Export of Polish agri food

In 2022, despite difficult conditions, the further increase in the Polish food export value was recorded in the international market. In 2022, the value of sale of agri-food commodities abroad reached a record-breaking level of EUR 47.6 billion (PLN 223 billion), by 26.7% higher than the year before.

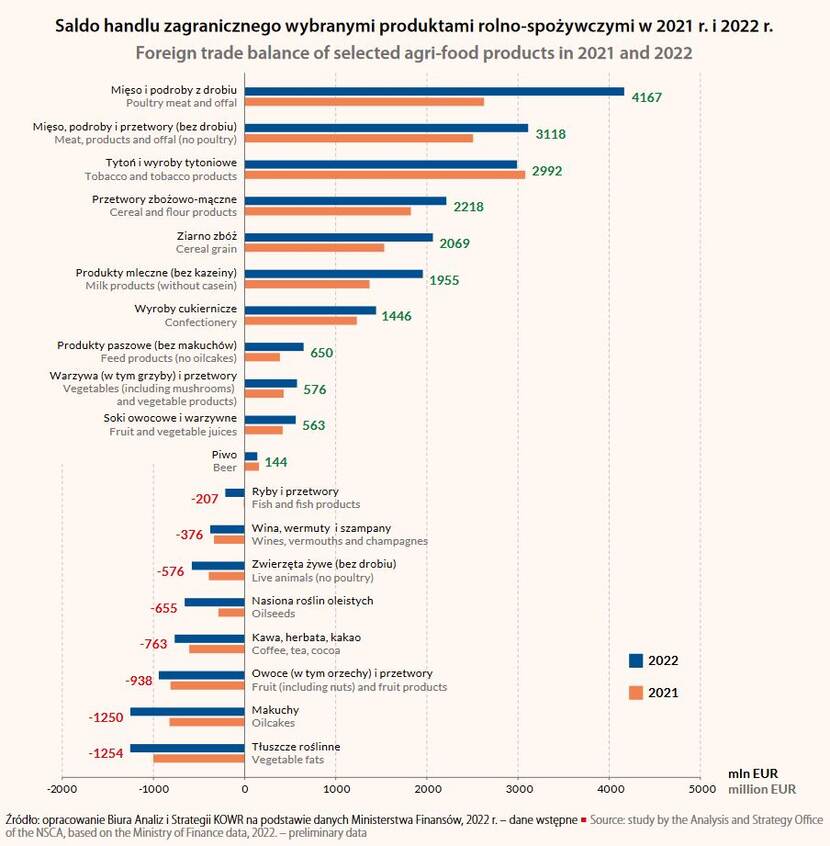

At the same time, the agri-food import amounted to EUR 32.1 billion (PLN 150 billion) and was by 28.6% higher than the year before. The positive trade balance amounted to EUR 15.5 billion (PLN 73 billion), by 23% higher than in 2021. Revenues obtained from the foreign sale by domestic exporters have been determined by the rising transaction prices of agri-food products in the international market, which were recorded after the beginning of the armed conflict in Ukraine.

At the same time, the trends of depreciation of PLN against the EU currency were a factor supporting the price competitiveness of Polish agri-food products, as more than 80% of revenues obtained from the food export to the EU were generated by the sale to the eurozone countries.

In the first half of 2022, the process of the activity of the EU HoReCa sector recovering after the pandemic as well as the rising prices of food in EU countries generated the increased demand for Polish food competitive in terms of prices and quality. At the same time, the good results achieved in the export were a consequence of the activity of domestic entrepreneurs towards the diversification of business relations in the markets of EU countries and third countries, thanks to the ability to adjust the product range offer to the diversified preferences of foreign consumers.

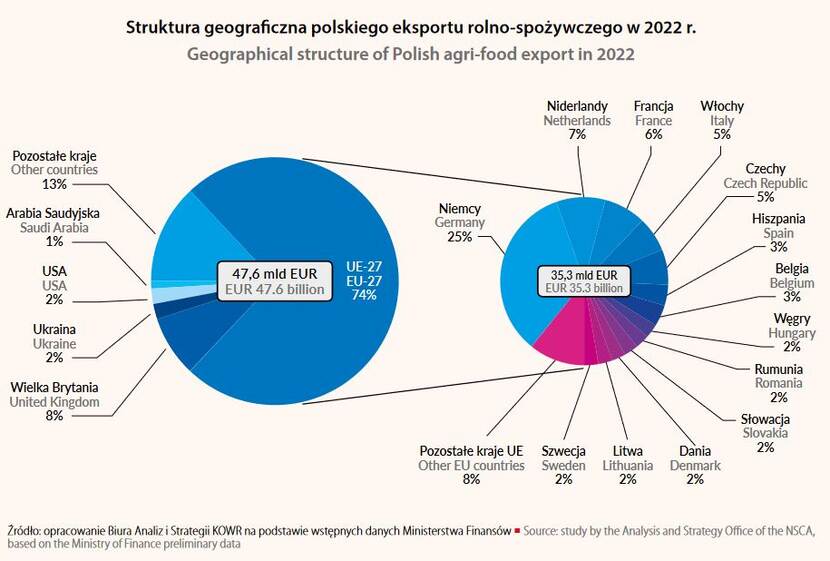

Geographical structure of the export of agri-food products from Poland

Just like in previous years, agri-food products were exported from Poland mainly to the European Union market. In 2022, deliveries to the EU-27 countries generated EUR 35.3 billion (an increase by 29%), accounting for more than 74% of total revenues from the agri-food export. The following products were sold mainly to the EU countries: poultry meat (EUR 3.3 billion), cigarettes (EUR 2.9 billion), milk products (EUR 2.6 billion), beef (EUR 1.8 billion), bread and bakery products (EUR 1.8 billion), pet food (EUR 1.6 billion) and chocolate products (eur1,5 billion).

Export to EU countries

The Polish agri-food export to the EU market is characterized by a significant geographical concentration. Germany remained the major trading partner of Poland. In 2022, the export to this country amounted to EUR 11.9 billion and was by 25% higher than the year before.

Products exported to:

- Germany were mainly cigarettes, poultry meat, fish products, pet food, bread and bakery products, maize kernels, chocolate and chocolate products. Important customers of Polish agri-food products were also:

- the Netherlands (EUR 3.1 billion, increase by 37%; mainly export of poultry meat, cigarettes, maize kernels, beef, chocolate and chocolate products, as well as fruit and vegetable juices);

- France (EUR 2.9 billion, increase by 35%; mainly export of poultry meat, meat products, beef, chocolate and chocolate products, bread and bakery products and pet food);

- Italy (EUR 2.3 billion, increase by 21%; mainly cigarettes, beef, fish products and cheese and cottage cheese were exported, which accounted for almost 45% of the export value);

- Czech Republic (EUR 2.2 billion, increase by 35%; mainly export of poultry meat, bread and bakery products, as well as cheese and cottage cheese).

In total, the export to the markets of the above-mentioned five countries (Germany, the Netherlands, France, Italy and the Czech Republic) generated EUR 22.4 billion, which accounted for more than 63% of the export value to the EU-27 countries.

Export to non-EU countries

In 2022, Poland exported to the non-EU countries agri-food products with the value of EUR 12.3 billion, by 20% more than in 2021. To the non-EU countries, Poland exported mainly: milk products (EUR 1.0 billion), poultry meat (EUR 990 million), wheat (EUR 776 million), chocolate and chocolate products (EUR 733 million), bread and bakery products (EUR 731 million) and cigarettes (EUR 612 million).

Important non-EU customers of domestic agri-food products, just like in previous years, were primarily:

- United Kingdom (revenues at the level of EUR 3.7 billion, value increase by 25%; mainly export of poultry meat, meat products, chocolate and chocolate products, as well as bread and bakery products);

- Ukraine (EUR 945 million, increase by 16%; mainly export of cheese and cottage cheese, pet food, coffee, chocolate and chocolate products, water, bread and bakery products and pork);

- United States (EUR 770 million, increase by 26%; mainly chocolate and chocolate products, fish and fish products, pork and meat products were exported to the USA);

- Saudi Arabia (EUR 521 million, increase by 2%; mainly cigarettes, bread and bakery products, wheat and cheese and cottage cheese were exported);

- Israel (EUR 439 million, increase by 50%; mainly export of beef, wheat and sugar).

- Norway (EUR 296 million, increase by 10%; mainly export of cigarettes, maize kernels, pet food and fruit products);

- Algeria (EUR 242 million, decrease by 42%; mainly export of concentrated milk and milk powder – 66% of the export value, as well as of tobacco – 26%).

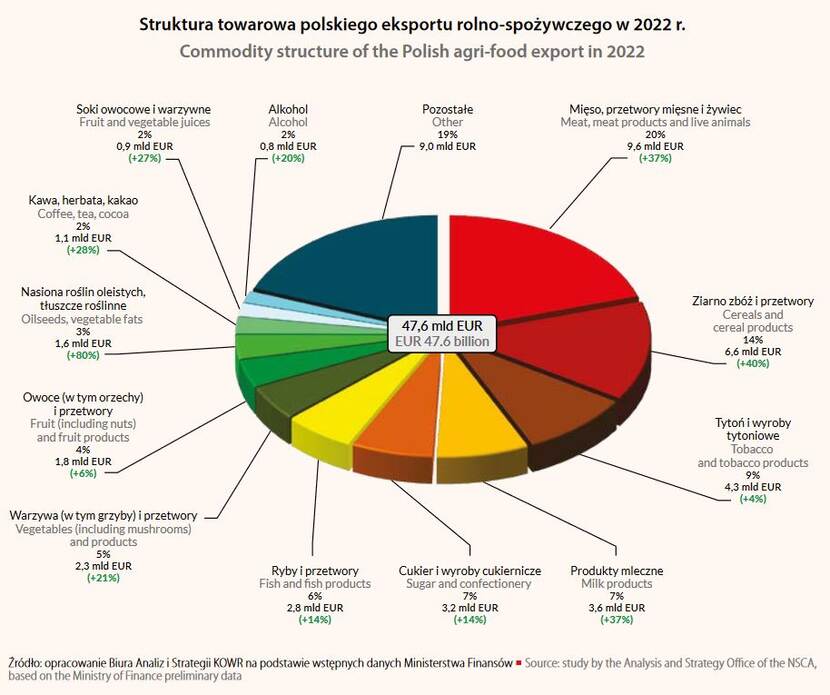

Commodity structure of the export of agri-food products from Poland

The commodity structure of the Polish agri-food export was dominated by meat and meat products. In 2022, the revenues from the foreign sale within this commodity group were by 37% higher than the year before and amounted to EUR 9.6 billion, accounting for 20% of the total Polish agrifood export value. The largest share in the export value of meat and meat products was that of: poultry meat (44% –EUR 4.3 billion), meat products (23% – EUR 2.2 billion), beef (22% – EUR 2.1 billion) and pork (8% – EUR 812 million). The export of live animals and other meat species was relatively small and accounted for the share of 2% and 1%, respectively, in the revenues from the export of meat products from Poland.

The second, in terms of value, position with the share of 14% in the export of agri-food products from Poland was occupied by cereal grains and processed products, whose total sale, when compared to 2021, increased by 40% to eur6,6 billion.

The revenues from the export of cereal

The revenues from the export of cereal grains amounted to EUR 3.1 billion. In the export volume structure of 9.1 million tonnes of cereal grains, maize accounted for 43% (3.9 million tonnes, increase in the export volume by 67%), wheat –40% (3.6 million tonnes, increase by 1%), rye – 5% (439 thousand tonnes, decrease by 59%) and barley – 3% (305 thousand tonnes, decrease by 33%). Exporters placed cereals mainly on the EU market (6.5 million tonnes, 72% of exported grain). In 2022, maize kernels were exported mainly to

- Germany (1.9 million tonnes, 48% of maizeexport),

- the Netherlands (586 thousand tonnes, 15%) and

- the United Kingdom (274 thousand tonnes, 7%).

The customers of wheat were mainly

- Germany (1.1 million tonnes, 32% of wheat export),

- Nigeria (445 thousand tonnes, 12%) and

- South Africa (253 thousand tonnes, 7%).

The major destination of the export of rye from Poland was Germany (363 thousand tonnes, 83% of rye export), and of barley:

- Germany (204 thousand tonnes, 67% of barley export),

- the Netherlands (37 thousand tonnes,12%) and

- Algeria (31 thousand tonnes, 10%).

An increase in the export value was recorded virtually in all commodity groups of agri-food products, i.e.

- tobacco and tobacco products (by 4%, to EUR 4.3 billion),

- milk products (by 37%, to EUR 3.6 billion),

- sugar and confectionery (by 14%, to EUR 3.2 billion),

- fish and fish products (by 14%, to EUR 2.8 billion), as well as

- vegetables and vegetable products (by 21%, to EUR 2.3 billion) and

- fruit including fruit products (by 6%, to EUR 1.8 billion).

Higher was also the export value of, inter alia,

- oilseeds and vegetable fats – by 80% (EUR 1.6 billion),

- coffee, tea and cocoa – by 28% (EUR 1.1 billion),

- fruit and vegetable juices –by 27% (EUR 0.9 billion) and

- alcohol – by 20% (EUR 0.8 billion).

Source: Polish food