Poland: poultry market

According to the forecast of the United States Department of Agriculture, in 2021 the world production of chicken meat will increase by 1.5%, to a record level of 102.1 million tonnes. But Poland in the first quarter of 2021 produced 1.7% less meat than in the previous year. This was due to the reduction of poultry insertions due to limited sales opportunities in HoReCa networks.

Global market

The expected growth will result from the growing demand for poultry on the global market, especially from the largest consumers of this type of meat, ie China, the European Union, the USA and Brazil. The relatively low growth rate of world production, forecast for 2021, is largely due to a lower than in previous years growth in demand for this type of meat from China, which is due to the restoration of pork production, competitive for poultry.

EU market

In the European Union market, three main factors influenced the supply and demand situation in the first four months:

- outbreaks of avian influenza detected in the area of most EU countries, resulting in a reduction in exports outside the Community

- restrictions on the functioning of the catering and hotel facilities introduced to counter the spread of the coronavirus epidemic, which resulted in the accumulation of stocks of poultry products on the market

- rising feed prices increasing production costs - stimulating the growth of poultry prices.

According to the EC forecast, poultry production in the EU in 2021 compared to 2020 will increase by 1%. The assumption of the forecast of its slight increase is the gradual lifting of restrictions imposed on hotel and catering facilities, resulting in an increased demand for poultry, and the restoration of trade relations with third countries that have introduced restrictions on the import of poultry products from EU countries affected by the avian influenza epidemic.

According to data from the Central Statistical Office of Poland, in the first quarter of 2021, meat industry enterprises (employing 50 and more employees) produced 1.7% less poultry meat than in the corresponding period last year. The supply situation on the domestic market was caused by the reduction of poultry insertions due to limited sales opportunities in HoReCa networks and on third country markets. The second factor influencing the reduction of production in Poland was the increased mortality of livestock caused by outbreaks of avian influenza - especially in areas with a high concentration of poultry production - which also affected reproductive flocks. The results of the purchases are confirmation of the difficult supply situation in the country. According to the data of the Central Statistical Office, in the first quarter of 2021, almost 8% less live poultry was delivered to purchase in Poland than a year ago.

Export in the EU

Avian influenza outbreaks located in the European Union in 2020 resulted in the closure of some non-EU outlets to EU exports. In the first quarter of 2021, the European Union countries exported 376,000 to third-country markets. tonnes of poultry meat, by 6.7% less than the year before. The main export directions of this assortment were: Ghana (68 thousand tons), Ukraine (38 thousand tons) and Congo (28 thousand tons). A much greater decrease was recorded in the import of poultry to the EU. According to the EC data, in the period from January to March 2021, the European Union imported only 98,000. tonnes of poultry meat, 29% less than in the corresponding period of 2020. Poultry was imported to the EU primarily from Brazil (54 thousand tonnes, 7% less than last year) and Thailand (35 thousand tonnes, 15% less).

Polish export

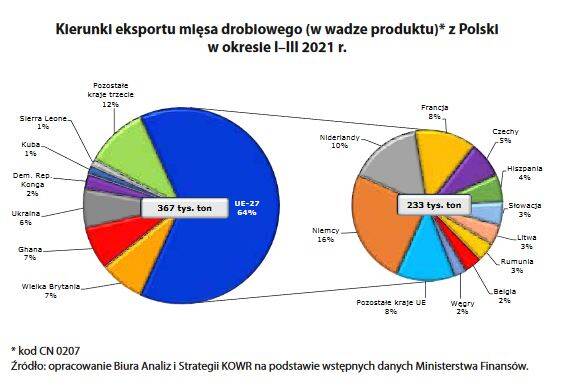

In the first quarter of 2021, a 2.6% increase in the volume of exports of the poultry assortment from Poland was recorded, with a simultaneous large, 9% decrease in revenues obtained on this account. Domestic exporters sold abroad 451 thousand. tonnes of poultry products in carcass equivalent (worth EUR 705 million) compared to 439 thousand. tonnes in the same period of 2020. The export was dominated by sales to the markets of the EU Member States, where 294 thousand were exported. tons, 2% less than last year. Despite restrictions on imports from the territory of Poland, introduced by some non-EU countries due to outbreaks of avian influenza, exports of poultry outside the EU increased by about 12%, to 157,000. tone. This was due to the possibility of redirecting some of the sold assortment to countries with greater import needs, which did not impose restrictions on purchases from Poland. In the first quarter of 2021, meat constituted over 80% of the poultry assortment sold from Poland.

The main export direction of poultry meat were EU countries, mainly: Germany (58 thousand tonnes, 16% of the volume), the Netherlands (37 thousand tonnes, 10%) and France (31 thousand tonnes, 8%), and among non-EU countries : Great Britain (27,000 tons, 7%), Ghana (26,000 tons, 7%) and Ukraine (23,000 tons, 6%) The high level of stocks of poultry products resulted in a significant reduction of imports. In the period from January to March 2021, 30 thousand. tonnes of poultry products, 15% less than last year.

Prices

The presented market situation related to the limitation of supply with simultaneous smaller possibilities of selling the poultry assortment on the domestic and foreign markets resulted in a dynamic increase in purchase prices of both broiler chickens and turkeys. According to the data of the Ministry of Agriculture, the average purchase prices of broiler chickens in Poland in the period from the beginning of January to the end of May 2021 increased from PLN 3.09 / kg to PLN 4.06 / kg, i.e. by 31%. At the same time, the purchase prices of turkeys in the analyzed period increased by 55%, to PLN 6.51 / kg. The level of prices paid to producers for chickens and turkeys was respectively 34% and 46% higher than in the previous year. In the opinion of KOWR analysts, the purchase prices of broiler chickens and turkeys by the end of the second quarter of 2021 should show an advantage of the upward trend. The high level of purchase prices should also remain in the third quarter of this year. An important market factor contributing to the increase in purchase prices will be the expected growing demand from the HoReCa sector related to the easing of sanitary restrictions, as well as the increased demand for this type of meat during the summer holiday season. Domestic purchase prices may also be positively influenced by high feed prices and the expected maintenance of price competitiveness on the EU market, which will ensure the possibility of selling the poultry assortment in EU countries that are traditional recipients of these products from Poland.

Source: Biuletyn Informacyjny KOWR

Read our other articles over animal production in Poland: