How will the conflict between Russia and Ukraine affect the agri-food sector in Colombia, Ecuador and Peru?

On February 24th 2022 the Russian army invaded Ukraine after years of political tension between the two countries. As of March, the United States, the European Union, other countries and even companies adopted a number of sanctions that put Russia under an economic siege. The expected and already ongoing effects on the world’s economy again bring to light the fact that conflicts are drivers of (global) food insecurity and are now exacerbating the fallout from the COVID-19 pandemic. And just as the butterfly effect theory predicts, this flapping of wings will also be felt in Latin American countries such as Colombia, Ecuador and Peru. This article presents the consequences of the conflict between Russia and Ukraine on the agri-food sector of these three countries.

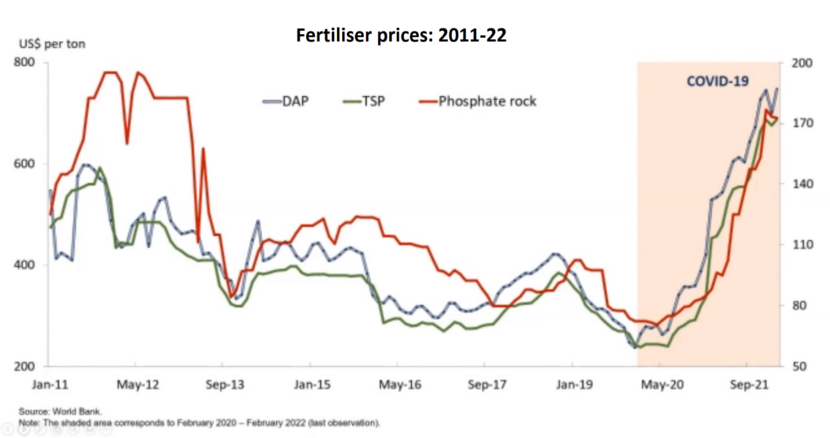

Global food inflation has already been driven up by different factors: the COVID-19 pandemic, the container shipping crisis and highest (bio)fuel prices leading to higher transport costs, climate change, currencies’ depreciation and disrupted supply chains, among others. The latest becomes even more relevant now as prices of agricultural inputs, feed, and foodstuffs, will be further on the rise due to the conflict in the Black Sea region. Russia’s invasion of Ukraine will continue disrupting global markets because these countries are now positioned as big suppliers of cereals and oil seeds (such as wheat, maize, barley, sunflower and maize), natural gas and fertilisers (nitrogenous and potash based).

Undoubtedly, this situation has negative impacts for agricultural producers worldwide as both animals and farms require feed and energy all-year-round and the new planting season requires the use of fertilisers. Now, looking at the situation of Colombia, Ecuador and Peru, the direct impact on food prices and trade as a whole is still relatively limited as the main commercial partners for Colombia and Peru are the United States and the European Union. However, Ecuador has a much larger trade flow with Russia, especially of agricultural products. Russia’s banning from the SWIFT system equally affects transactions for big companies such as the ones belonging to the flower industry as well as SME’s trading with this nation, as well as the export route via the EU being impeded – with some companies considering trade via Turkey.

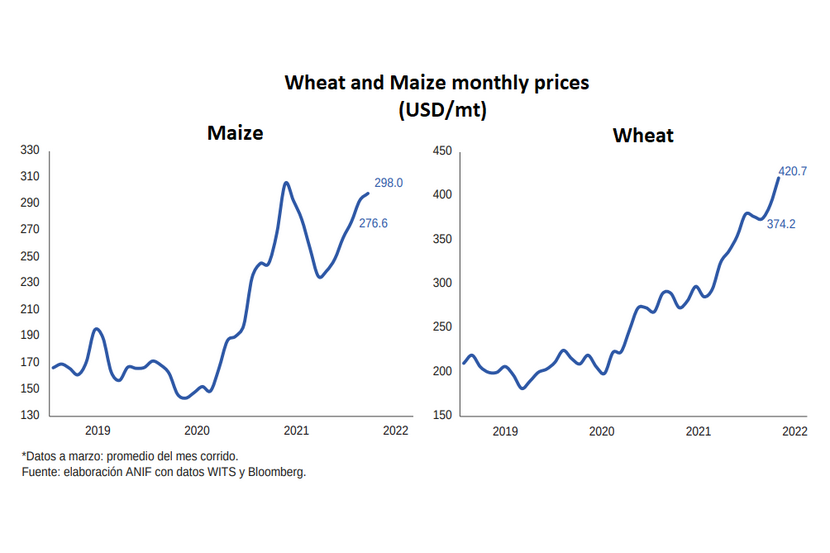

Taking into account that the three countries rely heavily on imports of maize – mainly from the US and Argentina – animal husbandry costs will be affected in the coming months due to the international maize prices increase (see graph above). Moreover, as these countries also depend highly on fertilisers’ imports from Russia and Ukraine, higher cost prices will be transferred to higher food prices in the coming months. In fact, Russia provides up to 50% of fertilisers imported in Peru, and together with Ukraine both countries provide around 42% and 41% of fertilisers imported in Colombia and Ecuador respectively. Below a brief analysis per country:

Ecuador

The economic effects for Ecuador have already been noticed. The commercial exchange between Russia and Ecuador amounted to USD 1.9 billion in 2021 (28.8% more than 2020). Due to the trade disruption with Russia (fourth in importance for Ecuador) and Ukraine (seventeenth destination of Ecuadorian exports) USD 2.4 million may no longer be exported weekly. As an alternative, new commercial routes via Turkey are currently being used.

Ecuadorian non-oil exports to Russia in 2021 resulted in a positive balance of USD 1 billion, with a growth of 8.7% compared to 2020 (USD 80 million more). Likewise, in the same period, non-oil exports to Ukraine reached USD 124 million, a 15.3% increase. Bananas, shrimps and flowers account for 93.9% of Ecuador’s non-oil export basket to the Russian and Ukrainian markets. Russia and Ukraine take up 25% of Ecuadorian banana production. Regarding fisheries and shrimps from Ecuador, Russia is the sixth importer, and only in the last year the exports’ volume doubled. Ecuador exports an average of USD 120 million of flowers to Ukraine, Belarus and, especially, Russia – third market after the US and the EU. From 2020 to 2021, the volume of Ecuadorian flowers’ exports to Russia increased four times.

Peru

Exports from Peru to Russia have experienced a 28% annual growth in average in the last 5 years, nevertheless, exports from Peru to Russia are quite small, representing only 0.7% of Peruvian exports abroad. Russia is the fourth largest exporter of wheat to the country, an important input used in the daily diet of Peruvians. Similarly, Peru is an importer of maize, with a 40% increase in its imports in 2021 and whose price increase mainly affects poultry producers, with repercussions on the basic family basket. In figures, Peru exported to Russia a total of USD 194 million in 2021, with grapes and avocados as the main agricultural products. With regards to agricultural imports, ammonium nitrate for agricultural use, urea and mineral fertilisers were the main products reaching USD 643 million.

Trade with Ukraine is significantly lower than with Russia. Exports to this nation represent only 0.14% of Peruvian exports (around USD 9 million), mainly in fishery products and to a lesser extent agricultural products such as Brazilian walnuts and ginger. Imports from Ukraine amounted to USD 153 million in products such as iron and steel. The conflict has a strong impact on Peruvian SME’s, which represent more than 24% of the companies trading with these countries.

Colombia

Colombia immediately sided with the EU and supports the EU's measures. In fact, trade will come to a standstill. But the consequences will be very noticeable: Inflation in Colombia was 8% last year and food prices have risen the most in relative terms, by about 20%. Despite measures announced by the government at the beginning of this year to reduce the costs of importing agro-inputs, this conflict will have a significant impact on the already rising food prices due to a lack of suppliers options. Read more about the situation in Colombia here: Is Colombia at risk of becoming a “hunger hotspot”? | Nieuwsbericht | Agroberichten Buitenland

Colombian imports from Ukraine rose from USD 37.4 million in 2020 to about USD 232.7 million in 2021, an increase of 522.2%. This concerns steel, agricultural machinery, crop protection products and fertilisers. Imports from Russia last year amounted to USD 540.6 million, compared to USD 231.8 million in 2020, an increase of 133.2%. Next to fertilisers, Colombia imports from Russia machinery, consumer goods, pharmaceuticals, meat, sugar and semi-finished products. On the other hand, Russia has become an interesting market for Colombian exports of products such as frozen meat, flowers and coffee.

The aftermath should not only be negative. Even though this conflict is already having terrible consequences, it bring an impulse to find alternatives. The world and these Andean countries may start producing fertilisers themselves, turn to organic fertilisers, speed up the transition to renewable energies and find new commercial routes. This could have a dampening effect on national food prices through greater local supply and reduce food security vulnerability.

The agricultural team LAN-Andes is working together with local and Dutch partners to address several issues mentioned in this article. For more information, please contact us at BOG-LNV@minbuza.nl