Serbian agriculture: The impact of the war in Ukraine

The crisis has made Serbian farmers' already complex situation even more complicated.

Since the start of COVID-19 pandemic, we have witnessed the global increase in food prices. Prices of inputs for agriculture production and logistical costs have been on rise way before the war in Ukraine started. With the outbreak of the war in Ukraine, the situation in the food sector got even more complex and complicated.

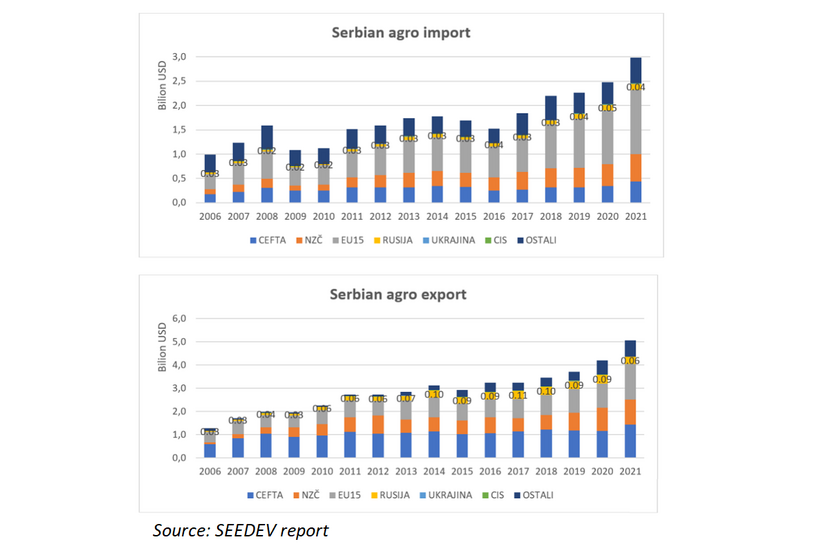

A report by the SEEDEV consultancy titled The Impact of the War in Ukraine on the Agriculture sector in Serbia shows that the Russian Federation (RF) and Ukraine have been two important (but not the most important) markets for Serbian agro trade. (See tables below)

According to the study, the export of agro products from Serbia to Russia is lower than 10% and import is around 2%. For the last five years Serbian export to Russia has been stagnating while the overall export from Serbia has been increasing.

As we have reported before (see more details on this here), the main agro export article to Russia is apples. Serbian apple producers were focused on the Russian market due to the high prices there for their produce.

This has changed since local apple production increased and the competition from Moldavia, Turkey and Azerbaijan became stronger. Since the start of the war, transport and logistics have become very difficult and thus much more expensive. The devaluation of the Russian Ruble made the Serbian produce more expensive for local consumers therefore less competitive. Besides apples, Serbia exports strawberries, peaches and nectarines to Russia. The main import product is tobacco.

Ukraine is a big producer of the important agriculture products that Serbia is also exporting and therefore Ukraine is not a significant foreign trade partner of Serbia (Ukraine only makes up 0.2% of the Serbian agriculture foreign trade exchange). The main agro export products to Ukraine have been: seeds (mainly sunflower seeds – $2.2 million, maize seeds $1.1 million); planting materials; dairy products; and fruits. The main imports from Ukraine are confectionary products; soya and soya products; and some tobacco products.

| The war is affecting the food sector in Hungary too. See more about that here. |

The report underlines what they call inappropriate and unpredictable responses to the crisis by various governments such as the introduction of export bans and the capping of the prices of food products that can only lead to further market disturbances.

In Serbia, the export ban led to a decrease of cereal prices on the local market and a standstill in the trade of cereals.

***

Our Newsflashes have everything you need.

Hungary Newsflash Week 12, 2022

Rising chicken egg prices on the market, cereal exports remain mostly uninterrupted, meat sector trends continue in which pork and beef declines while chicken rises, and the drought becomes severe enough for the official announcement of a water-stressed period - The week in Hungarian agriculture

Serbia Newsflash Week 12, 2022

The revoking of the ban on export to North Macedonia, int'l investments and national grants yield results, successes in waste management, cloud-based e-administration for enterprises to be introduced, and a World Bank rural development loan to be rolled out - The week in Serbian agriculture