Spain: The egg sector maintains its investments

Despite the pressure the sector is under due to low prices and high production costs, committed investments towards a totally cage-free industry are maintained. In addition, two major buyouts by investment funds have brought the laying poultry market back into the limelight.

A sector under pressure

In a context marked by the pandemic, the poultry laying market in Spain has accelerated its growth and transformation towards a cage-free model. A change that, however, this year, will have to deal with a double pressure: low prices and much higher costs, especially for feed and cardboard. Tensions are expected to last at least until the beginning of the next fiscal year 2022.

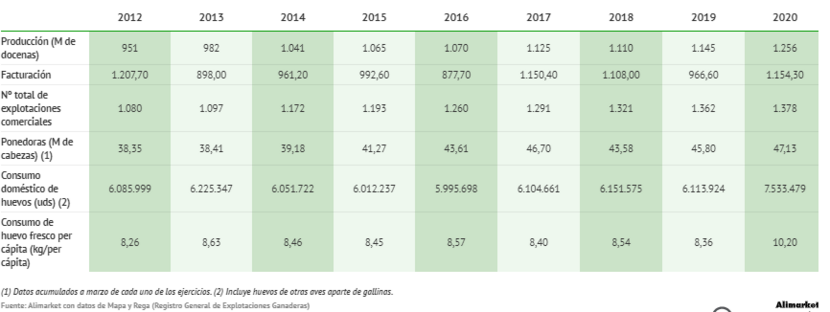

The COVID effect has boosted domestic egg consumption by over 23% in volume terms during 2020, with per capita consumption of 10.2 kg, two more than the average of the last eight years. Not so in the horeca channel, strongly affected by restrictions and forcing its reorientation towards exports. The volume of eggs exported rose by 6% in 2020, with France, Germany and the Netherlands leading the destinations. "Exports can be a medium-term solution," the general manager of Granja Avícola Rujamar argues, although for others the international price barely covers costs.

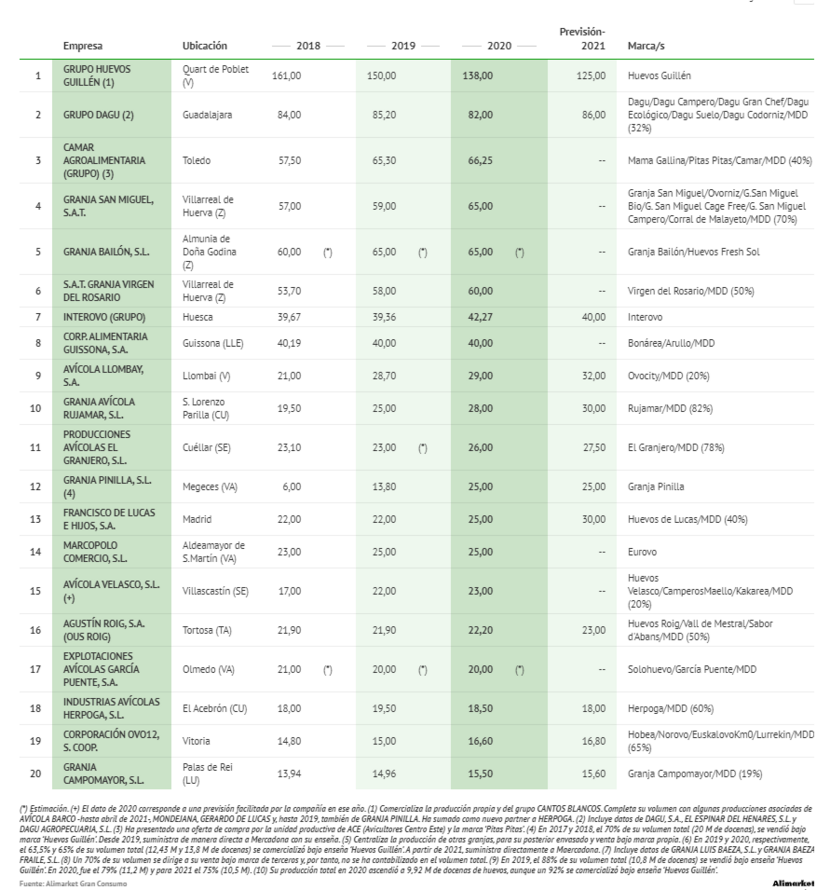

The sector reached a production of 1,256 million dozen eggs in 2020 (Table 1), an increase of 9.7% over 2019, record growth in recent years. In value, turnover rose from €966.6 million in 2019 to more than €1,154 million in 2020, up 19.4% (Table 2).

Demand for alternative eggs on the rise

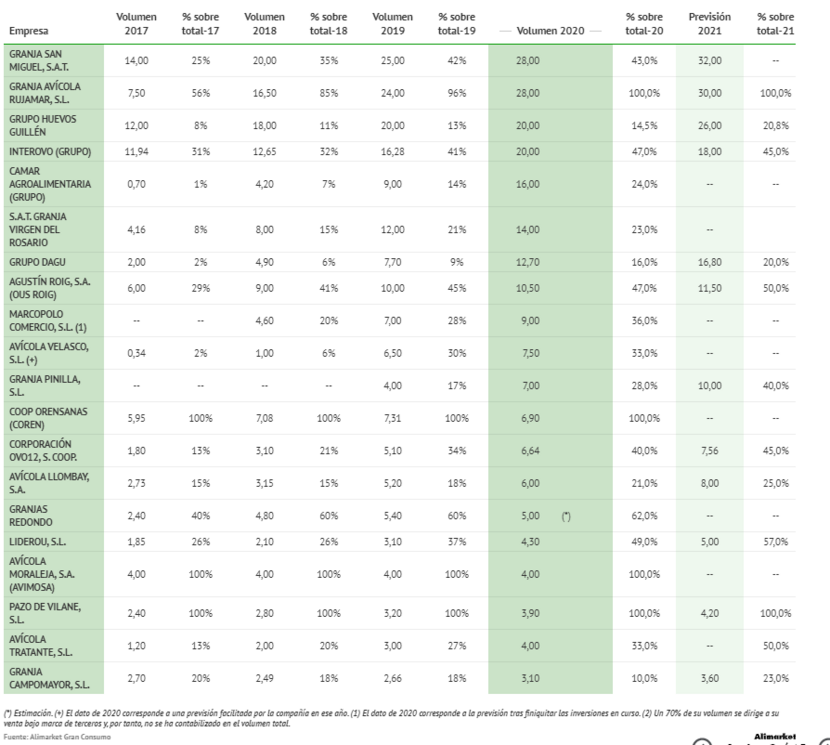

In 2020, the long-awaited take-off in the demand for alternative eggs has finally occurred, and, up to June of the same year, Spanish households increased their purchases of cage-free eggs by 10.6%, according to data from the Ministry of Agriculture. Kantar's 'Consumer Panel' agrees with the above, noting that domestic consumption of cage-free eggs in the country reached a penetration of 46% in the same period.

Meanwhile, free-range eggs reached almost 600,000 new households and increased their penetration by 3.3%, while organic eggs reached 9.4% penetration, having added 200,000 new customers.

The evolution in alternative consumption finally is in line with the sector's great commitment to this type of production, which has tripled the volume coming from cage-free hens in just three years. Last 2020, the top 45 producers (Table 3) in the country totaled a cage-free production of more than 238 million dozen eggs, up 23.1%. Leading the way since 2017 are Granja San Miguel and the mentioned Rujamar, with 23.5% of the alternative volume in their hands, although with different exposure to the new farming methods. While the former maintains 57% of its production housed in conventional farms, Rujamar released, practically, 100% of its hens a couple of years ago.

No slowdown in sectorial conversion

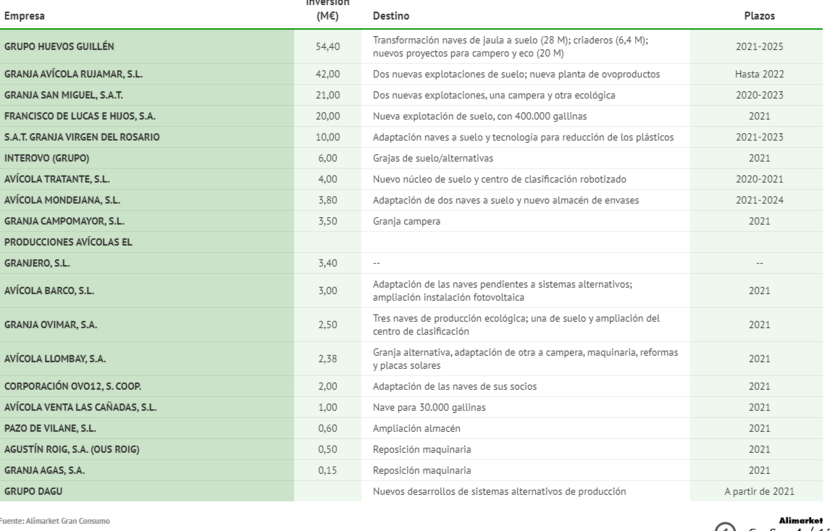

Despite the fact that the health crisis is slowing down modern retailers' objectives to eliminate the sale of enriched cage eggs from their shelves, in general, the sector is maintaining its industrial conversion plans prior to the outbreak of the coronavirus. "In the coming months, the withdrawal from cage farming will be greater and with a view to 2022, driven by the commitments adopted by the retail sector, many of them having set 2023 as the target date", Grupo Huevos Guillén’s director points out.

That group is the leader in the planned investments, with a budget of €60.7 million up to 2025. In 2021 alone, Mercadona's main supplier will invest just over a fifth of this amount. "This will lead us to be able to reach 42% of the total hen census in alternative systems at the beginning of 2022", its director says, “compared to the 28% that they represented at the end of 2020”.

Nor has Rujamar altered its investment programme, which will involve an overall expenditure of more than €40 million up to the next financial year 2023. Rujamar was one of the first to support retailers in their decision to stop selling eggs from caged hens, a choice it seems to have made with complete success, according to its forecasts. In 2021, it will again break its record in terms of volume sold, with 30 million dozen eggs, all cage-free.

In short, the pandemic has not slowed down the industrial reconversion plans, with more than €180 million in new investments; Huevos Guillén, Rujamar and San Miguel are at the forefront of the transition concentrating 65% of the total amount (Table 4).

Latest private equity operations in the Spanish food sector

In mid-July, Spanish companies Dagu and Ous Roig announced their merger, led by investment fund Cleon Capital, to become the largest egg producer in Spain, with a turnover of around €90 million.

According to Cleon's data, the merger of Dagu (based in Guadalajara) and Ous Roig (based in Tortosa, Tarragona) allows it to have "3 million laying hens and more than 2.2 million square meters of land and production facilities" in the country.

Another very recent operation is that of Tresmares Capital, backed by Banco Santander, which has just completed the acquisition of a minority stake - around 25% - in Rujamar. According to the published figures, Rujamar has a turnover of around €25 million, with an ebitda of between seven and ten million euros.

Towards a sustainable and digital transition

Once the farming model has been consolidated, the sector has opened up to sustainability and digitalization. Rujamar and San Miguel are the standard-bearers of change, having agreed to choose Almanzora Cartón Packaging as a partner to develop their plans towards new, more sustainable packaging.

Moreover, the pandemic has precipitated the need to digitize the supply chain in response to the growing demand to provide more and better information to the consumer, as well as to improve traceability and visibility. The most advanced in this field is Rujamar, which has already begun to incorporate blockchain technology in its organic eggs. The project has been developed in collaboration with technology partner Trace Food Alimenticia. San Miguel also plans to take some steps in this direction.

Source: Alimarket