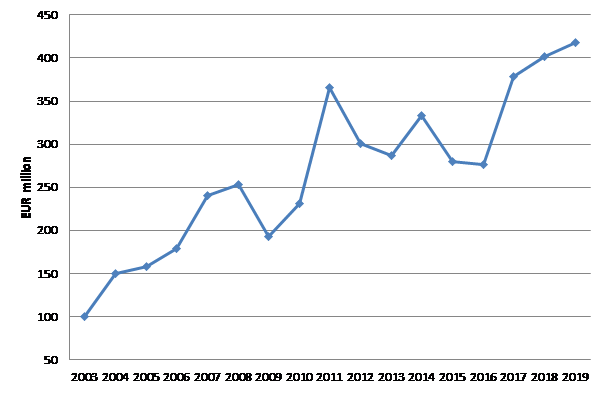

Overview of Dutch agricultural export to South Korea in 2019

Dutch agricultural exports to South Korea continued to grow in 2019, with a total export value of EUR 418 million, an increase of 4.0% compared to the previous year. Some commodities showed a new trend in export value due to sudden increase in demand resulting from African Swine Fever outbreak in the region, while others were caused by trade disputes. The largest export commodity in 2019 was milk powder preparation, followed by pork, butter preparation, food processing machinery and beer. Milk powder preparation and pork were ranked in the fourth and sixth places respectively by export value among all kinds of trade commodities including non-agricultural products exported from the Netherlands into South Korea.

Fig.1 Agricultural exports from the Netherlands into South Korea by year

| No. |

Year 2018 |

Year 2019 | ||

|

Commodities Exports |

EUR Mil. |

Commodities Exports |

EUR Mil. | |

| 1 | Pork | 79 | Milk powder preparation | 80 |

| 2 | Milk powder preparation | 72 | Pork | 63 |

| 3 | Butter preparation | 37 | Butter preparation | 29 |

| 4 | Food processing machinery | 20 | Food processing machinery | 28 |

| 5 | Beer | 19 | Beer | 27 |

| 6 | Feed | 17 | Feed | 21 |

| 7 | Cheese | 12 | Farming machinery | 14 |

| 8 | Cocoa preparation | 12 | Cheese | 13 |

| 9 | Farming machinery | 11 | Cocoa preparation | 12 |

| 10 | Starch | 9 | Malt Extract | 10 |

Milk powder

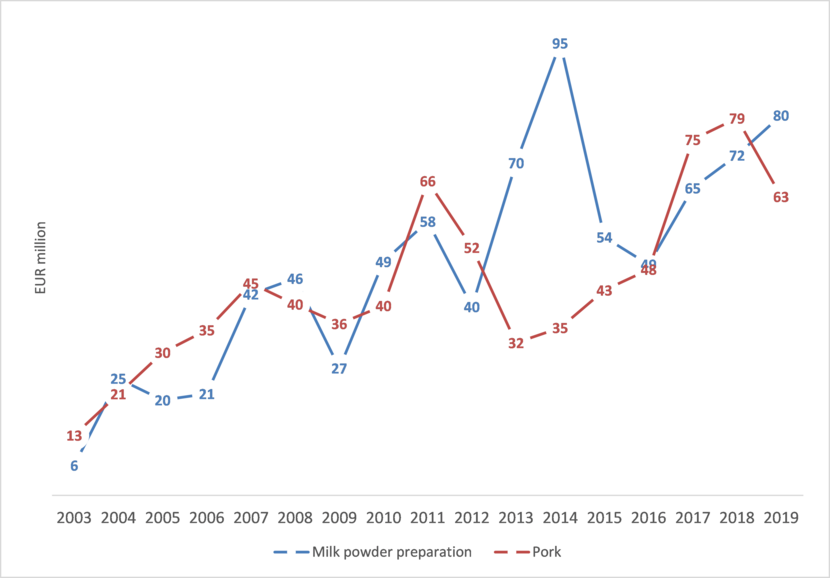

Milk powder preparation is a blend of milk and whey powder, which was created to lower the customs duty when exported into South Korea. Milk powder preparation exports continued to grow, and reached EUR 80 million in 2018, with an increase of 12% compared to the previous year. The Netherlands is the largest exporter of milk powder preparation, accounting for 63% of the market. As local raw milk in South Korea costs more than twice as much as the world average raw milk, the demand for high-quality dairy ingredients from abroad is high. The Netherlands has a good name in the Korean market for its high-quality dairy chain. Dutch milk powder preparation is largely used in the Korean dairy and confectionary sectors.

Pork

Pork exports stood at EUR 63 million in 2019, 21% down from a year earlier. Since local pork price is about twice as expensive as that of imported pork, Korean consumers have increasingly demanded imported pork products. However, in 2019, the outbreak of African Swine Fever in some Asian countries such as China, led to insufficient supply of pork from the Netherlands and thus caused a drop in Dutch pork exports to South Korea. The Netherlands was the 6th largest exporter of pork after the US, Germany, Spain, Canada and Chile. Around 61% of pork exported from the Netherlands into Korea was frozen pork belly (called Samgyeopsal in South Korea) which is mainly used for Korean BBQ.

Fig.2 Pork and milk powder preparation exports from the Netherlands into South Korea by year

Butter preparation

The Netherlands has competed with New Zealand and Australia for this market in South Korea. Dutch exports have fluctuated depending on exchange rates and market prices. Butter preparation exports decreased to EUR 29 million in 2019, which is a decrease of 21% compared to a year earlier.

Food processing machinery

The Netherlands has exported different kinds of food processing machinery into South Korea. Recent trade trends show an increase thanks to the increasing exports of meat processing machinery. Korean pig/poultry companies and associations are increasingly introducing Dutch meat processing/slaughter system to modernize their own facilities.

The Netherlands was the 2nd largest exporter of food processing machinery after Japan. However, with regards to meat processing machinery, the Netherlands was the largest exporter in 2019, accounting for 51% of the market.

Beer

South Korea's total imports of beer stood at EUR 250 million in 2019, a decline of 9.3% from EUR 276 million a year earlier. This marked the first on-year decrease since 2009. The drop was largely attributable to the ongoing "No Japan" campaign among Korean consumers, who have been boycotting Japanese products after the start of the Korea-Japan trade dispute in July of 2019. South Korea's imports of Japanese beer halved in 2019 to EUR 35 million, which marks a drastic fall from EUR 70 million posted in 2018, losing its No. 1 spot to Chinese products. This campaign, however, put a positive effect on Dutch beer exports; Dutch beer exports hit a record high of EUR 27 million in 2019, 43% up on-year. The Netherlands was the 5th exporter of beer, after China, Japan, Belgium and the US.