Steering through COVID-19: Reflecting about South African agri-business

A large part of the agricultural industry has always been treated an essential service since coronavirus started to spread in South Africa. This has not left the industry without problems. Between 4 and 13 May 2020 South Africa recorded an average rate of more than 520 confirmed new COVID-19 cases per day. These were the highest figures per day since the first case was recorded on 5 March 2020 in the country. Like other parts of the world, regulations have consistently changed. Here, we are sharing some of key regulatory developments and how the agricultural industry has been affected.

Background: Judging from the face of statistics

Between 4 and 13 May 2020 South Africa recorded an average rate of more than 520 confirmed new COVID-19 cases per day. These were the highest figures per day since the first case was recorded on 5 March 2020 in the country.

In the Netherlands, the first confirmed case was recorded on 27 February. Having reached the total number of more than 40,000 confirmed cases, and 5,450 of officially confirmed deaths to date, the average per day of confirmed COVID-19 cases in the Netherlands is now about 200. This is far much lower than the averages that the Dutch recorded during the period between the second half of March and the end of April when their daily confirmed cases ranged from 500 to more than 1,000 per day.

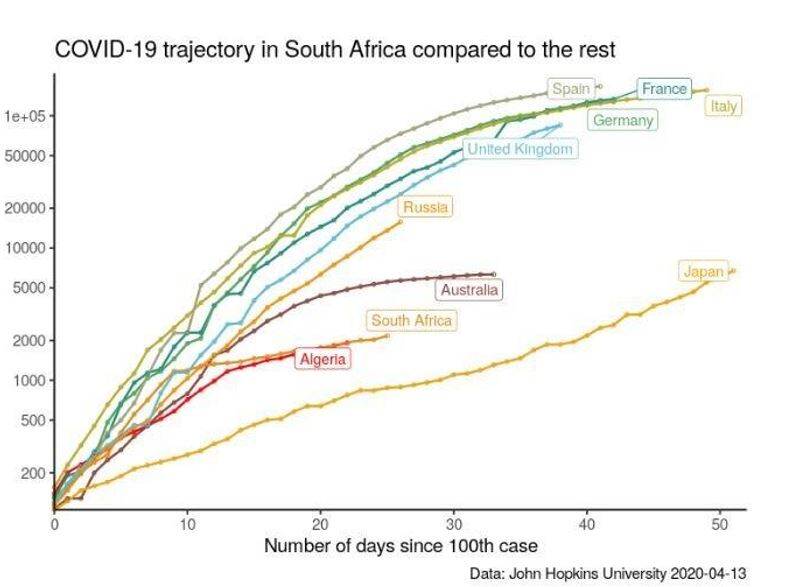

By 14 May, South Africa had recorded a total number of about 12,074 confirmed cases and 206 deaths. If one is to go by comparisons in population size and the numbers of confirmed cases and deaths, the current situation entails that the Netherlands are still in a worse situation than South Africans. The South African population is currently above 59 million people, while the Netherlands population stands at 17,4 million people. So COVID-19 figures in South Africa, as a percentage of total population, are way below those of the Netherlands.

On 23 April 2020 the South African government announced relaxation of strict lockdown regulations which were put in place on 26 March 2020. The 26 March regulations were implemented for 5 weeks - first for three weeks, and further extended to another two weeks. These strict measures had put a major part of the economy on a stand-still except for the economic activities considered as essential services. Major food and agricultural economic activities were in the category of essential services.

Categorizing agriculture as one of the essential services during the strict lockdown regulations resulted in the agricultural value chains experiencing limited disruptions in both internal and export trade flows. Most of the essential food products entering the country by air or sea were allowed. Cargo from high risk countries was required to go through sanitization. Disembarkation of Cargo Crew was permitted on condition that they would be subjected to Quarantine laws of the country. Special provisions and arrangements were made by the Ministry of Trade, Industry and Competition of South Africa (DTIC) for operators in this category to obtain export permits. The South Africa Revenue Services listed essential goods that could be exempted from VAT. Agri and food goods on this list were: Any food product, including non-alcohol beverages, animal food, and chemicals, packaging and ancillary products used in the production of any food product. Transport, logistics and export of these essential goods to other countries were allowed.

During this period operations for agricultural products which were not considered essential were not allowed. Products such as wine, tobacco (cigarettes), cotton and fisheries remained in the category of non-essential services.

Relaxing the lockdown regulations from 1 May 2020

As the period of 5 weeks explained above approached the end, the South African Government announced relaxation of some of the restrictions in the economy. This development has seen agriculture and food receiving more attention in terms of extending the flexibilities to other agricultural commodities and their supporting services.

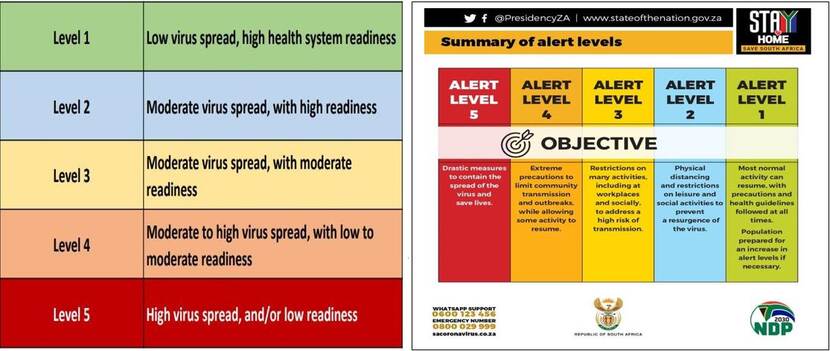

This relaxation is presented as a new response approach to COVID – 19. It is presented as a 5 levels phased approach seeking to help the economy to gradually recover from the negative influences of the pandemic. In this range of phases, level 5 is considered to be the highest level of measures, while level 1 is considered to be the lowest level of measures. The lockdown measures which were imposed from 26 March to 30 April were of level 5, while total opening of the economy would be categorized as level 1.

On 1 May, the country moved from level 5 (total lockdown) to level 4, lifting certain restrictions and allowing certain businesses and industries to re-open. In addition to agriculture and food industries, the government has also opened the entire energy sector, part of mining, manufacturing, construction, (limited) retail including informal traders and transport. It is estimated that about 1.5 million employees have returned to work due to level 4 relaxation of regulations.

While the economy is expected to open in phases, businesses that are allowed to open in level 4 are expected to implement restrict hygiene measures. They are also expected to allow their employees to return to work in stages, starting with only one third of the total number of employees. These employees are expected to be guided and supported to follow strict hygiene measures such as social distancing and wearing face masks at all times of duty. The government is making strong recommendations that where it is possible for employees to work from home, business owners should encourage their employees to do so, even for the sectors that are allowed to operate under level 4. Overcrowding in retails shops including food shops is not allowed – customers are expected to queue outside the shops until enough space is available inside.

Apart from short trips taken to access or undertake operations related to essential needs such as food, medicine, warm clothing and ICT equipment, all citizens are expected to remain at home. Every citizen going out of their house to access or undertake operations related to essential needs is legally expected to wear face mask. Travel between provinces or across the international borders is still not allowed (note that when stage 4 started travel between provinces was allowed for 7 days just for only people holding permit to return to work). International flights for passengers are not allowed both in and out of the country, except for purposes of repatriations arranged with respective embassies. In line with the phased approached underlined above, inbound and outbound flights for passengers will only be allowed at level 1.

So for agriculture, what has changed from level 5 to level 4

Since there was already a good list of agricultural services that were allowed to operate during level 5, the changes in level 4 have mainly seen the expansion of those services. Essentially, the entire primary production sector is allowed to operate with some strict sanitation measures. In livestock, veterinary services are allowed and auctions are allowed to a maximum of 50 persons per session. Wine is now produced for export market, but not for local market since alcoholic drinks are not allowed for public consumption and sale. Cotton is also being produced for export market. Fisheries industry is also allowed to operate.

Some agricultural sub-sectors, such as citrus have now entered into the harvesting season. Level 4 regulations are allowing farmers to recruit workers to assist with harvesting. Export and delivery to local markets of citrus remain intact, benefiting from the fact that export of essential agricultural products has always remained open even during the total lockdown at level 5. The first 2020 shipment vessel for citrus exported to China and Japan left South Africa on 1 May. By 3 May South Africa was already loading the third vessel destined to the same countries.

All agricultural operations allowed to take place are expected to follow the same strict sanitation measures as other sectors that are allowed to open business. Since travel across provinces or borders is not allowed, businesses are encouraged to employ people from the localities where they are operating. Businesses that have the capability to transport workers from other provinces using chartered planes are allowed to do so.

Maintenance and repair of equipment used to undertake essential services is allowed, meaning that agri-businesses that are allowed to operate can call artisans and operators that provide them with maintenance services.

Just as it was the case during level 5, it is required that those who travel to work must have a letter from their employers that confirm that they are travelling for work related to essential services.

Good for agriculture – but challenges abound

Some of the challenges experienced in the South African agricultural sector during COVID – 19 reflect dual nature of the country’s agricultural sector with advanced commercial elements on one side, and small scale elements ranging from subsistence to smallholder commercially developing agriculture on the other. During COVID-19, it has been a common argument of analysts that developing smallholders and those lower than them will struggle to survive and recover from the economic shocks caused by COVID – 19.

Further, COVID-19 related market complexion has created new gaps in the supply chain. For examples restaurants that are able to operate under level 4 are only those that are able to use food delivery services. Tourism and hospitality operations are still not allowed to operate. Schools that used to provide supply channels through school feeding schemes are still closed. Commercial primary producers and smallholders who relied only on these channels have to resort to new avenues which are either impossible or difficult to find.

Informal traders selling primary food products in their local communities, are sometimes used as alternative distribution channels. In other words, localization of distribution streams is becoming order of the day. However, observers have noted that due to the fact that most of the people have lost their jobs, more and more citizens cannot afford to buy food. There is an extensive range of campaigns in the country on food donations to poor communities. Retailers and informal traders have therefore lost a large customer pool due to extensive loss of jobs.

Though production and distribution of wine is allowed for export market, local distribution and serving is still not allowed. About 70% of production from some of the wineries is distributed to the local market. Small hospitality and tourism businesses attached to wineries have also lost cash flows. This situation has generally meant keeping wine on the shelf for a long period resulting in running out of shelf space. Campaigns against alcohol consumption that dominate COVID – 19 measures are affecting the reputation of the wine industry. Forecasting for future planning is not possible due to the unpredictable nature of COVID – 19 and related regulations. Outcries from this situation denote that COVID-19 has reactivated the scars from effects of Climate Change experienced by the industry about two years ago in the Western Cape Province of the country. From the effects of COVID-19 alone, the industry is said to have lost about 500 Million Rands.

The limited operation of restaurants and closure of tourism industry also affect imported food items. South African large and chain restaurants and tourism industry do not rely only on the local, but also on imported agricultural products. Food import and distribution lines are therefore experiencing a knock-on effect from limited operation or total closure of these industries.

While in general local producers targeting export market have indicated that they are not experiencing major logistical challenges, some have commented that COVID–19 measures from other parts of the world require careful planning. For example, exporters should understand current COVID-19 measures in the importing countries. They should follow developments closely due to frequent changes in regulations. It is also important to ascertain availability of vessels and containers before starting to prepare produce from the farm for export market.

In the midst of these challenges, major players and policy makers across the agricultural value chain have positioned themselves to learn from other countries. Dutch international agri-businesses based in South Africa are tapping from experiences shared by their counterparts in other countries, including the Netherlands, where the pandemic is worse and/or has been experienced for a longer period than South Africa.

How long will these challenges and measures take?

Absurd as this question and its answers may be, policy and plans by the South African Government are made on the scenario of reaching the peak of the epidemic, at the country level, by September 2020. This is a shift from the earlier projections which asserted that the peak would be reached between July and August. Changes in projections have been based on lack of enough empirical evidence to back up these projections. There are still arguments from various commentators that even the September 2020 date is projected from limited empirical evidence. This implies that new dates beyond September could, soon or later, be announced by the decision makers.

The ambiguity of when the country’s infection rate could reach the peak essentially breeds the ambiguity about when the phased approach currently in place could move from level 4 – to 3 – to 2 – and eventually to level 1. Some commentators, including decision makers have indicated that if the situation becomes worse than it is now, a decision to move back to level 5 could be made and implemented. Tightening and relaxation of measures between level 5 and 1 could be implemented sporadically among provinces or districts as some areas of the country experience extremely higher rates of the pandemic than others. At the time of publishing this article, the City of Cape Town, based in the Western Cape Province of South Africa, was recording more than 80% of the country’s total number of COVID-19 confirmed cases per day.

When President Cyril Ramaphosa addressed the nation on 13 May 2020 he indicated that some parts of the country could be moved to level 3 by the beginning of June 2020. Considering that the spread of the virus is concentrated in big cities, speculations are that these cities will not benefit from planned relaxation of regulations at the beginning of June.

Notwithstanding this situation, there are calls from labour organisations and some political parties for the government not to tighten regulations. These calls are also advocating for relaxation of regulations from level 4 to level 3. The calls are made in the interest of rescuing the economy and allowing workers to continue, if not return to work.

Whether the government tightens or relaxes regulations one fact remains: major food operations will continue enjoying the essential-needs status, while careful planning, searching for new market channels, reliance on the local labour, keeping alcoholic drinks on the shelf or export markets only will remain a short, if not a long term order of the South African agri-business.