Dairy market in Hungary

Low buying-in price, VAT reduction and quality attributes for fresh milk in Hungary

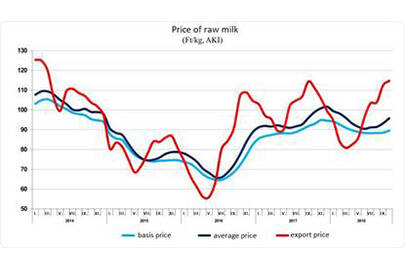

In Europe, the buying-in price of raw milk is constantly rising. Although Hungarian milk is no exception to this, it is still much cheaper than in other countries. While in the European Union there is an average of 106-107 forints per kilogram (0,34 euro/kg), in Hungary, 93.1 forints (0,3 euro/kg), which is the lowest in the region. The goal of the government is reaching at least 100 forints per kg.

By 1 April 2015, the European Union lifted the quota of milk production. As a consequence of this many producers slaughtered their animals as a result of very low prices due to overproduction. Because of this in 2017 all over the EU supply difficulties have emerged and a general 130 to 140 percent price increase has occurred in the European market. In Hungary, the government wanted to handle the crisis before it would have happened: it provided subsidy of HUF 64 billion (206.5 million Euros) for the dairy farmers. By doing so, the Hungarian milking cow population remained the same size.

High purchasing prices on the world market could basically be in favor of Hungarian producers, but in Hungary demand is not only factor which determines the price of raw milk. The problem is that the Hungarian market is price-sensitive, so retailers cannot raise prices, also because Hungarian dairies must also compete with cheap imported products as well.

On the other hand, despite the good quality of Hungarian milk in regard to its fat content it is lagging behind its competitors. The same content value in the Netherlands is 4.4%, while in Hungary 3.6% - 3.7%. In order to change this, better nutrition of milking cows would be needed. Although there are efforts from the producers’ side to feed the animals with better quality forage, they have less capital for this purpose which in turn depresses prices to a certain extent.

The result of the internationally low purchase price is that exports of Hungarian raw milk are increasing, while domestic milk processing uses 98 percent Hungarian milk. The common practice is – because of low price – the raw milk goes to abroad and comes back as processed product.

To improve the competitiveness of Hungarian milk, the government reduced the VAT on raw milk and fresh milk from 27% to 5% in 2018. At the same time, the Hungarian milk producers' organization signed a cooperation agreement with 7 retail chains, each of them undertook to implement VAT cuts in the sales prices. By doing so the effect of the first VAT reduction was positive, the producers prices could raise while sales price remained moderate.

But since it did not cover the UHT and ESL dairies - determining the Hungarian liquid milk market - , only 16 to 18 percent of the milk sold in Hungary was affected by the VAT reduction.

From 2019, the VAT on durable (UHT, ESL) milk products will also decrease, which may - in the light of previous VAT abatement experience – only partly appear in retail prices and partly increase traders' margins. However the most important outcome of the VAT cut is that it will lead to remarkable decrease in cases of VAT fraud, what the sector is severely affected by. Last but not least it will strengthen the Hungarian milk sector’s competitiveness that is still suffering from a low buying-in price.