The agri-food sector, one of the driving forces of Spain's economy (9.7% of national GDP), has the opportunity to become a powerhouse in innovation as well. Spanish foodtech startups have raised investments worth €695 million in 2021, 220% more than the previous year.

Despite the difficulties suffered by the economy as a result of the COVID, the net figure of 407 startups in the sector is consolidated, of which 9% were born in 2021. Spain is thus positioned as a powerhouse, similar to France, ahead of the United Kingdom, although still far behind Israel's 900 startups. Madrid has surpassed Cataluña in attracting the headquarters of these companies, becoming a pole for the foodtech sector (Fig. 1).

Fig. 1. Ranking of the 3 regions with the highest number of startups

Foodtech investment in Spain

However, the most noteworthy fact of 2021 is the significant growth in investment received by these Spanish startups, reaching €695 million, an increase of 220%, more than triple that of 2020 (Fig. 2). This figure places the foodtech sector as the second largest category of investment in startups in Spain.

Fig. 2. Total investments of foodtech startups

Spanish foodtech startups are beginning to attract higher investments, even from the initial rounds. It is remarkable as one can see by the growth in the number of projects facing series A and B and the decrease in the number of early series (Fig. 3).

Fig. 3. Startup investment stage

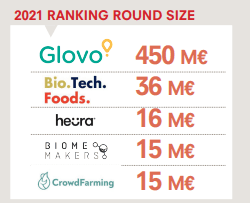

Glovo leads the highest round, with 450 million euros, followed by Biotech Foods, Heura, Biome Markers and Crowdfarming (Fig. 4).

Fig. 4. 2021 Ranking round size

Which areas of the value chain do startups focus on?

A balanced distribution (Fig. 5) is maintained between the different areas with it being important to highlight the growth of projects located in the agritech industry, from 17% in 2020 to 24% last year. The number of projects working at the end of the value chain is also growing slightly, as a result of the reactivation of the horeca sector, while the percentage of those located in processing or logistics and retail is contracting slightly.

Fig. 5. Percentage of foodtech startups by area of the value chain

In a more detailed analysis, Fig. 6 shows the percentage of startups by sub-category in agriculture and food processing.

Fig. 6. Percentage of startups by sub-category in agritech and food processing

Fig. 7 shows the figures by sub-category for logistics and retail and the horeca channel.

Fig. 7. Percentage of startups by sub-category in logistics and retail and restaurant tech

The report also makes groupings of broad categories in order to have an elevated view of the activity of the entrepreneurial ecosystem. The 2021 ranking is led by startups that are working on product innovation (24%), which includes everything related to new ingredients, from their origin to the manufacturing of final products. It is closely followed by direct-to-consumer models (22%) and, finally, the digitalization of farming (12%).

Technological strength

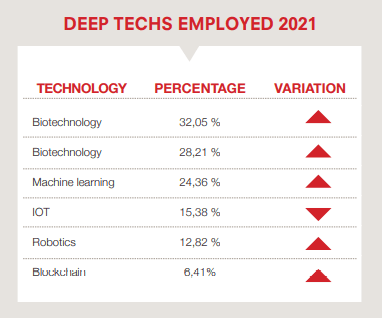

This is key to the proper development and competitiveness of Spanish foodtech startups in the global market. Delving into technological solvency, key to attracting investment and thriving in the market, the report shows that more than 70% of the projects analyzed use some of the so-called “Deep Tech”. The use of biotechnology, artificial intelligence and machine-learning is growing significantly, given rise to an unprecedented technological robustness (Fig. 8).

Fig. 8. “Deep Techs” employed in 2021

Keys for growth

While in 2020, Spanish startups considered the role of the industry and public support as the main tools that can boost their growth in the coming years, in 2021 the role played by internalization with various tools (investment, international growth plans and presence in industry events) and the acquisition of good business practices through incubation and acceleration programs stand out as important (Fig. 9).

Fig. 9. Top 5 tools according to startups to boost the sector

Investing in foodtech worldwide

With a global size of €14.5 trillion, the agri-food sector value chain is seen as the next great opportunity in the financial sphere, similar to that of the internet at the end of the last century. This is why foodtech has established itself as a key sector for investment in 2021. In the first half of the year alone, foodtech startups have raised rounds worth 24 billion dollars, a figure very close to the total investment in 2020, which amounted to 30 billion dollars.

Globally, the US continues to lead the ranking of countries with the most investment in foodtech, however, in Europe, the interest of investors in the sector has continued to grow and its startups are moving closer to the top.

Foodtech is a broad term that encompasses all those agents that apply technology to the agri-food value chain, from food production to consumption, providing efficiency, safety and a significant improvement in sustainability. “The State of Foodtech in Spain”, the 2021 report by Eatable Adventures, analyzes its current situation, assessing the potential of the sector for the Spanish economy and identifying the keys to its growth and consolidation.

Read the full report in English here: https://bit.ly/3zmAdZ4

Source: Eatable Adventures