Romania: Coface Study on Dairy and Cheese Manufacturing Sector

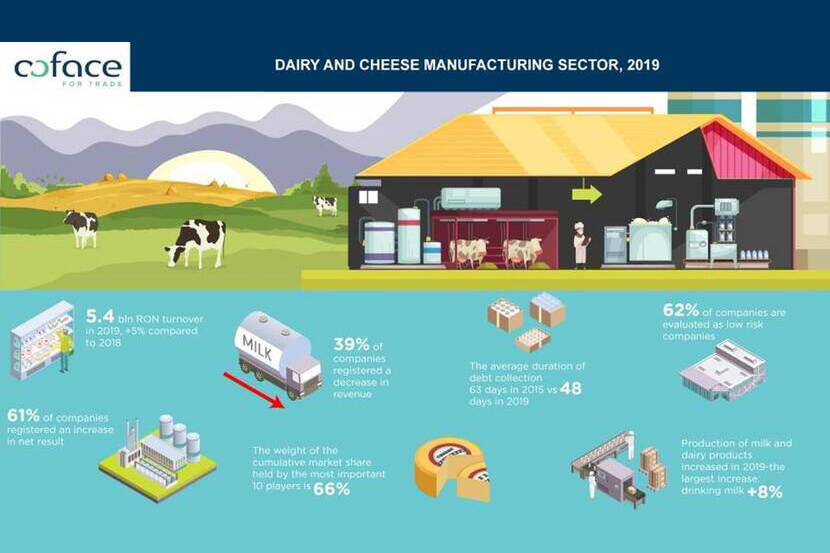

The production of consumption milk increased by 8% in 2019 in comparison to 2018.

Strengths:

- More than half of the companies (61%) recorded an increase in net income

- Profitability sector increase from 4.3% in 2018 to 5.4% in 2019

- 46% of companies in this sector made investments in 2019

Vulnerabilities:

- More than a third of companies (39%) recorded a decrease in revenues

- Almost half of the companies (47%) reported in 2019 a degree of indebtedness higher than 80%

- Companies in the analyzed sector have an autonomy in force majeure situations of 70 days (below the recommended level of 90 days)

A new study conducted by Coface Romania on the sector of “Dairy and Cheese Manufacturing” (NACE 1051) indicates a positive evolution of revenues in 2019, which increased with approximately 5% compared to 2018, with a slightly higher profitability. The study aggregated the data of 494 companies that submitted their financial situation for 2019 (as of September 2020) and generated a consolidated turnover of RON 5.4 billion. The weight of the cumulative market share held by the most important 10 players is 66%, which indicates a medium to high degree of concentration.

Approximately 34% of the companies registered a net loss at the end of 2019, 18% of the companies having recorded a loss higher than -20% and 10% of them a profit over 20%. Most of the companies analyzed by Coface (62%) are classified as low risk companies. The average duration of debt collection in the analyzed sector decreased from 63 days, the level registered in 2015, to 48 days in 2019.

“Although this sector benefits from a relatively constant evolution given the consumption trends of the population, there are threats that market players should take into account in future strategies.

The financing structure of the activities for almost half of the companies in the sector (indebtedness degree > 80% for 47% of companies, short-term debts represent 100% of total debts for 45% of companies) is a threat that could even determine the exit from the market of these companies.

The increase of dairy products import is an additional pressure, especially in the context of the EC Regulation no. 775/2018 entered into force on 1 April 2020 regarding food labeling. Thus, if the raw material does not come entirely from Romania, the label will not display <Produced in Romania> and will display <Produced in the European Union>, which will make products differentiation more difficult for consumers in terms of the manufacturing place”, declared Nicoleta Marin, Senior Financial Analyst, Coface Romania.

According to statistical data, the production of milk and dairy products increased in 2019, the largest increase being for drinking milk (8%). For the period aug. 2019 – aug. 2020, in terms of the amount of milk collected for processing, the largest amount was recorded in June 2020, namely 108,979 tons. Also, the quantity of raw milk imported by the processing units increased by 24,160 tons (+28.2%), in the period January-October 2020 compared to the same period in 2019. In regard to dairy products obtained, for the same period, production increases were reported for: butter with 928 tons (+10.8%), drinking milk with 24,655 tons (+9.1%) and cheese with 1,286 tons (+1.6%).

“The dairy and cheese manufacturing sector remains polarized, with a high degree of player concentration, the upper segment being dominated by multinational companies, with robust experience and scalability of the entire production chain - raw material – processing – distribution that allows them to operate in relatively low margin conditions. The “single digit” margins as well as the return on invested capital (ROE) in the vicinity of the local average (ie calculated for all domestic sectors) determine a continuous optimization of local production capacities, a fact visible in the decisions taken by top players during the year 2020.

Vertical integration, optimization of milk production and processing operations, development of brand portfolio visibility, expansion of product categories and market migration in the area of high quality products (eg. bio) are vectors that will dominate the evolution of this sector during the current year“, stated Bogdan Nichișoiu, Rating Manager, Coface Romania.