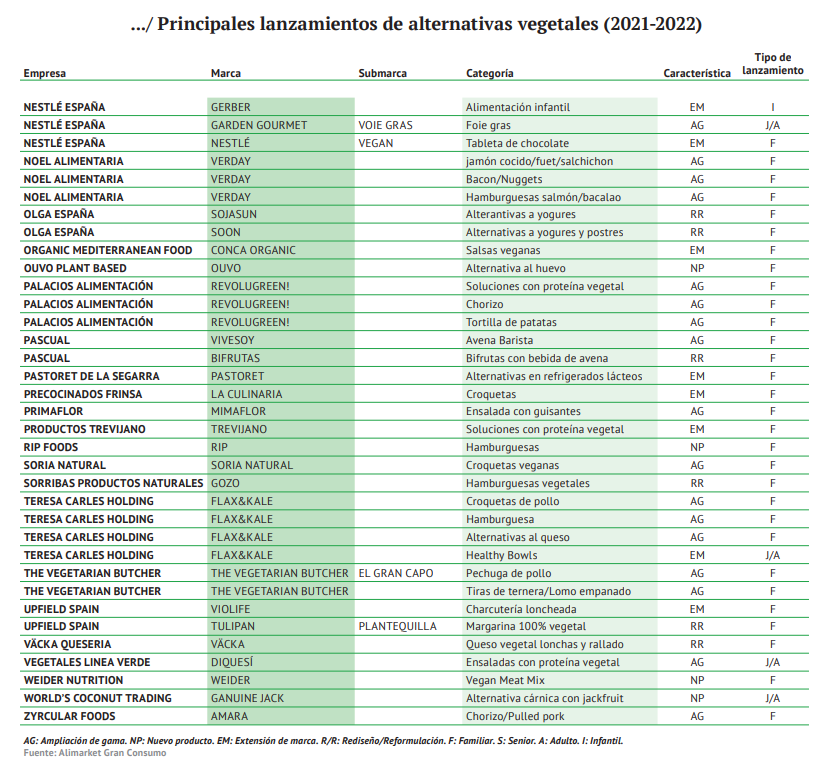

In a context of global growth, and taking into account its under-representation on the shelves and in market shares compared to its conventional counterparts, the best news is that plant-based companies continue to drive the category. This momentum appears mainly in the families of alternatives to refrigerated dairy and meat product substitutes, with significant developments also in plant-based beverages and emerging categories (Figs. 1, 2 and 3).

“Back to basics”

The total growth figures for 2022 and the vitality of innovation are, however, up against a wall that is difficult to overcome, as the current inflationary context imposes on this type of product, with average prices higher than their animal-based counterparts, which has inevitably slowed down their consumption over the last few months. It is again a time of "back to basics" and none of these veggie categories are close to price parity with their competitors.

The most mature of the three families, vegetable drinks, ended 2022 with an exceptionally contained average price performance, which has evolved by less than 1%, and still continues to show an average consumer selling price of just over 40% compared to drinking milk.

The average price of yoghurts and vegetable desserts was around €4/kg, higher than that of bifidus (€3.02/kg) or kefir (€3.17/kg), to name two value dairy segments. In the same vein, for example, marinated vegetable snacks from Mercadona's white label, which are slightly more than 120% more expensive than the chicken breast fillets marketed by the same supermarket chain.

The sector calls for a level playing field

Beyond the data and context, the plant-based segment has continued to make important moments and headlines in recent months. One of these took place last October, when Liquats Vegetals, Danone, Frías Nutrición, Pascual and Iparlat officially presented the new association of plant-based food and beverage producers in Spain, "Vegetales”.

Among the main demands of Vegetales are the need for institutional recognition of the category at a legal level to give legal security to the sector and to dispel doubts about these products, establishing what their contribution in terms of nutrition and sustainability is. In addition, the sector asked to “compete on equal terms with all products with a similar nutritional profile to this category in terms of taxation of plant-based drinks”.

See the full report in Spanish here: C2201_R44604_141_ALI_ALI042023_PRODUCTOS67.indd (alimarket.es)