Spain’s food exports expanded by 3.5% in January-June 2019

Spanish exports of food, beverages and tobacco grew by 3.5% during the first half of the year to exceed €24.6 billion, opposed to the 0.7% decline recorded in the same period in 2018.

Food exports

Data released by the Secretariat of State for Trade, also show that the category “fruits, vegetables and legumes” is the most relevant as its sales totaled €10.24 billion (+4.5%).

Vegetable exports increased by 10.06%, with the good performance of pepper (+16.12%) -being the first vegetable exported by Spain- followed by lettuce (+5.5%) and cabbage (+20.64%).

Fruit exports suffered a decline of 0.22%, highlighting the good performance of berries, reaching an all-time high of sales abroad of €1.23 billion.

After fruit and vegetables, the main exported stuffs were meat products to almost €3.79 billion (+9.2%), “other food products” to €2.8 billion (+8.3%), and oils and fats whose exports fell by 2.7% to €2 billion.

Foreign sales of food, beverages and tobacco represented 16.7% of total Spain’s exports, only behind capital goods (+20.5%) and ahead of vehicles (15.8%) and chemical products (14.4%).

Food Imports

In the first six months of 2019, imports of food, beverages and tobacco recorded a fall of 2.1% to €17 billion, in contrast with the 3.1% rise observed during the same period of 2018.

“Other food products” are the most important stuffs in value, with an expenditure of €4.4 billion (+3.4%), followed by fishery products to €3.4 billion (-1.6%), fruit and vegetables to €2.9 billion (-0.2%) and sugars, coffee and cocoa to €1.36 billion (no change).

Food trade balance

The difference between sales and purchases stood at €7.56 billion until June this year.

Lower growth in total Spanish exports

In the first half of 2019, total Spain’s export of goods increased by 1.7% over the same period last year, reaching €147.4 billion, a new record according to the same source.

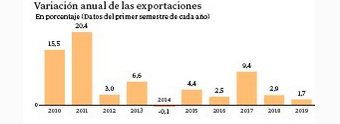

However, it is striking (Fig. 1) that the increase in exports (the real driving force of the Spanish economy in recent years, especially during the crisis) in this period is the lowest of the last five years and the second lowest (after the 0.1% fall in 2014) in ten years.

Fig. 1. Annual change of Spanish exports (first half of each year)

The Exporters and Investors Club assures that the international instability and slower growth in international trade “are not sufficient factors to explain the Spanish exports slowdown”. Its President blames this lack of foreign sector dynamism on “the political forces’ inability to create a solid and stable government to face the necessary reforms to boost the international competitiveness of Spanish companies”.

Total trade deficit increases

Total imports grew by 1.6% to an unprecedented amount of €162 billion. They increased in chemical products (+6.7%), capital goods (+4.5%) and energy products (+0.6%), while those of the automobile sector fell by 2.5%.

The total trade balance (Fig. 2) recorded a deficit of €14.7 billion, 0.9% higher than the one recorded between January and June 2018.

Fig. 2. Trade balance evolution

The trade balance by sector (Fig. 3) shows that food, beverages and tobacco is the second best performer.

Fig. 3. Trade balance by sector January-June 2019

Several sources