Swine fever in China besieges Spanish processing industry

African swine fever, which has been hitting China since August 2018, is taking a heavy toll on the Spanish meat industry. The strong growth in Spanish exports is leading to an increase in the raw material’s price, which the processing industry estimates at around €1.2 billion in 2019.

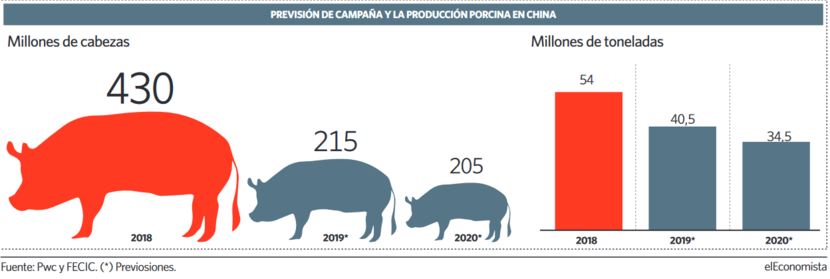

According to a report carried out by PwC for the sectorial organization Fecic, the disease will cause the China’s pig herd to be reduced by 50% by the end this year, i.e. almost 200 million heads, the equivalent 2% worldwide and the entire European herd (Fig. 1).

Fig. 1. Forecast on pig production in China

In view of the situation, China has focused on Europe. The US is not an attractive market for it because of its tariff policy and the use of ractopamine as a food additive, which is banned in China. And, within Europe, the market which is suffering the most from it consequences is the Spanish one.

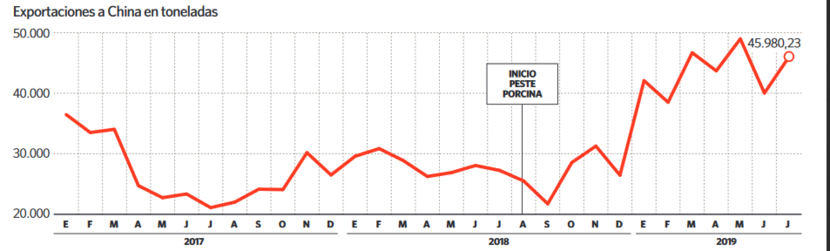

This year Spain has become the world’s leading pork exporter to China, displacing Germany and the US. A greater demand from the Asiatic market –in which Spain has a very good reputation for quality and food safety, making it a benchmark supplier- has meant that exports from the Spanish sector have augmented by 52% in volume and more than 90% in value (Fig. 2). “Exports to China have increased by 80% since the appearance of ASF”, J. Collado, from Fecic, points out.

Fig. 2. Evolution of Spanish pork exports to China

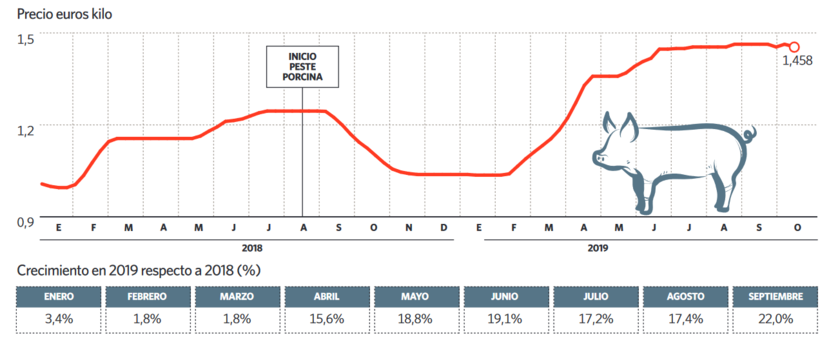

The immediate consequence of this has been an unprecedented increase in the raw material’s cost used in pork processing industry, which at a time when pork consumption is also weak, companies cannot pass it through to consumers. While, in January 2018, the price of a kilo of pork was 1 euro, during this month of October, it reached €1.46, which implies a growth of 46% (Fig. 3). This increase is very significant conceding that the cost of the raw material represents more than half of the industry’s total costs.

Fig. 3. Evolution of pig prices in Spain

The effect of this strong increase in exports has an uneven influence along the chain. Producers, slaughterhouses and cutting plants are greatly benefiting from these sells abroad, but a strong competitor for the Spanish raw material has appeared to the processing industry. This meant that, “when demand exceeds supply, there is tension in prices”, M. Huerta, from the sectorial organization Anice, explains.

The pork meat processing industry in Spain faces a bill equivalent to 10-12% of its annual turnover, some €1.2 billion. The situation is not currently generating a shortage in raw materials, but “we have ahead of us five years of high demand, high prices and a lot of pressure on the sector’s margins”, J. Collado says.

An industry in jeopardy

Pork is the main business of the Spanish meat industry, representing 64.5% of its production (4.52 million tons per year), 66% of its companies (around 2,500) and 45% of jobs (43,400).

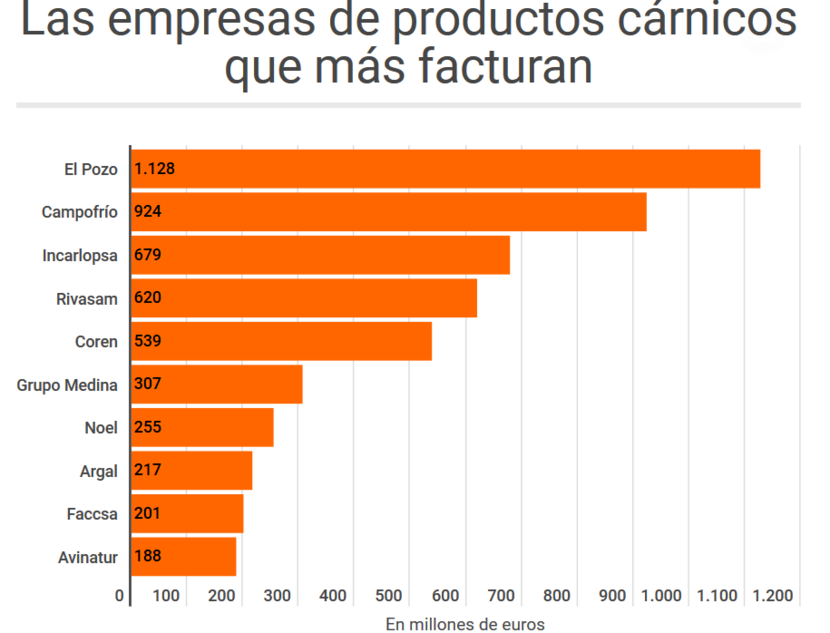

It is a very fragmented sector, as 65% of its industries has fewer than 10 employees and only 1.3% has more than 250. The 30 largest companies, including Campofrío, ElPozo, Incarlopsa (Fig. 4), generate 42.5% of total turnover, i.e., close to €4.4 billion.

Fig. 4. Main Spanish meat companies

As expected, the current crisis threatens small business even more. The industry sector also has very limited bargaining power, coupled with a 7% drop in meat consumption in Spanish households due to changing habits and stagnant population growth.

Good outlook for producers

Farmers, on the other hand, are benefiting from this China’s increased demand, especially for higher prices. “Since last Christmas the pig price has risen by 40%, although the average is 10% compared to last year”, M.A. Higuera, from the producers’ organization Anprogapor, declares.

In 2018, 52.4 million pigs were slaughtered in Spain resulting in a production of 4.52 million tons of pork meat. These figures place Spain in fourth position at world level and second at EU level.

What will happen to the end of the disease in China?

Rising prices have no prevented farmers from seeing the situation prudently. In general, the circumstances are positive for the producers but “you have to keep your feet on the ground, because you don’t know how long the disease will last in Asia”, P. Matarranz, from the farmers’ organization Upa, says.

“We will have to look for other markets, although there may also be greater demand from other countries where the disease is spreading”. Everybody agrees that China offers attractive business opportunities and that “demand is not expected to decline in the short and even medium term”. D. de Miguel, from the interbranch Interporc, stresses that “we should not concentrate on the same market. It is important to improve trade relations with other Asian countries such as Japan, Philippines or South Korea”. “Now China is a customer which is growing a lot, but our main markets are the EU and Spain, which account for 70% of our production and which we have to take care of. China is not a structural market for the Spanish pigs”, De Miguel points out.

Source: Eleconomista.es & Expansión