Spain: Opportunities for agrifood sectors in Japan

The Spanish embassy in Tokyo has published a report containing the main data on the EU-Japan Economic Partnership Agreement, an overview of the Japanese agrifood sectors and the opportunities for Spanish (and other European) companies.

After several years of negotiations, the EU-Japan Economic Partnership Agreement (EPA) entered into force on 1 February, 2019. It has been considered as the largest agreement made by the European Union (EU), presenting numerous opportunities for Spanish companies interested in the Japanese market.

Japan is the fourth largest agrifood market for the EU, with an export value of approximately €6 billion per year and is the third largest destination for non-EU Spanish agrifood exports, amounting €911.4 million in 2018.

In general, the EPA implementation implies the tariff-free export of more than 84% of EU agrifood tariff lines to Japan, representing 87% of export value.

Another novelty of the EPA is the protection of 42 Spanish Geographical Indications in the Japanese market.

Characteristics of the Japanese market

Japan is the third largest economy in the world and its potential for Spanish food and beverage companies is very high; we are dealing with an agrifood market of €411 billion, in which the average annual expenditure is €7,623 per household.

The Japanese population is almost 127 million and it is the country with the highest rates of elderly people; 94% of its population lives in urban areas.

The agricultural sector is relatively small and faces a number of obstacles that restrict its productivity, such as high production costs, ageing of farmers and the small size of farms. As a result, Japan is a country with high agricultural dependency ratios, with only 37% of self-sufficiency in 2018, with a trade deficit of near €55 billion. Agrifood imports grew by 7% in 2018 and accounted for 9% of total Japanese imports in the same year.

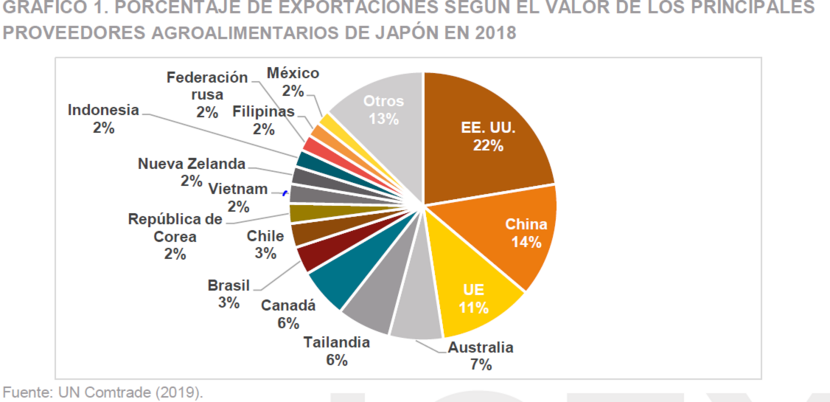

During 2018 the main supplier to the Japanese market in terms of value was the US (22%), followed by China (14%) and the EU (11%) (Fig. 1).

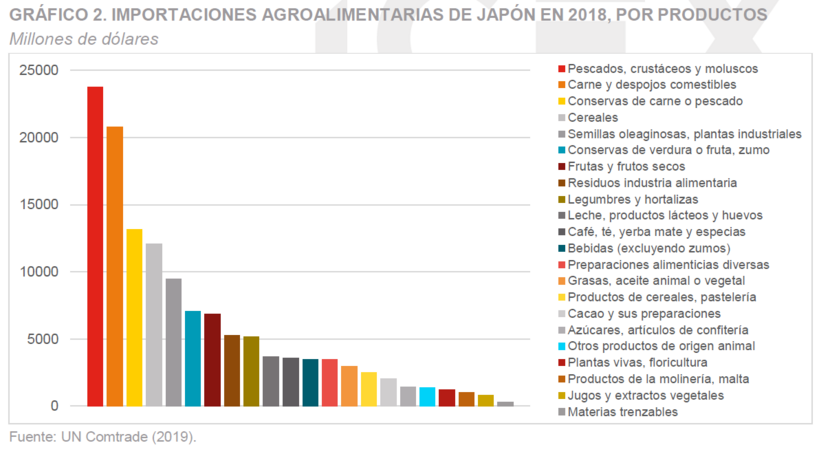

The main food stuffs imported by Japan were “fish, crustaceans and molluscs” (18% of total), “meat and edible offal” (16%), “canned meat or fish” (10%), “cereals” (9%), “oilseeds, industrial plants” (7%) (Fig. 2). In particular, at the level of specific products, the largest imports were pork, beef, soybeans, wheat, chicken and coffee.

The Spanish supply

In 2018, Spain was Japan’s second largest supplier of EU agrifood products, only after France, with Spanish exports representing 2% of Japanese agrifood imports. The Japanese market accounts for 1.5% of total Spanish food and beverage exports.

The total figure for agrifood export was €911.4 million, equivalent to 35% of total exports from Spain and Japan.

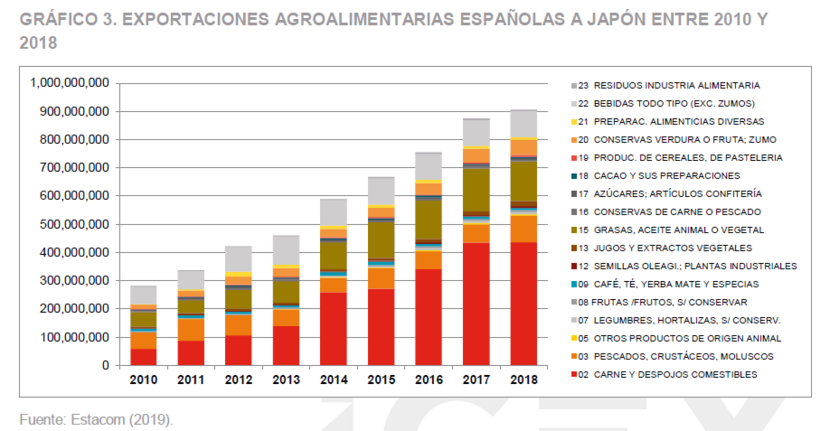

The tariff chapter, which contributed most to agrifood exports, was that of “meat and edible offal”, accounting for 17% of total amount. Within it, pork exports, accounting for 96% of meat exports, stood out. Other relevant stuffs were olive oil, tuna fillets, wine, preserved tomatoes, and juices.

The value of agrifood exports (Fig. 3) has more than quadrupled after the crisis, with steady growth accelerating from 2014 onwards thanks mainly to the very positive performance of pork and olive oil.

Market opportunities

The implication of the EPA entry into force during its first six months is summarized:

- Pork: Spanish exports have increased by 10% in value and volume. This growth has been driven mainly by frozen product exports. Other EU countries, such as Denmark, have seen their exports increase by similar amounts. Meanwhile, some of their international competitors such as the US and Canada have suffered value decreases of 9% and 5% respectively.

- Olive oil: Although the EPA has no tariff implications regarding this product, it benefits indirectly due to the visibility provided by the agreement.

- Fish, crustaceans and molluscs: The export’s performance of the main subheadings of this chapter have had different results. Thus, while tuna fillets have increased by 49% in value and fresh tuna and halibut have obtained a 16% growth in value, exports of anchovy, black hake, deep-see cod and toothfish have been reduced by 82%.

- Beverages (excluding juices):

- Still wine: Spanish exports have increased by 30% in volume and 18% in value. Other European countries, such as Italy and France, have also increased their export figures. In contrast, Chilean exports have decreased by 7% in volume and 2% in value.

- Sparkling and liqueur wines: Exports of Spanish sparkling wines have grown by 69% in volume and 46% in value, while exports from France and Italy have also increased. In the case of liqueur wines, Spanish exports have grown by 7% in volume and 19% in value, and those of its main competitor, Portugal, have reached figures of 25% in volume and 10% in value.

- Preserved fruit and vegetables, juice: The 10% increase in value of preserved tomato exports stands out. However, other items such as fruit or vegetable juices or canned citrus fruits have decreased in value by 23% and 3% respectively.

- Sugars and confectionery: Among the main products exported, sweets have seen their exports increase by 56% in value, while in white chocolate this increase has been 22%.

- Cheese: Despite the limited amount of Spanish cheese export to Japan, thanks to the marked tariff reduction, exports have grown by 64% in volume and 33% in value in the case of blue cheese. Exports from other EU countries have increased at different levels: those from Italy have increased by 20%, from the Netherlands by 10%, from Germany by 6% and from France by 2%, while those from Denmark have stagnated.

- Beef: Although the export of Spanish beef to Japan is currently banned, the EPA includes significant advantages for meat of European origin.

The last chapters of the report are devoted to explaining the variations in the tariff system that the EPA entails and to providing access key to the Japanese market. At the end of the report, several links are included giving access to studies on the pigmeat market in Japan, the sheepmeat and goatmeat market and the beer market, among others.

The full report in Spanish is available here https://bit.ly/38vT4Dl

Source: ICEX