Ghana's Food Manufacturing Industry

In Ghana, population growth is increasing, bringing with it, a sharp expansion of the country’s middle class. More than half (51%) of the population live in urban areas, a figure that is expected to increase by 3.1% per annum in the coming years. This new trend in economic and demographic shifts has had interesting influence on the dietary preferences of Ghanaian consumers- The preference for processed foods. Given time, demand and need for convenience, the growing middle class consumers are prioritizing diversity, nutrition and safety in their food purchases, resulting in the increased demand for healthy ready-to-eat meals and processed products.

Despite the growing demand from consumers, Ghana’s food processing sector remain largely underdeveloped. Although one would find a retail shop stocked with vast variety of processed foods, only a small percentage of the food consumed in Ghana are processed locally. The reality is that Ghana’s processing industry remains low in capacity, with a wide gap that is filled by imports.

The Embassy and RVO commissioned a report on Ghana’s Food Manufacturing Sector, identifying the critical challenges impairing growth of the processing industry, key potential solutions to resolving these challenges as well as opportunities (including opportunities for the Dutch private sector). Four broad sectors- Aquaculture, Poultry, Fruits and Vegetable were tackled under these objectives.

Aquaculture Sector

The aquaculture sector in Ghana has different fish-holding systems. These include floating cages, earthen ponds and concrete tanks, with floating cages being the most common one which forms about 75 to 93 percent. Tilapia is the most preferred for farming, marketing and consumption and is about 80 percent of farmed fish harvest, and was the focus of the study on the aquaculture sector.

Ghana does not have any industrial aquaculture processing factory though there are two large tuna canneries- Pioneer Food Cannery and Seaboard of Ghana. Farmed fish is preserved mainly through primary and secondary processing techniques by freezing, salting, drying, smoking, grilling and fermenting or combination of these.

Constraints of the sector include high costs of inputs, high mortality rates of fingerlings, insufficient supply of full-grown tilapia to secondary processors, lack of funds and inadequate equipment. Regardless of these constraints, opportunities lie in export of fish to ECOWAS market, provision of technical services, improving feed quality and lowering cost of feed production. There are also opportunities which the Dutch sector is able (and willing) to pursue. These lie in the area of feed supply and the supply of culturing systems.

Poultry Sector

Although poultry produce is the most affordable source of protein in Ghana, the sector is faced by its own challenges and opportunities. Despite the rise in consumption of poultry meat, the growth in demand does not benefit local producers as there is a huge gap that is filled by imports.

Poultry processing comprises two categories of processors- formal and informal. Formal processors produce in a purposefully constructed space with requisite certifications from FDA (Food and Drugs Authority) and GSA (Ghana Standards Authority) whereas informal processors slaughter and dress birds in makeshift spaces without GSA and FDA certifications.

There are a number of constraints mentioned as poor quality of increased demand, dynamics of marketing and distribution, cost of power, working capital deficiency and low accumulation of productivity enhancing capital goods.

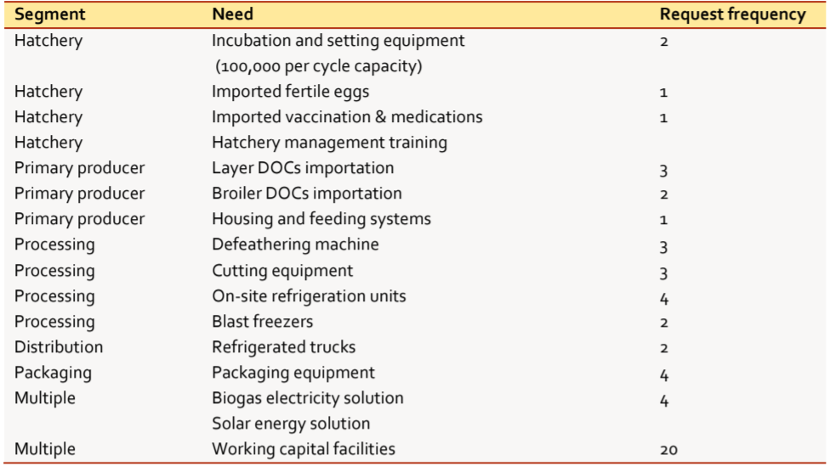

These challenges notwithstanding, there are huge opportunities for the Dutch private sector. These are summarized in the table below.

Vegetables

Tomatoes, peppers (both sweet and hot chillies), onions and okra are the four top vegetables commonly produced in Ghana. The study focused more on tomatoes, a commodity which is grown in 10 out of the 16 regions of Ghana. Its cultivation is dominated by smallholders with average land holdings of less than 2 ha.

Opportunities for the Dutch private sector lie in the following areas

- Improved Varieties of seeds/ Seed banks/ Tissue culture seedling production

- Supply of horticulture-specific agrochemicals

- Tailor-made equipment solutions for small and medium scale enterprises

- Sustainable packaging solutions, particularly restorable pouches for retail markets and large storage solutions conducive to high average temperature and humidity environments

Fruits - Mango Subsector

Mango cultivation in Ghana is a more recent phenomenon compared to cocoa or oil palm. Nevertheless, it has become the fastest growing horticulture crop under large scale production. With two cultivation seasons per year, the Southern zone of Ghana accounts for about 81.3 percent of mango cultivation in Ghana.

Fresh-cuts fruits and fruit juice processing is by far the most dominant form of fruit processing in Ghana. Most processors of fruit juice are engaged in either fresh unpasteurized processing with a shelf life of one week or pasteurized juices with six months’ shelf life. Most fruit juice processors in Ghana are small scale processors (60 percent) with production capacity of less than 1 ton per day.

The fruits processing industry holds a huge opportunity for the Dutch private sector.

The full report contains a number of detailed business cases and appendix worth reading, and can be accessed through this link.

You can contact the agricultural team in Ghana by e-mail, acc-lnv@minbuza.nl