Spain’s fruit and vegetable exports: 2020 figures and trends (I)

In 2020, the Spanish fruit and vegetable sector shown its robustness, its capacity to react and adapt to supply European markets, its main customers. Looking ahead to 2021, uncertainty remains because the evolution of the pandemic and other latent issues in the sector may influence exports.

Looking ahead to the current year, uncertainty remains because, although there is more knowledge and experience, the evolution of the pandemic and other latent issues in the sector may influence exports in 2021. In any case, according to the report published by Alimarket, the sector has further strengthened abroad in 2020.

Threats

The most positive intuition suggests that 2021 could be a better year than the previous one, although uncertainty continues to hover, not only because of the pandemic but also because of other issues specific to the sector. Among these latent or already present concerns in the sector, Alimarket mentions the following:

(1) Strength of foreign competition

(2) Changes in the management model of part of the production and marketing in Spain; in some cases they are driven by the arrival of private investment funds

(3) Difficulty to continue growing in markets outside the EU; this may be due to geopolitical problems (Russia, USA and now UK) or due to the complicated phytosanitary protocols required.

Faced with this scenario, the bet of a large part of the sector, as the leader Anecoop assures, is to innovate and become more efficient. To this end, the sector must make progress in its investment plans.

Export value is growing

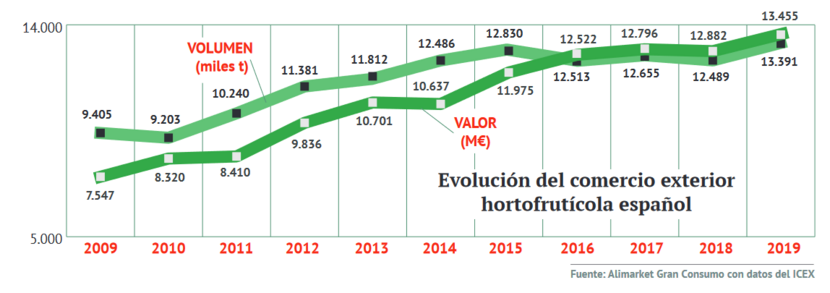

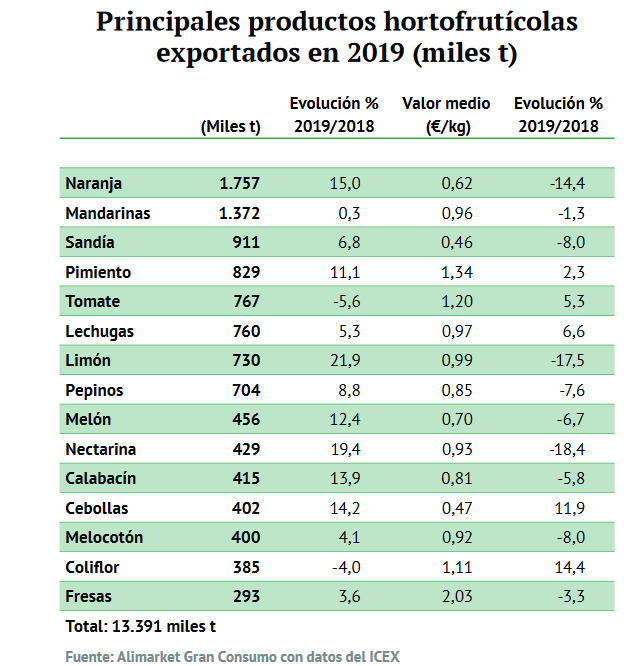

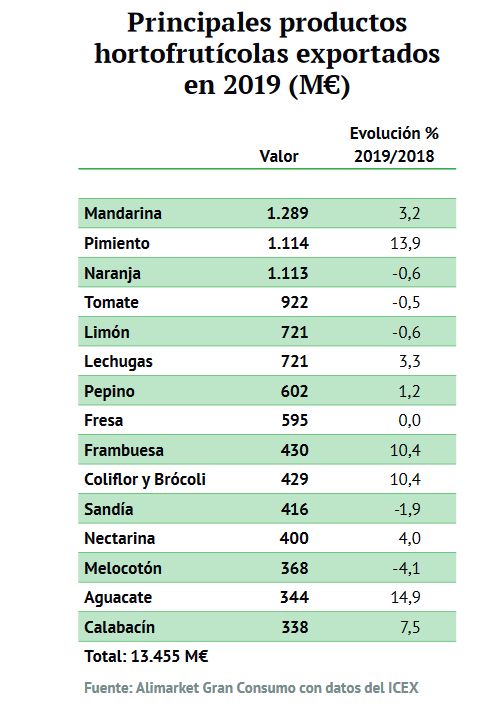

According to data provided by the sectoral organization FEPEX, the export volume of fruit and vegetables in 2020 was similar to 2019, around 13.5 Mt. The turnover was close to 14,200 M€, which would represent a growth of 5% compared to 2019 and 88% if we compare it with the 2009 figure (Fig.1).

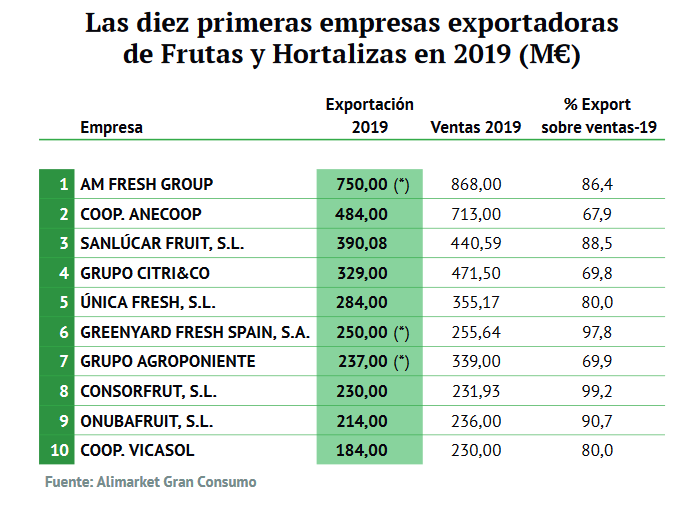

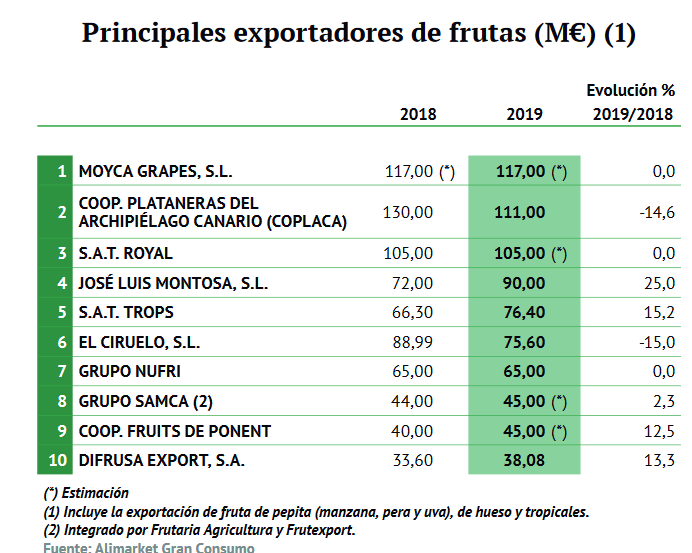

Exporting more than 50% of the volume grown in the country, Spain has great specialists. Fig. 2 shows the top 10 prepared by Alimarket. Together they had a combined turnover of more than €4 billion from foreign marketing in 2019.

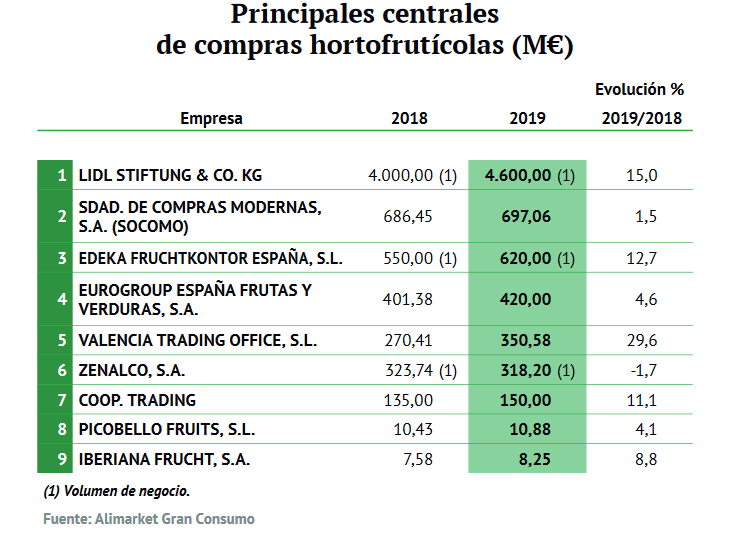

These major exporters are joined by European supermarket purchasing centers (Fig. 3)

However, there are those who do not have such a positive view. The aforementioned Anecoop explains that the increase in demand in spring generated expectations for the summer and autumn campaign that were not fulfilled. Although sales normalized during the summer, "autumn was below expectations". According to some exporters, from September to the end of 2020, exports suffered a generalized fall caused by the decrease in consumption by families and the closure of the horeca channel in almost all of Europe.

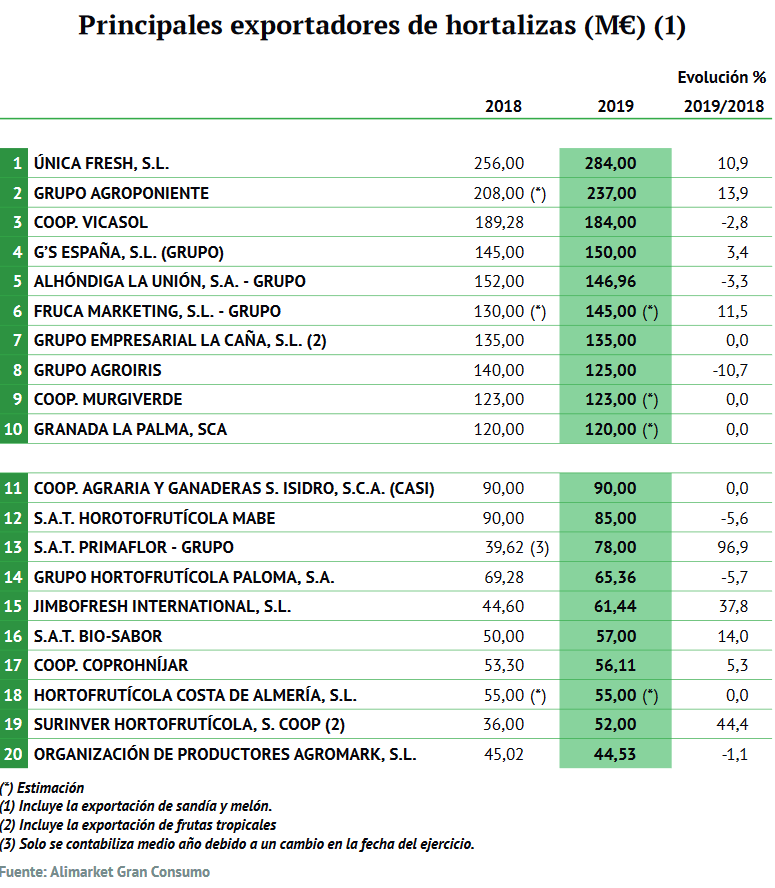

With the data estimated by FEPEX, 43% would correspond to the sale of vegetables (Fig. 4) and the remaining 57% to fruits (Fig. 5).

Private Equity and citrus

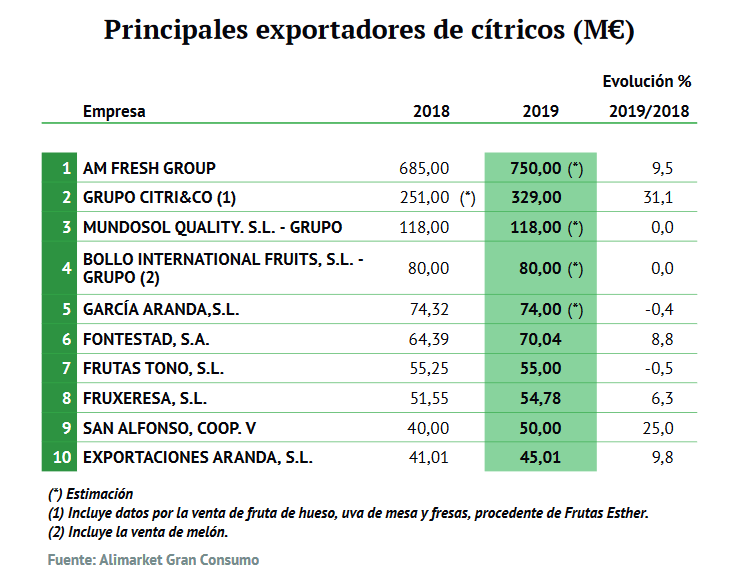

Focusing the analysis on citrus, this sector closed the season with very positive results in terms of profitability. It must be taken into account that it came from the most adverse previous seasons. In addition to reaching prices not been seen for a long time, in the last year many companies started new projects to continue gaining profitability and competitiveness abroad (Fig. 6).

To continue adding value to the sector, some companies are opting for new business models supported by private investment funds. Thus, and this is just an example, in 2017, the firm Miura formed the Citri&Co group, having already managed to position itself as the second largest specialist citrus exporter behind only AM Fresh Group.

This highlights the strong interest in citrus fruits as a valuable and profitable product.

Berries in the spotlight

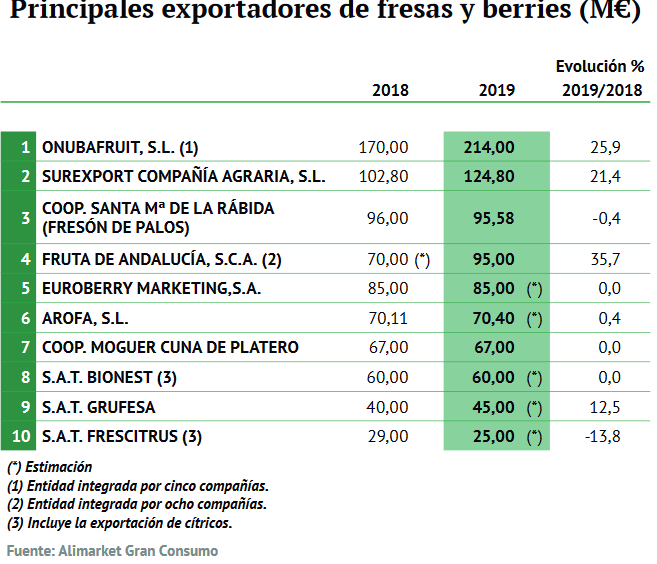

Berry exports suffered a significant drop in the first nine months of 2020 due to the decline in sales of most products: blackberry (-41%), raspberry (-33%), currant (-79%) and strawberry (-3%). Only blueberry managed to increase its sales by around 20%. Despite the results, there is a strong interest in these fruits due to their positive evolution in recent years (Fig. 7).

In addition to citrus and grapes, the attractiveness of berries and their potential growth abroad has prompted investment fund Alantra Private Equity Fund III to enter berry specialist Surexport. Its aim is to make it one of the largest berry suppliers across Europe. According to the Alimarket ranking, this company is in second place, with foreign sales of 124 M€.

The fourth largest exporter, Fruta de Andalucía, faces the 2020/2021 season with "moderate optimism". Fresón de Palos, whose demand in 2020 was similar to those of previous years, is somewhat more optimistic.

Spanish tropical fruits gain success in Europe

Border restrictions and difficulties in importing from transoceanic countries during the first phase of the pandemic had a positive impact on the export of Spanish tropical fruits to the rest of Europe. From January to September, more than 105,000 tons of avocado (+14%) and almost 39,000 tons of mango (+35%) were sold abroad. With a stabilized summer, "at the end of August and September a significant decline in demand began to be noticed," Reyes Gutiérrez sources points out.

For the director of SAT Trops, this past year has been a very pleasant surprise seeing "how avocado consumption has been strengthened not because it is an exotic product, but because it is seen as an everyday one".

Tomato loses weight

Vegetable exports (Figs. 8 and 9) remained very stable during the first nine months of 2020. The positive performance of peppers in volume (+3%) and value (+5%) should be noted. Meanwhile, tomato followed the opposite trend, with a drop of 8% in volume; in turnover, it was able to hold up due to the strong increase in prices.

What is clear is that bell pepper exports have definitely surpassed tomato exports. It is possible that this gap will continue to widen in the coming years as the area planted with tomatoes continues to fall each season. While production will remain stable in the major tomato producing countries, in Spain it could fall by up to 20% in the next decade. This will be due to a significant reduction in surface area, competition from third countries, lack of water and low profitability in some varieties.

The opposite is happening with peppers: every year more area is dedicated to them, varieties are improved and investments are made to increase profitability. Because it is necessary to obtain higher yields. The average bell pepper harvest in Almería would be 9 kg/m2, while in the Netherlands it is 30 kg/m2.

Source: Alimarket