Spain: Plant-based products drive innovation in the food industry

Consumption data and industry progress in this category make it the niche with the greatest growth potential in the coming years in Spain. In 2021, meat analogues and vegetable beverages were at the forefront of this positive development. The Dutch role in strengthening the protein ecosystem to be discussed on June 7th at the Free From Expo (see last paragraph).

The plant-based segment continues to have the wind in its sails and making the innovation headlines in the Spanish food industry. In 2020, the main categories involved grew by double digits, with the vegetable beverages growing by more than 12%. Alternatives to meat products grew at a rate of 19%, reaching 29% in the supply of the replica meats mainly. Yoghurts and vegetable desserts showed a positive evolution of more than 17%. These and other data appear in an article published by Alimarket magazine.

In 2021, the supply of plant-based alternatives was growing again, in a context that has seen many food categories experiencing a logical decline in demand, once the "lockdown effect" which characterized 2020 was behind us.

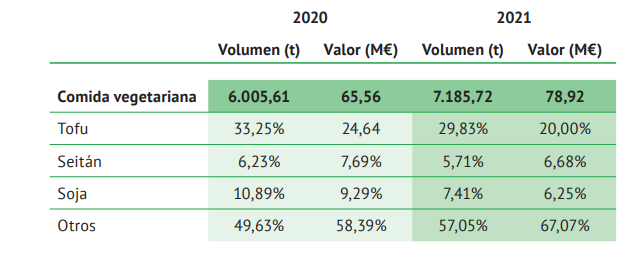

Leading this growth in 2021 was the category of meat product alternatives, which again grew at a rate of 19%, accelerating to 37% in the meat replica segment, reaching a market value of €78.9 million (Fig. 1).

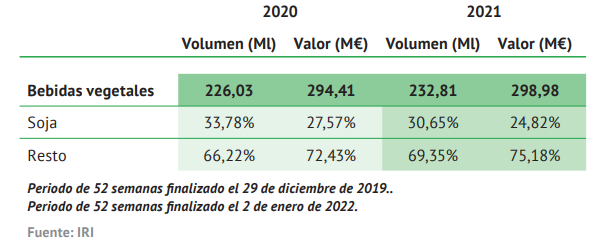

The supply of alternatives to yoghurts and dairy desserts followed closely behind, growing by 17.6% and a market value of €61.7 million. The most mature of the top three categories, vegetable drinks, again grew by 3% to €299 million (Fig. 2).

The analysis published by Alimarket also highlights the category of vegetable alternatives to cheese, which for the first time exceeded a market value of €10 million in organized retail. Last year it grew by 111.6% to reach €13.4 million. In addition to this, in 2021, veggie sausages were worth more than €18.5 million.

Understanding the consumer

The performance of these consumption data, which moves in line with the progressive growth of the flexitarian population, according to studies such as 'The Green Revolution', and mainly thanks to the notable effort being made by the industry in the creation of the category, place us today in front of the niche with the greatest growth potential for the coming years in the Spanish packaged food supply.

"The most important thing is to understand consumer motivations, to understand why this change is taking place", Hugo Verkuil, CEO of The Vegetarian Butcher, Unilever's meat replicas division, recently explained. "We see that consumers, on the one hand, value animal welfare, which is at the origin of why some groups of consumers such as vegetarians and vegans started to adopt this diet. Then you see how it has evolved towards a type of consumption that is understood as healthy, and thirdly, there is concern for the environment, which is the fastest growing motivation. I believe that if the taste experience is good and the price is right, the consumer will be driven by these consumer motivations and will easily adopt the plant-based diet”.

Pricing is the key challenge

With these words, Verkuil also put on the table one of the key challenges facing this offer in order to face the democratization of its consumption: price. Today, even in a really complicated context for the study of this factor, the leading national retail chain, Mercadona, markets its natural soya desserts under its own brand with an average price 120% higher than its natural yoghurt under the same brand. In the vegetable hamburger category, where it operates under the 'Kioene' and 'Tivall' brands, they represent a differential of 70% and 132%, respectively, with respect to beef and pork burgers. One has to go as far as the vegetable drinks segment to see how this differential is narrowing. Here, a liter of 'Alitey' vegetable oat drink, the most popular variety in the category, is sold at a price 20% higher than a liter of 'Hacendado' semi-skimmed milk.

Risk of slowdown due to inflation

In an inflationary scenario such as the current one, in which the consumer's purchasing power is being reduced, different sources in the sector are already warning of the risk of a slowdown in the evolution of demand for the categories with the greatest price differential, which could be seen during the next months before the return of the consumer to a more basic basket. This inflationary movement, however, was not yet reflected in the 2021 data.

Dutch role in strengthening the global protein ecosystem

Within the framework of the Free From Functional Food Expo, taking place in Barcelona, on June 7th and 8th, 2022, this embassy is pleased to invite you to a conference and a networking reception.

The conference will be held on the 7th, at 14:30, in the Vegan&Plant-Based area of the Expo. The same day, the networking reception, starting at 16:15, will take place in the Enterprise Europe Network (EEN) area.