Fruit processing industry in Poland

The fruit processing is a well-developed sector of the Polish food industry. Its development is supported by a rich and growing raw material base and demand for fruit products.

The technological level and productivity of the domestic fruit processing match up to the standards of developed EU countries. In the last five years (2018–2022), the production of fruit products in Poland was at the level of 1–1.2 million tonnes. Dominant among fruit products are frozen fruit. In 2021, the share of frozen fruit in the value of sold production of fruit products in total amounted to about 36%. Also, concentrated juices with the share of about 32% are also of great importance in the domestic fruit processing. Important fruit processing products in Poland are also: jams, marmalades, plum jams and fruit purees, drinking juices and beverages.

The development of the fruit processing in the country is to a large extent supported by the growing export demand. In the years 2018–2022 the export value of fruit products from Poland increased from EUR 1.4 billion to about EUR 1.9 billion.

Fruit juices

The production of juices is supported by a rich raw material base of Polish horticulture and the continued domestic and foreign demand for manufactured products. Poland is one of the leading global producers of concentrated juices. Poland is the largest producer in the EU and the second producer in the world, after China, of concentrated apple juice. Poland is also the largest producer in the world of concentrated black currant and chokeberry juice and the significant producer of concentrated sour cherry, raspberry and strawberry juices.

In the last five years (2018–2022), national processing plants produced annually 279–465 thousand tonnes of concentrated juices (with vegetable juices) in total. In the product range structure of the domestic production of concentrated juices, concentrated apple juice takes the dominant position, with the share of about 90% in the total production of juices. The production scale of other concentrated juices in Poland is much smaller. The domestic processing industry in the last five years produced 4–18 thousand tonnes of sour cherry juices, 11–17.5 thousand tonnes of currant juices, as well as 3–8 thousand tonnes of chokeberry juices, 5.5–8.5 thousand tonnes of strawberry juices and 2–4.5 thousand tonnes of raspberry juice.

In the structure of export revenues in 2022, the largest share was that of apple juice whose foreign sales accounted for more than a half (EUR 462 million; 53%) of the revenues obtained from foreign sales of this product range group.

The main export destinations of juices were the European Union countries, to which sales reached the value of EUR 667 million, which accounted for 77% of the total export value of this product range group. In the EU market, the main export destinations were:

- Germany (EUR 262 million – 30%),

- the Netherlands (EUR 128 million – 15%) and

- Austria (EUR 110 million – 13%).

Outside the European Union, the largest revenues were obtained from the export to

- the United Kingdom (EUR 87 million – 10%) and

- the United States (EUR 46 million – 5%).

Frozen fruit

The production of frozen fruit is one of the main types of fruit processing in Poland. The raw material used for the production of frozen fruit includes currants, strawberries, sour cherries, raspberries and plums from the domestic crops. In 2021, the share of frozen fruit in the value structure of sold production of fruit products amounted to 36%. The production of frozen fruit is to a large extent dependent on the yield and quality of fruit harvested in the country, which results in a diversified volume of frozen fruit produced. In the years 2018–2022, the domestic processing industry produced annually from 379 thousand tonnes to 445 thousand tonnes of frozen fruit.

Frozen fruit produced in Poland are primarily intended for export. The export value of frozen fruit in the years 2018–2021 amounted to EUR 466–697 million and largely depended on the changing domestic production. In 2022, the revenues from the export of frozen fruit from Poland reached EUR 697 million and were by 13% higher than in 2021. Just like in the case of frozen vegetables, frozen fruit are mainly purchased in the EU market. In 2022, sales of frozen fruit to the EU countries generated 80% of the revenues from the export of this commodity group. The major customers of frozen fruit products in the EU were

- Germany (EUR 211 million – share of 30% in the export value),

- the Netherlands (EUR 68 million – 10%),

- France (EUR 66 million – 9%) and

- Belgium (EUR 61 million – 9%), and

outside the EU –

- the United Kingdom (EUR 44 million – 6%) as well as

- Norway and Belarus (EUR 19 million each – 3% each).

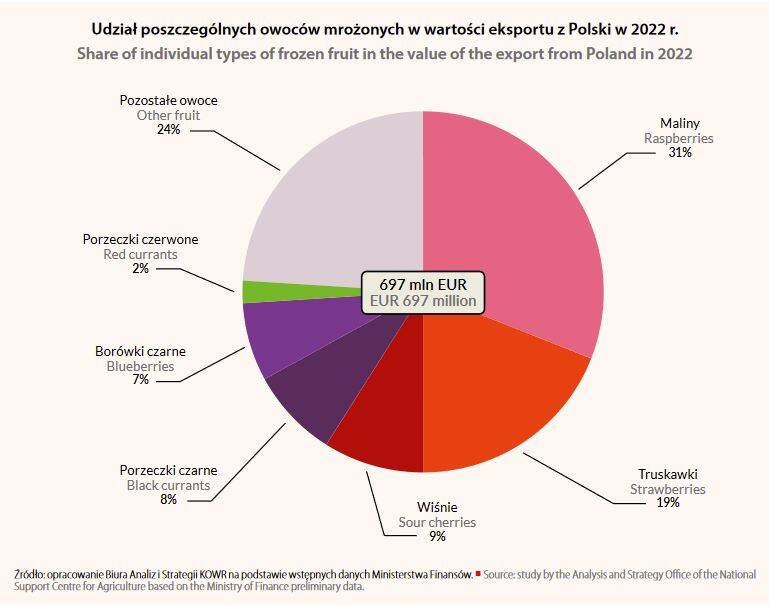

The commodity structure of export of frozen fruit in 2022, as in previous years, was dominated by frozen raspberries (EUR 219 million; share of 31%) and strawberries (EUR 129 million; 19%). The direction of development of the domestic fruit processing sector is the further adaptation of the market offer to changing expectations of consumers. Increasing public awareness of healthy food will have a significant impact on the domestic market for fruit products. Therefore, measures taken will be geared towards the further development of the market for innovative products characterized by high quality parameters. The challenge for the domestic fruit processing is the increase in the export. Polish fruit products enjoy recognition in the international market, since they are distinguished by very good quality, and products offered are adapted to diversified preferences of foreign consumers. The further development of domestic export will be based on the growing demand for these products in the global market and on information and promotional measures carried out with the aim of gaining new outlet markets.

Source: Polish food