ARGENTINA: Agro-industry highlights in 2023

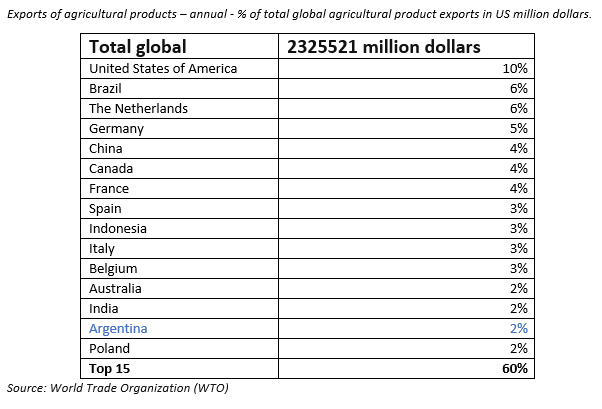

In recent years Argentina has faced periods of intense drought, brought on by climate change. Argentina also faced heavy export taxes on agricultural products and other unfriendly policies that hampered production. In 2021 this led to Argentina falling out of the top 15 of exporting countries of agricultural products, a position the country had held for the past 40 years.

However, in 2022, Argentina managed to regain its position, moving from 18th to 14th, according to the World Trade Organization (WTO).

While at a regional level Argentina still ranks second behind Brazil, its growth has been slowed down in the last 10 years. At the same time, its neighboring countries such as Chile, Uruguay, or Paraguay show growth of their agricultural sector.

On average, the agro-industry represents around 23% of the Argentine GDP, being the country’s main economic activity. This not only includes purely productive activities -primary or agro-industrial- but also all related services, such as exports, trade and transportation.

Additionally, employment levels generated by the agro-industry are remarkable, estimated to constitute 23% of all private employment.

ARGENTINA’S INTERNATIONAL POSITION

At the international trade level, agro-industrial exports were responsible for six out of 10 dollars entering the country in the first half of 2023. This is even more remarkable considering the drought of 2022. Soy, corn and bovine chains stand out as Argentina’s main sources of export.

Furthermore, Argentina in 2022 was the primary global exporter of beans, peanuts, lemon essential oil, lemon juice and soybean oil.

In 2023, trade between Argentina and the European Union saw a deficit of US 128 million dollars, accounting for 9,8% of the country’s exports and 15,1% of its imports.

However, the exports to the EU decreased when compared to previous years. The reason for this lies in a lower demand from the EU and a decline in prices. This decreased demand is not unique to Argentina but occurred in the whole of Latin America.

The prices of the main commodities exported by the region, which had significantly increased in the first half of 2022 as a result of Russia’s invasion to Ukraine, reversed their tendency and in 2023 were, on average, at lower levels than in the previous years.

Using soybeans as an example, Argentina’s main export commodity, the price fluctuated unpredictably during 2023. This was influenced by various factors: reduced supply due to the country’s drought, the volatility of Argentina exchange rate policy, Brazil’s record harvest, increased demand from China, and delays in the supply of US soybeans.

ARGENTINA & THE EU

Exports from the European Union amounted to USD 516 million, experiencing a 13,4% interannual decrease ( -USD 80 million) mainly caused by reduced sales in industrial manufactures, fuels and energy. Germany, The Netherlands (with the Port of Rotterdam serving as a transit hub to other EU countries), Spain, France and Poland, were the top five exporters, accounting for 68,3% of the EU’s total sales. Soybean flour and soybean pellets from soybean oil extraction contributed 24,6% of the total exports to the European Union.

Nearly 70% of total imports from the EU came from Germany, Italy, Spain, France, Ireland and the Netherlands, respectively.

ARGENTINA & THE NETHERLANDS

According to the latest report of Argentina’s National Institute of Statistics and Censuses (INDEC), exports to The Netherlands reached US 1.558 billion dollars in 2023, representing 2,3% of Argentina’s total exports and placing it among the country’s top 10 trading partners.

The main exported commodity is peanuts, maintaining its share in the trade balance between both countries. However, soybean flour and soybean pellets experienced a 78% decline in their trade share compared to the previous year.

Another agro-industrial product that suffered a significant decrease in exports from Argentina to the Netherlands was biodiesel.

Similarly affected were other agro-industrial goods such as wines and grape must, lemons, rice, blueberries and corn. However, it is noteworthy that meat products, especially boneless, fresh or refrigerated meat, remained practically unchanged.

On the other hand, imports from The Netherlands totaled US 703 million dollars, resulting in a trade surplus for Argentina of US 855 million dollars.

The year 2024 started with a new liberal government for Argentina, promising and working on measures to liberalize trade, the exchange rate, and deregulate the economy overall. However, export taxes still apply to many agro-industrial products and prices are anticipated to keep declining. On the other hand, the favorable weather conditions brought by ‘El Niño” suggest a record harvest is on the horizon. With these factors in play, alongside expectations of the agricultural sector reclaiming its share of the country's exports, it is set to have a significant impact on the economy.