Impacts of the conflict between Russia and Ukraine on the Andean countries (Part II)

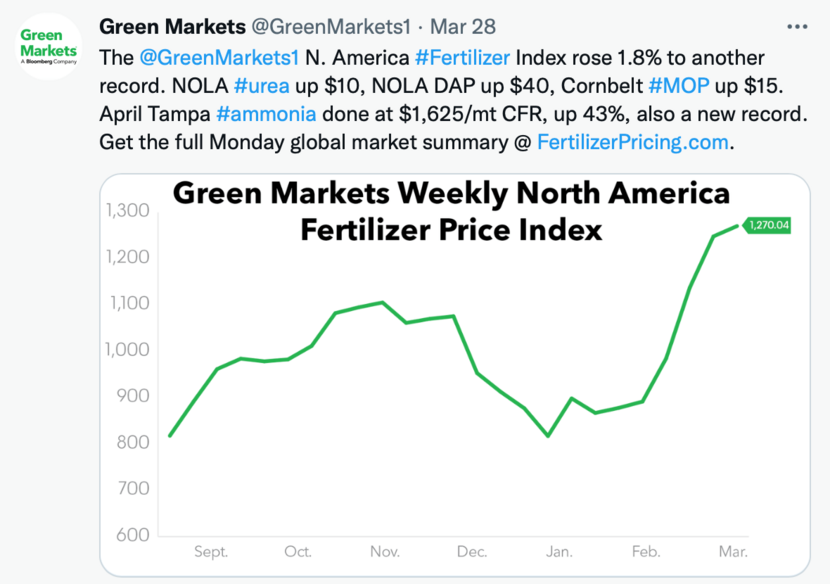

Fertilizer prices continue to rise to record highs as the Russian invasion of Ukraine puts a large part of the world's fertilizer supply at risk, adding to concerns about rising global food inflation. An index of nitrogenous fertilizer ammonia prices in Tampa rose 43% to $1,625 a metric ton last Friday, a record high for the 29-year index.

At the same time, prices for staple crops like wheat, corn and soybeans are soaring, and war at one of the world's major grain suppliers threatens to push millions more into food insecurity. Rising costs of agricultural inputs, such as fertilizers, push producers to consider reducing the sowing areas which could drive food prices to even higher levels. This is aggravated by the recent announcement of the US Federal Reserve about the interest rates hike which may lead various Central Banks to adopt the same measures, which will hamper access to and worsen conditions of loans and other financial services, also for farmers. This article presents the impacts of the conflict between Russia and Ukraine on the agri-food sector of Colombia, Ecuador and Peru.

Colombia: Combined efforts to overcome the crisis

In search of joint solutions and measures to alleviate the crisis, the Colombian private and public sector have lobbied European authorities and government representatives of countries suppliers of agricultural inputs. On the one hand, the president of the Association of Banana Growers of Colombia (Augura) travelled to Brussels this week to meet with senior officials of the European Parliament to discuss key issues regarding the recent situation in the agribusiness sector and its emerging rise of inputs’ costs. The agricultural sector is experiencing a slowdown in its production and export. On the other hand, seeking to secure sourcing to supply the agricultural sector, the Colombian government is organising meetings with Ambassadors from various inputs’ supplying countries, namely: the United States, China, Canada, Trinidad and Tobago, Morocco, and United Arab Emirates.

Additional measures have been adopted such as the expedition of the agricultural inputs’ law to eliminate customs duties for more than 160 agricultural inputs. Likewise, an alleviation fund from last year’s financial profits of the Agricultural Bank (public entity under the Ministry of Agriculture) was set to make approximately EUR 18 million available to agricultural producers as of April. Funds were allocated to subsidize agricultural insurances and ten special credit lines were launched by the Agricultural Bank, while incentives to maize and soy production are being explored with the local private sector.

Peru: Uncertainty fuelled by political instability

The difficulties caused by the conflict between Russia and Ukraine threaten Peru’s food security. According to Mariana Escobar, FAO’s representative in Peru, the country’s reliance on Russia in terms of potassium and nitrogen fertilisers is up to 19.9% and 55.7% respectively. This rise has been achieving record prices as shown by the Green Markets North America Price Index with a rise last Friday of 1.8% after consecutive rises of 15.5% in the previous weeks. The impact of the fertilisers’ prices rise coupled with the political crisis in the country – as the president just survived another impeachment vote - has increased the prices of the basic food basket to a great extent. The government declared an emergency in the agricultural sector for 120 days, based on the fallout from COVID-19 and the soaring price of fertilizers. The government is within the 10-day deadline for the approval of the plan that will allow actions for the continuity of activities in the sector.

Ecuador: A race against time to alleviate the economic impacts

It is crystal clear that the conflict in the Black Sea region has hit (agricultural exports from) Ecuador much more than its neighbouring countries, Colombia and Peru. With the intention to close a bilateral trade agreement with the Russian Federation, the Russian market is now positioned as the 5th largest export destination for Ecuador. At the same time, Ecuador became the most important exporter to Russia of bananas, flowers and shrimp.

Therefore, the banana sector is one of the most affected, taking into account that 95% of the bananas consumed in Russia are sourced from Ecuador. Likewise, banana exports to Russia and Ukraine account for 25% of the country's total exports. Finding alternative markets is not an easy way out. Bananas exported to Russia do not meet the standards set by different potential markets, such as: the European Union, the United States, South Korea and Japan. Without market alternatives, this industry faces total losses of USD 8 million per week, additional to the risk of losing 50,000 direct and 4,000 indirect jobs and an economic damage to 50,000 hectares of banana production (mostly cultivated by small growers).

For this reason, last Monday 28th of March more than 500 banana growers protested in the harbour city of Guayaquil for the millionaire losses in the sector. According to the association of banana traders (AEBE), the sanctions imposed on Russia blocked banana exports from European ports to St. Petersburg. Due to excess supply, prices have dropped drastically. The average price of a box of bananas was between EUR 3.0 and EUR 5.5, nowadays it ranges from EUR 0.05 and EUR 1.2. The traders’ association asked the Ecuadorian government for tax exemptions and access to credit for both producers and exporters.

For the Ecuadorian flowers’ industry, the situation is no different. Flowers are the second most exported non-petrol product. So much so that Ecuador is the 3rd largest exporter world-wide and the Russian Federation is its largest customer. Around USD 40 million have not been paid for, and therefore lost for the sector. It is clear that Ecuador needs to find alternative markets as soon as possible. However, as the product is specifically bred for Russia this entails a major challenge. Implicitly, the ongoing crisis also affects Dutch breeders, who have very close relations with the Ecuadorian flower sector.

Ecuador strives now for the European Union to provide quicker and simpler market access procedures – and any other form of support – in their pursuit of alternative markets. Additionally, the Ecuadorian government are continuing to push their Free Trade Agreement Agendas, amongst others with China, Mexico and South Korea.

The agricultural team LAN-Andes is working together with local and Dutch partners to address several issues mentioned in this article. For more information, please contact us at BOG-LNV@minbuza.nl