Structuur, landgebruik en winstgevendheid van de Japanse landbouw

Samenvatting

De Japanse landbouw heeft het imago van kleinschalig, inefficiënte landbouwproductie die zwaar beschermd moet worden door hoge tariefmuren en genereuze subsidies. Toch is dat beeld maar slechts ten dele terecht. Het klopt dat er op dit moment zo’n 2,1 miljoen, veelal parttime en vergrijsde, boeren zijn, die op kleine stukjes grond voornamelijk rijst produceren. Maar circa 35.000 grootschalige boeren zijn nu al verantwoordelijk voor meer dan 53% van de totale productie, en zij hebben over het algemeen een uitstekend inkomen. In de Japanse landbouw lijkt steeds scherper een tweedeling te ontstaan van enerzijds een enorme groep kleinschalige rijstboeren op leeftijd, en anderzijds de grootschalige landbouwbedrijven. Het landbouwteam van de Nederlandse ambassade onderzocht daarom in een marktscan de agrarische bedrijfsomvang, output, en verdiencapaciteit om een beeld te krijgen van Japanse boer van de toekomst. De uitgebreide marktscan met statistische data en een lijst met de 500 grootste (non-rijst) landbouwbedrijven is nu beschikbaar.

A full English version of the report is available.

The Japanese government has ambitious plans to increase the self-sufficiency rate from 37% to 45% in 2030 and bring agricultural export to JPY3,5 trillion (appr. €40 bn.) in 2030. To achieve this, the sector needs to be reshaped into Smart Agriculture using all kinds of modern equipment like drones, AI, Robots and IoT. It also requires a resilient farmer who has the size and financial resources to do capital-intensive investments. There is an ongoing trend in Japan that the percentage of number and output of large-scale farms is increasing while the number of smaller farms is declining.

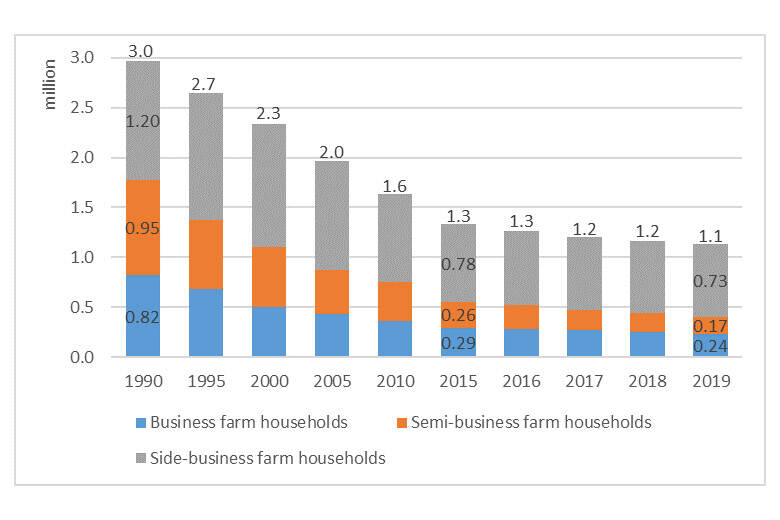

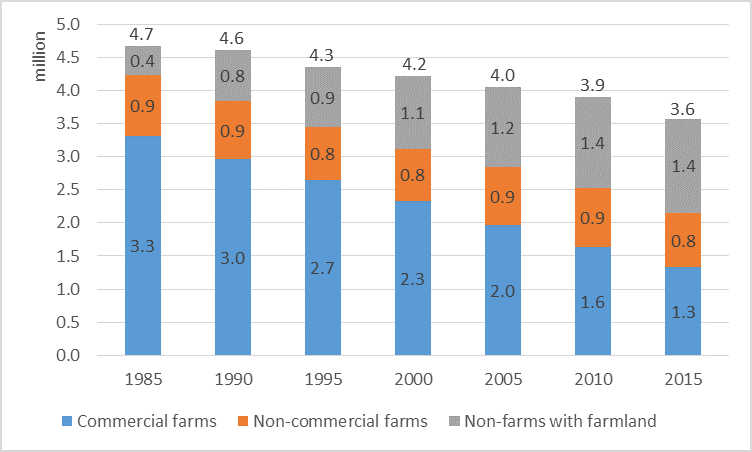

Family farming is most common in Japan and covers a wide range of farm types and sizes, with both full- and part-time farmers, and side business farmers. In 2019 Japan had 3,6 million farmland owners, 2,1 million households who occasionally working on the land, and 1,1 million (part-time) family farms. The last group are the so-called “commercial farms”. These commercial farms are defined as those cultivating >0.3 ha of farmland OR earning more than JPY 500.000 (€ 4.250) per year from sales of agricultural products. The number of commercial farms has declined sharply over the years: from 3,3 million in 1985 to 1,1 million in 2019 (figure 1).

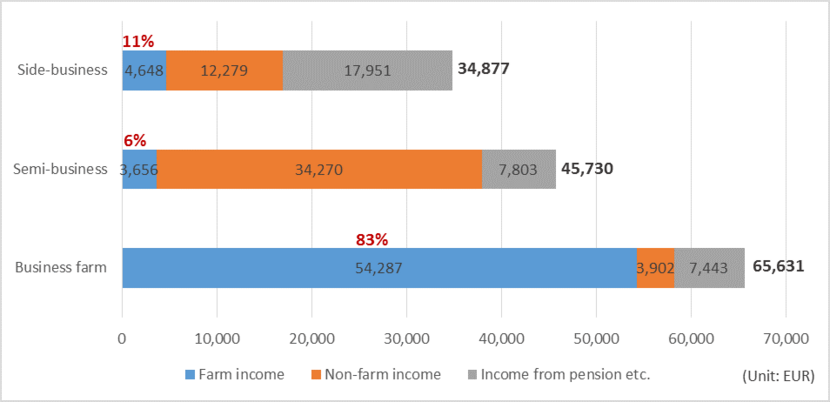

Commercial farms can be divided in three sub categories: business farms (in total 235.500 farmers); semi-business (165.500); and side-business farms (729.100). Business farms should earn more than 50 % of the net household income from farming, while semi-business and side-business farms earn much less, respectively only 6 % and 11 % of their household income from farming (see figure 2).

Figure 1: Number of commercial farms by status of farm business, 1990-2019

Japan has a total cultivated agricultural area of 4.4 million ha of land of which 2,9 million ha is cultivated by the 1,1 million commercial farms. The national average farm size per commercial farm is therefore small (26 ha in Hokkaido; 1,8 ha in other prefectures). However this does not reveal much about the current state of business farms in Japan, because nearly 80% is semi-business or side-business farms. The average area of the 235.500 business farms is 5,6 ha, while that of semi-business and side-business farms is much lower (res. 1,6 ha and 1,1ha).

The majority of the Japanese commercial farms is still family-owned, although there is a steady shift towards corporate farms with modern management that employ workers. The number of corporate farms increased from 8.700 in 2005 to 18.900 in 2015. The average size of corporate farms can be compared with Hokkaido’s commercial farming (26 ha).The wording “corporate farm” can however be misleading as also many small (in sales value) companies are included. In 2015 about only 45% of these corporate farms had annual sales of over JPY 30 million (€253.000). Generally these corporate farming organizations are commercially quite successful.

In 2003 also non-agricultural companies entered the agricultural sector when they were allowed to lease farmland. As of December 2018, 3.286 non-agricultural companies are engaged in farming. The role of the non-agricultural holdings must however not be overestimated: in 2018 they leased only 10.020 hectares in total.

For a long time the image of an ageing, small-scaled, heavily subsidized farmer above 70 has been dominating the picture of Japanese agriculture. For a large part this is correct, as the majority is working part-time on 1 or 2 hectares of (mostly rice) land, generating an additional income of €3.400-€4.600 on top of other income sources (figure 2). Commercial and corporate farms are however much more successful. In comparison: the 235.500 business farms generates an average income (+/- € 55.000) from agriculture.

Figure 2: Sources of income of commercial farms by type of farm, 2018

One of the key economic drivers of future changes within the family farming sector – and in contrast to the non-family farming sector- is the differential between farm incomes and incomes in the rest of the economy. The business farmers have an average net income of €54.230 generated from sales and subsidies in value of €166.230. The situation is even much better on the corporate farms (€1.343.921 sales value) and €131.491 net income. In comparison: Japanese households had in 2018 an average annual income of JPY 5,17 million (€42.500).

A Dutch farmer earned in 2019 around €85.900, based on an average output value of €599.700 (profitability 14%). In Japan the profitability is much higher thanks to higher prices and subsidies. Prices received by Japanese producers are on average 72% above world market prices. The OECD producer support estimate (PSE) was between 2015-2017 about 46% of gross farm receipts.

Despite the decline of numbers, side business farms (-2.1% year on year) and non-commercial farms (-0.6% year on year) are relatively stable. (figure 3). It suggests that a rather stable, refreshing group of ageing farmers stay in part-time, mostly rice, production for the local market, or to satisfy household food needs. However , especially the middle group of semi-business and smaller business farms are struggling to survive (figure 1). Between 1990 and 2019, the number of business (-3.75%) and semi-business farms (-4.35%) dropped significantly.

Figure 3: Number of households with farmland by type, 1985-2015

Three percent (or 35.000) of the farms already accounts for 53% of the total agricultural production. This last group is yearly growing in economic importance. In 2019 there were approximately 60,000 large commercial farms and corporate commercial farms that have a earning capacity of €170,000 sales value, which leads in combination with all kinds of subsidies to a net income of more than €55,000. Agriculture can be profitable business in Japan!

By: Evert Jan Krajenbrink, Yuko Saito, September 2020

Follow us on Twitter:

@agritokio

@ejkrajenbrink

The full report and a list of the 500 largest Japanese farms (excluding rice farms) are available for Dutch companies on request. Interested companies can send an email to: TOK-LNV@minbuza.nl