Import substitution of food products in Russia: failed or win?

In spite of the strategy of the authorities, Russia is still unable to replace supplies of the main categories of imported products due to domestic production, including those prohibited for import under counter-sanctions in August 2014. European suppliers were replaced by companies from other countries, and in a number of cases it is not about replacing, but about re-exporting the same, mostly European, "banned" products. The evidence of this situation are the figures of the Analytical Review run by the National Rating Agency (NRA).

How it started

In August 2014, an embargo was imposed on the import of certain categories of goods from Western countries into the country as a response to Western sanctions. The first ban on the supply of goods - meat, fish, dairy products, cheeses, vegetables, fruits - concerned the EU countries and the United States. A year later, the sanctions were extended to Albania, Liechtenstein, Iceland and Montenegro, and later to Ukraine.

Vision and reality

The dropping out volume of banned food products was planned to be replaced by Russian goods in accordance with the 2012 import substitution strategy. However, analysts believe that it was possible to do this only partially, and a significant part of the products are still imported from abroad, but from other countries. For example, the volume of imports of dairy products by the end of 2020 was supposed to decrease by 30%, but in reality the reduction was 20%.

The situation turned out to be a failure with the reduction of vegetable imports: it was envisaged that by 2020 vegetable imports would decrease by 70.3%, however, in fact, this category imports have decreased just by 27%. Due to the climate, Russia will stay a net importer of fruits and vegetables for a long time.

Meat & fish sectors are leading

For eight years that have passed since the adoption of the import substitution strategy in Russia, only meat imports have been significantly reduced in Russian food market - by 65%.

In the 2000s, the import of meat and offal to Russia was about 2.5-3 million tons, said the head of the National Meat Association Sergei Yushin, but in 2020 the country was already importing less than 600 thousand tons. Russia has increased the production of poultry and pork, the expert reports: from 0.8 million to 5.05 million tons and from 1.6 million to 4.25 million tons, respectively.

Domestic fish production also increased: from 3.68 tonnes of salmon in 2013 to 4.21 tonnes in 2019.

Re-export replacing sanctioned import

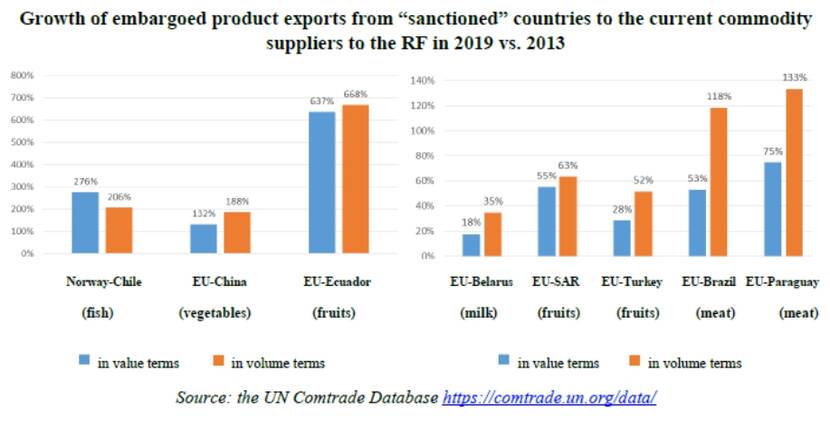

In a number of cases, supplies from countries that fell under Russian sanctions were replaced by the import of products from third countries. However, it follows from the NRA study that this was partially due to the re-export of the same products prohibited for direct import into Russia.

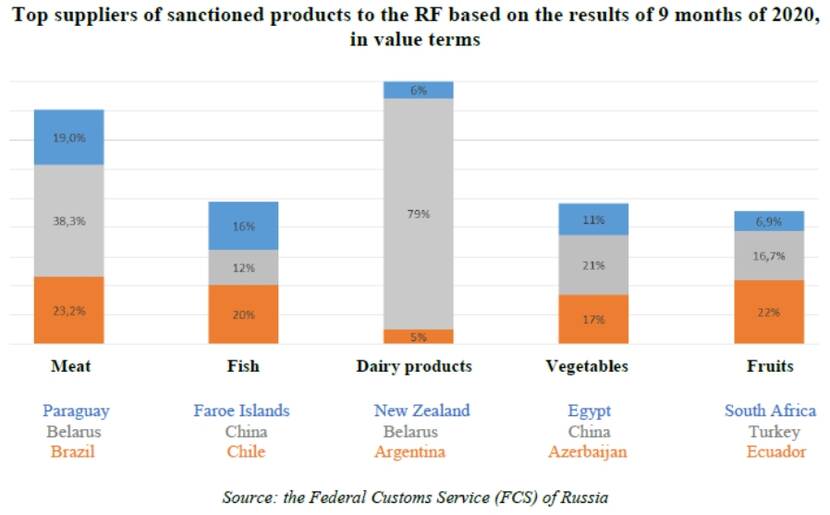

Norway, which supplied up to 40% of imported fish to the Russian Federation before the embargo, was replaced by Chile and the Faroe Islands, from which today 20% and 16%, respectively, come from. At the same time, the supply of Norwegian fish to Chile has tripled. Ecuador, from where 22% of fruit is now imported to Russia, has actually replaced the European Union in this market. However, analysts have found out that recently Ecuador itself has increased purchases of these products in Europe seven times, which exceeds the volume of domestic consumption. The supply of vegetables from Europe to the Russian Federation was partially replaced by China: the share of this country in imports is 21% against 8% in 2013. Meanwhile, in parallel, the PRC itself has tripled purchases of vegetables in the European Union.

If before the embargo the EU accounted for 43% of dairy products imported into the Russian Federation, now Belarus has become the main supplier (79% versus 39% before the sanctions). Belarus has also replaced the EU in meat supplies: now its share in the structure of imports in the Russian Federation is 29% against 12% in 2013. From Paraguay, from where meat was imported to a limited extent before the sanctions, now 19% is imported. Experts also admit the re-export of sanctioned products through the EAEU countries, Moldova, Serbia, Azerbaijan.

Government’s opinion

The Kremlin recognized the program of import substitution of products as successful. The goal of the import substitution program was to satisfy on its own the basic, and not all, needs of Russians in food products, the Kremlin explained. The program successfully coped with these tasks.

The Ministry of Agriculture commented on the information about the 'failure' of import substitution. According to the results of 2020, the production of basic foodstuffs exceeded the norms established by the Food Security Doctrine, the Ministry of Agriculture said. And it is the level of self-sufficiency in food products, which is spelled out in the Doctrine, that is the main guideline in the work of the industry, the department emphasized.

Thus, in 2021, the country produced grain more than one and a half times more than it is consumed domestically: the food security doctrine established a threshold value of at least 95% of the need, while it was collected 163.6%.

Self-sufficiency in meat and meat products reached 100.4% (in the Doctrine it was indicated as 85%). The production of livestock and poultry for slaughter (in live weight) in farms of all categories in 2020, according to the Ministry of Agriculture, amounted to 15.6 million tons, which is 3.2% (+481 thousand tons) more than in 2019. This included an increase in the production of pigs (+ 9.1%), poultry (+ 0.4%) and cattle (+ 0.2%).

Vegetable oil was produced almost twice as much as the country needs: given the established self-sufficiency level of 90%, Russia produced 190.1% in 2020. Despite the fact that in 2020 sugar production reduced, agricultural producers fully covered the needs of the domestic market, while the Doctrine indicates a minimum threshold level of 90%.

According to Deputy Prime Minister of Russia Victoria Abramchenko, Russian agriculture is no longer only about grain. Thanks to large-scale investments, other areas are developing, in particular, animal husbandry: “Over the past 20 years, we have essentially created a modern and competitive industry from scratch, confidently entered the world market with Russian meat. We have hundreds of modern livestock complexes, processing enterprises, and the production of meat and milk is growing. For production of pork, poultry meat, we entered the top 5 world producers. In beef production we are in the top ten countries.”

Opportunities for Dutch agro business in light of import substitution

As emphasized by Abramchenko, development of agricultural science is a key direction for the government in import substitution strategy of Russian agricultural sector. So, the main efforts are planned to be focused on accelerated scientific and technical transformation of agriculture in the nearest future. This project is about creation of independent selection and genetics, including on the basis of genomic and post-genomic technologies. It is necessary to create competitive varieties and hybrids of agricultural crops, including those adapted to climate change. Secondly, to ensure an increase in the productivity of agricultural animals through the implementation of their genetic potential and the introduction of advanced feeding and housing technologies. Therefore, Russian agriculture has to adapt foreign technologies and develop breeding and genetic centers in the most promising areas. In plant growing, these are potatoes, corn, sunflowers and grapes.

So, in this regard Dutch agricultural businesses can get definite advantages of the current strategy of Russian government for import substitution. The focus of cooperation between Russian and Dutch agro sectors has been shifted to technologies, equipment, genetics, planting materials, transfer of knowledge and expertise. In current situation Dutch agro sector can offer a fishing rod to Russian agriculture for it to be able to catch fish by themselves. From this point of view, the room for cooperation is still in place, and there are some of opportunities. However, one should keep in mind the challenges of starting and doing business in Russia including tough competition with other European players and local producers, tax treaty between the Netherlands and Russia to be over in January 2022 and other issues.

LAN-Team Moscow

Sources: NRA, RBC, RBC, Kommersant, RG.ru, Tass